Peru is poised to boost copper output as global demand outstrips supply

Glencore, the commodities trader whose May initial public offering raised $10 billion, has just paid $475 million in cash to CST Mining Group for a 70% interest in Marcobre S.A.C., sole owner of the Marcona Copper Property and the Mina Justa Project located in southern Peru.

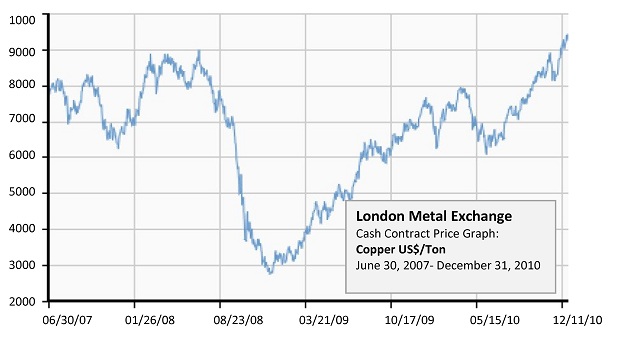

Glencore’s move into Peruvian copper certainly makes sense given that the metal’s market price hit a record $10,000/ton in February – when some analysts were projecting an annual average price of $11,250/ton for the 2011, according to the Financial Times.

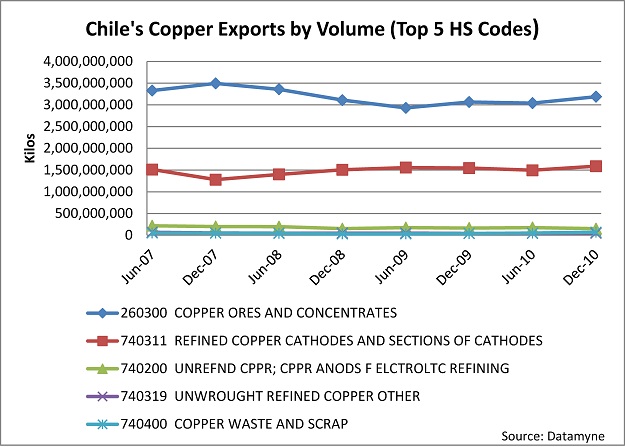

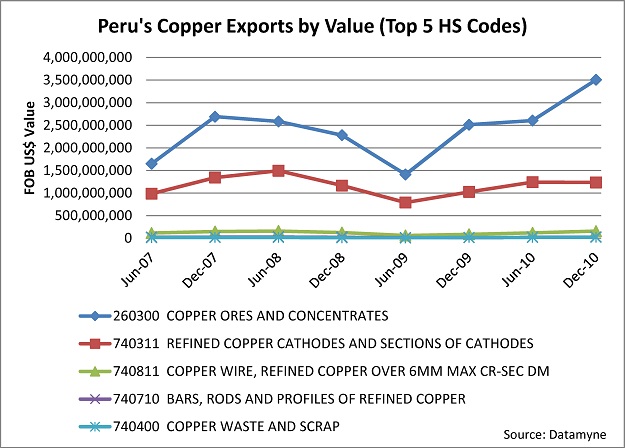

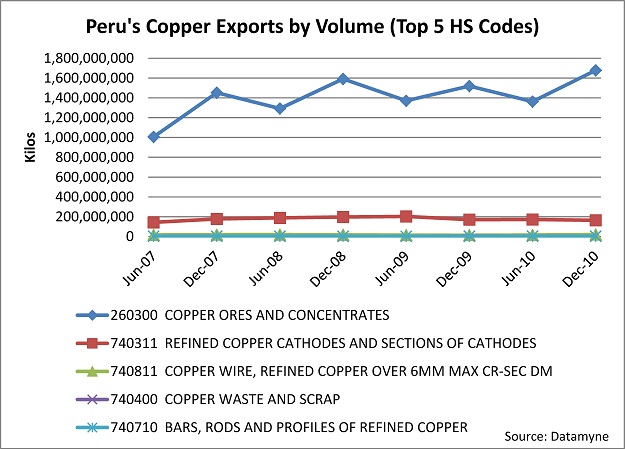

And, as the FT reported in June, while top source Chile supplies one-third of the world’s copper, second-ranked Peru could be equally crucial to the copper market over the next five years. Macquarie, the Australian bank, estimates Peru will account for 32% of growth in global copper mine output over that period. A key variable: newly elected Peruvian president Ollanta Humala’s plans to raise taxes on his country’s mining sector.

As July wound down, Southern Copper Corp. announced plans to double its copper production by 2015, increasing output at both its Mexican and Peruvian mining operations. These plans come, the Wall Street Journal story notes, at a time when demand has outstripped supply. The International Copper Study Group reports the world refined-copper market was in deficit by 69,000 metric tons in January to April, widening from a 57,000-ton shortfall in the year-ago period.

Below, as a benchmark, are the trends in exports by value and volume from the two top sources, Chile and Peru, through year-end 2010 as captured by our trade data. We’ve included the price trend line from the London Metal Exchange over the same period for reference.

In August, we’ll follow up with the trade data through first-half 2011.