Do surging shipments and dropping prices signal dumping?

Potential scandal aside, Solyndra’s August bankruptcy filing, close behind the failures of Evergreen Solar and SpectraWatt, signals a fast and hard shake-out of the US solar energy industry.

A global glut of photovoltaic solar panels, falling prices, cutbacks in (or an uncertain future for) government subsidies, and competition from low-cost Chinese manufacturers are contributing factors. Back in June, an anticipated shift to enough supply to more than satisfy demand looked like a boon for consumers (see, for example, this Financial Times report). But supply has surged at a disruptive rate. Many now feel that lower prices for consumers aren’t worth the jobs lost as US solar manufacturers are shut out – US Senator Ron Wyden (D-Ore.) among them.

The chair of the Senate Finance Committee’s Subcommittee on Trade has called on President Obama to curb Chinese solar product imports which, he charges, are heavily subsidized by the Chinese government and are priced at levels that do not reflect the reality of the marketplace.

More specifically, Wyden wants the Department of Commerce to initiate an investigation into the application of anti-dumping and countervailing duties as a remedy against surging Chinese imports threatening US industry. You can read Wyden’s letter to the president here.

There are several questions to be answered in investigating allegations of dumping. Is the volume of shipments significant or negligible? Is the export price lower than the domestic price charged for the product? Is the importing country’s domestic industry materially harmed by the imports?

We were interested to see what the trade data could reveal about US imports of solar panels from China. We searched the bill-of-lading data for first half 2011 for the details of recent shipments, including the shippers and consignees. [Update 9/22/11: Yesterday we pulled a table that had been part of our original September 20 posting. That table of “Top Shippers of Solar Panels from China to the US” was incorrectly labeled: The listing of shippers ranked by volume was based on bill of lading data on shipments of solar panels and solar panel components. We regret the lack of precision in the label.]

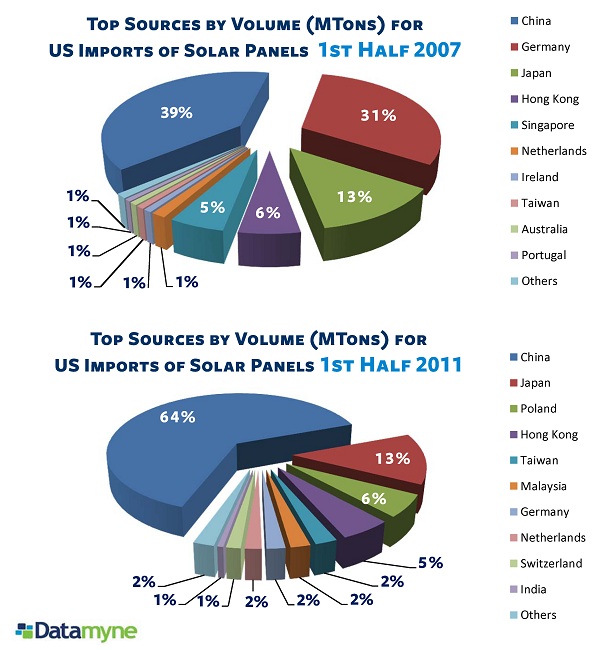

We found that the import data does indeed show China quickly gaining share in the US imported solar panel market, shipping 64% (by volume) in the first half of this year compared to 39% during the same period in 2007.

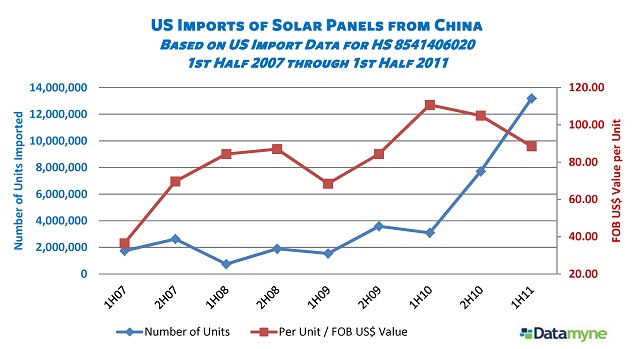

Finally, the trade data indicates a recent surge in imports accompanied by a rapid drop in price.

Should the Commerce Department take up an anti-dumping investigation into Chinese solar panels, you can follow its course here. For more information about using trade data to detect possible dumping, contact us.