A new free report from Descartes Datamyne provides trade data on Tesla electric vehicles exports, including Model S and Model X, volumes and country destinations in 2016.

Tesla shipped 22,007 electric vehicles (EVs) to markets abroad in 2016, an 11.9% increase over 2015, according to Descartes Datamyne waterborne export data.

Based on the manifests filed by exporters, our data captures the number of vehicles exported by Tesla each month as well as the countries where they are off-loaded. The data provides an indicator of the direction of EV foreign sales – or “deliveries” in Tesla parlance – in Asia and Europe (but not in North America, where the EVs ship overland).

The data is available in our free report Tracking Tesla 2016

Issued annually since 2014, the latest report shows the Netherlands remains the top destination for Tesla electric vehicles exports, taking delivery on 11,973 cars in 2016 compared with 11,696 in 2015. The Netherlands is the hub of Tesla’s European distribution system. Second-ranked Norway received 3,904 Tesla EVs in 2016 compared with 3,317 in 2015.

China, the second-ranked destination in 2014, with 2,388 vehicles, held on to eighth place, receiving 176 vehicles in 2016, an increase over 149 in 2015. Hong Kong, which received 602 vehicles in 2014, then surged into the lead among Asian destinations with 2,445 vehicles in 2015, received 2,543 vehicles in 2016. No. 4 three years in a row, Belgium took delivery on 187 cars in 2014, 766 in 2015, and 1,735 in 2016.

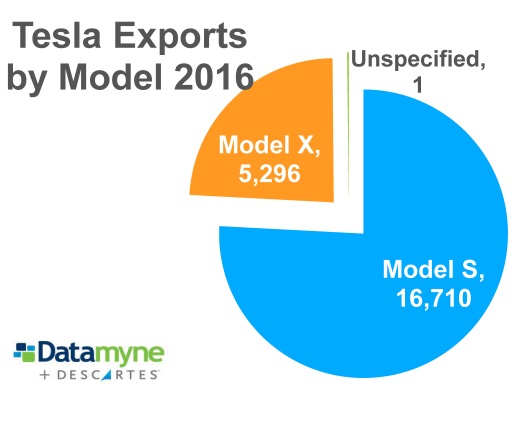

The 2016 numbers include both Tesla Model S and Model X cars. Model S EVs accounted for 76% of Tesla electric vehicle exports last year, as this chart from our free report shows:

You can see more data in our free report. Click here to download Tracking Tesla 2016.

Related: