LATAM may be on course for growth, but diversification is needed

Writing in the Miami Herald earlier this month, Andres Oppenheimer asks whether 2011 will be the dawn of the “Latin American decade” – as a recent Standard & Poor’s webcast argues [you can access a replay of the S&P webcast here].

Not only has S&P rated Brazil, Peru and Panama “investment grade” (until recently only Chile and Mexico were so rated in the region), but a recent World Bank report on natural resources in Latin America and the Caribbean, Beyond boom and busts?, forecasts economic stability and growth. Oppenheimer also quotes Alejandro Foxley, head of CIEPLAN: “We are likely to see Uruguay and Chile among the world’s advanced economies in 10 or 15 years. And Brazil, Argentina, Mexico and eventually Colombia are likely to join them in the next 15 to 20 years.”

But Oppenheimer is not entirely convinced. One reason for skepticism: the region’s growth depends over much on raw materials and on commodity prices that depend very much on China’s economy.

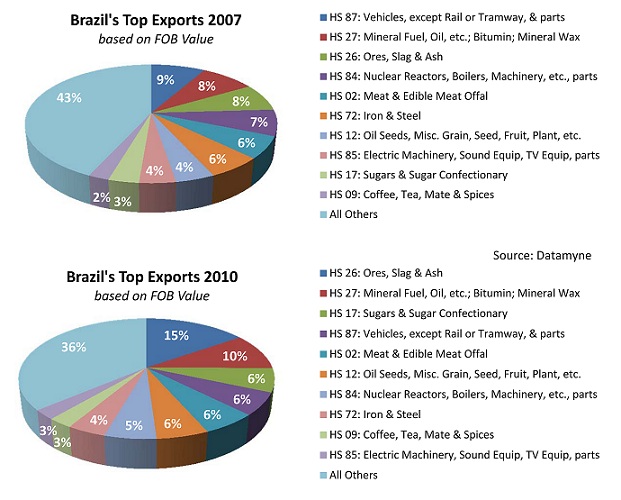

We took a look at the trade data and found some evidence for the skeptics’ view. For example, as Brazil’s exports increased by more than 20% from 2007 to 2010, raw materials ascended its list of top exports (by value) while manufactured goods slipped in rank (see the chart). During this period, China jumped from Brazil’s third- to first-ranked export market, as Brazilian exports to China grew 186%. China’s top Brazilian imports? Iron ore, oil, soybeans, cane & cane/beet sugar, and coffee.

China seems to be moving – quickly – up the charts as an export market throughout Latin America. And commodities do dominate export trade, but that’s as it has been in the past. Many LATAM countries recognize the risk and have set policies to diversify their mixes of exports and markets: they may find it harder to do with China as a top customer.