The United States has traditionally been a strong target for dog and cat food imports, with the U.S. market share of global sales around 42%. However, U.S. pet food exports continue to rise, according to data from Descartes Datamyne™ .

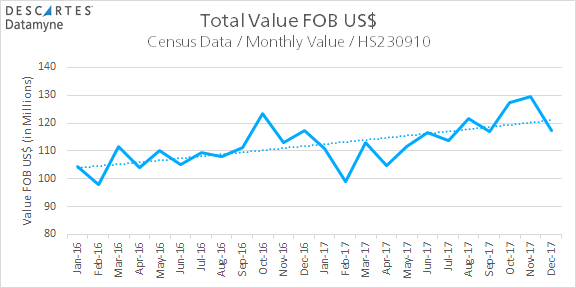

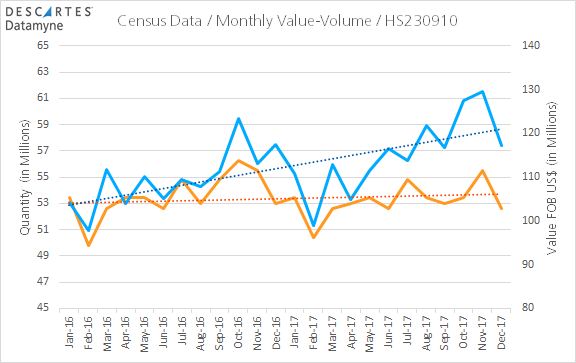

Despite a seasonal decline in December of 2017, retail dog and cat food (HS code 230910, dog and cat food, put up for retail sale) ranked 19th by value of fourth quarter agricultural exports with an increase of almost 6% over the same period in 2016. Taken as a whole, exports in 2017 were valued at $1.3 billion, up 5% compared to 2016.

This performance in 2017 acts as a strong rebound from recent economic trends for U.S. pet food exports and is characterized by analyst Jared Koerten of Euromonitor as a “stunning and historic trend reversal”.

Nearly all of the increased value is accounted for by an increase in value sales rather than volume. The volume of retail dog and cat food exports fell by over 6% throughout 2017 and U.S. production was stagnant. This is accounted for in the industry by what Koerten described as a “mass premiumization” and a demand for specialized food greatly increasing globally.

Top Export Markets for Pet Food

Two of the top destinations for U.S. pet food are the other North American Free Trade Agreement countries, Canada and Mexico. Canada is the top destination for U.S. pet food by a wide margin, importing nearly $530 million in 2017 with a value increase of 6% over 2016. Mexico, while dropping 3% in value compared to 2016, still imported $81 million.

Other top destinations include many East and Southeast Asian countries. Four of the top five non-NAFTA destinations for U.S. dog and cat food are Japan, South Korea, the Philippines and Hong Kong. While Japan’s imports of U.S. pet food held relatively steady, South Korea, the Philippines, and Hong Kong have collectively gained 1.5% of the U.S. export market share. The value of exports to the four countries combined totaled $221 million in 2017 and the value of exports to Hong Kong and the Philippines each increased over 20% in 2017 compared to 2016.

Emerging Markets for Pet Food

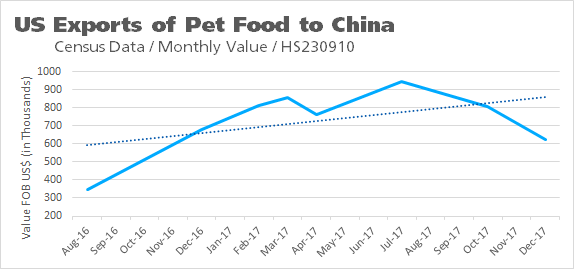

One of the top emerging markets for U.S. pet food is China. China is certainly an attractive market for U.S. suppliers. Even amid evolving trade policies, pet food is not a current target of tariff changes. The National Bureau of Statistics of China reports that the People’s Republic is third in the world for dog ownership, behind only the U.S. (55.3 million) and Brazil (35.7 million) and second in global cat ownership. Changing cultures and the growth of China’s consumer economy have resulted in even more widespread pet ownership. Since 2012, annual spending on pet food has more than quadrupled and is expected to reach more than $5 billion by 2022.

Export data from Descartes Datamyne currently ranks China at 25th in market share; however, the data also reveals that China’s imports of U.S. pet food grew by over 120% in 2017 compared to 2016. If that growth remains steady, China will become a top five destination for U.S. dog and cat food by 2030.

To establish a foothold, however, companies must navigate a minefield of regulations, as well as compete with both well established brands and a market full of counterfeits.

Keeping Pace with Emerging Markets and Current Trends

Staying up-to-date on global trends and tariff changes is imperative to sustain and increase a company’s competitive position. Generating profit depends on effective execution in several areas: having quality products, fulfilling customer requirements, understanding where the demand exists, complying with regulations, and operating a cost-effective supply chain.

Descartes offers a wide suite of solutions to help businesses achieve higher trade compliance rates, increase insight and leverage market research, perform due diligence with denied party screening, minimize duty spend.

Resources and Global Trade Content Solutions:

- Descartes Datamyne: Descartes Datamyne maritime bill of lading data captures the transactional and logistical details of U.S. import trade in this or any season. Ask for a demo.

- Descartes Datamyne Market Insight: Descartes Datamyne Market Insight works with businesses to identify and deliver the datasets and reports that they need to improve insight and business intelligence. Ask for a demo.