Comments due Feb.11 on proposed hike in price of imports from top US source

Today’s the deadline for comments on a new plan to replace a long-standing trade pact on US imported fresh tomatoes from Mexico. The old pact was challenged by Florida growers last June. The proposed replacement sets new floors under prices for Mexican tomatoes during summer and winter, as well as tomatoes produced in open field/adapted environments and controlled environments. (Comments are to be filed, and all documents are available on IA-Access. Refer to Case No. A-201-820.)

The trade pact that drew the Florida Tomato Exchange’s challenge is technically a “suspension agreement” dating back to 1996, when the Commerce Department first suspended antidumping proceedings because the US and Mexico had reached a deal on the price.

There have been price adjustments before (in 1998, 2002, 2008), but this latest deal calls for a big hike – in some cases more than double the current reference price, according to the Commerce Department media release.

The Florida Tomato Exchange and Certified Greenhouse Farmers have issued a statement of tentative support for the agreement.

The Mexican signatories to the proposed deal are:

- La Confederación de Asociaciones Agrícolas del Estado de Sinaloa (CAADES) A.C.

- Consejo Agrícola de Baja California, A.C.

- Asociación Mexicana de Horticultura Protegida, A.C.

- Unión Agrícola Regional de Sonora, Productores de Hortalizas Frutas y Legumbres

- Confederación Nacional de Productores de Hortalizas

While the growers may be more or less in accord, US importers and distributors are not. The Fresh Produce Association of the Americas asserts that the jump in prices will effectively lock a big share of Mexican production out the market, to the cost of US jobholders and consumers. You can listen to what the FPAA has to say here.

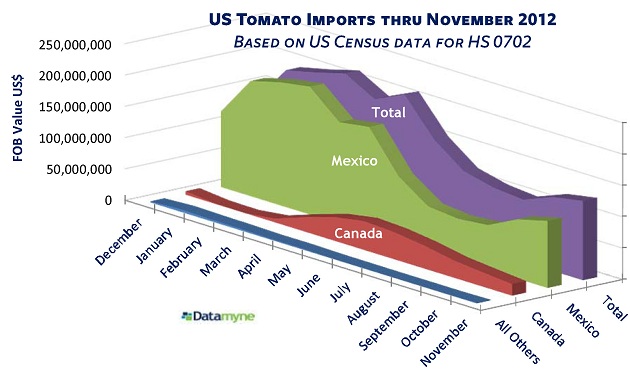

Certainly the agreement will mean fewer, pricier tomatoes on offer from greengrocers in the US where imported fresh tomatoes – especially January through March, as the chart below shows – are Mexican tomatoes.