US tariffs on Chinese steel imports could near 500% with the Commerce Department International Trade Administration’s preliminary decision to slap anti-dumping duties of 256% on corrosion-resistant steel – this on top of countervailing duties of 236% imposed in November to offset Chinese government subsidies of its steel producers. The decision memo and related documents are available on the ITA Access website under Case No. A-570-026.

Earlier this year, six US steelmakers filed a series of petitions with the Department of Commerce and the US Trade Commission claiming foreign producers were flooding the US market with cut-rate steel products. The coalition asked for AD/CVD investigations into corrosion-resistant steel (CORE) from China, India, Italy, Korea, and Taiwan on June 3.

The steelmakers followed up with similar petitions concerning cold-rolled steel and hot-rolled steel over the summer – see Steelmakers Pushback against Low Price Imports.

In November, the ITA issued its determination of the subsidy rates on which the CVDs on CORE imported from China are based (Case No. C-570-027):

| Company | Subsidy Rate |

| Yieh Phui (China) Technomaterial Co., Ltd. | 26.26% |

| Angang Group Hong Kong Company Ltd. | 235.66% |

| Baoshan Iron & Steel Co., Ltd. | 235.66% |

| Duferco S.A., Hebei Iron & Steel Group, Tangshan Iron and Steel Group Co., Ltd. | 235.66% |

| Changshu Everbright Material Technology | 235.66% |

| Handan Iron & Steel Group | 235.66% |

| All Others | 26.26% |

On December 21, the Commerce Department released its determination of the margin on which the AD tariff is based:

| Exporter / Producer | Dumping Margin |

| Yieh Phui (China) Technomaterial Co. Ltd. | 255.80 |

| Jiangyin Zongcheng Steel Co. Ltd | 255.80 |

| Union Steel China | 255.80 |

| PRC-wide Entities (includes Baoshan Iron & Steel Co., Ltd. and Hebei Iron & Steel Co., Ltd. -Tangshan Branch) | 255.80 |

Commerce also determined that imports from Taiwan (ITA Access Case No. A-583-856) and Italy’s Marcegaglia SpA (A-475-832) will not face anti-dumping tariffs. Imports from other Italian producers will be subject to 3.1% AD tariffs. The government found dumping margins of 3.25% for most South Korean steel imports, with Hyundai Steel Co.’s shipments subject to duties of 3.5% (A-580-878). Indian imports are subject to duties from 6.6% to 6.9% (A-533-863).

One of the petitioners that sought the ITA investigation, AK Steel, expressed pleasure with the heft of the anti-dumping duties on Chinese CORE – and disappointment in the relatively light dumping margins for India, Italy, South Korea, and Taiwan “as they do not appear to adequately address the dumping that we believe is occurring in the US market.”

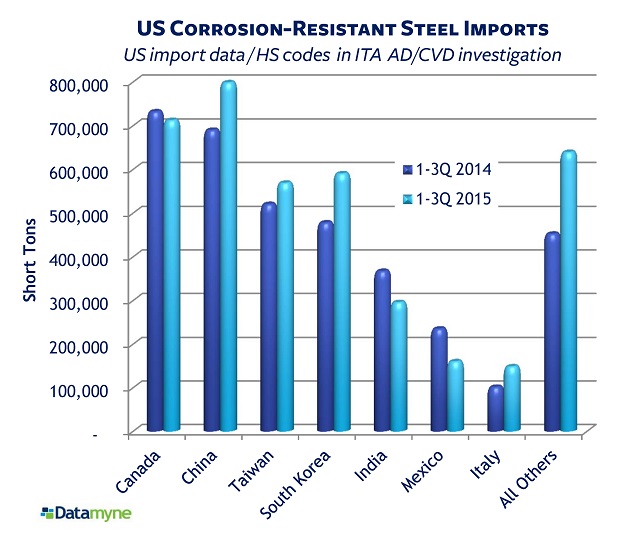

Here is the recent data on US CORE import volumes:

The ITA’s final setting of punitive duties on CORE is expected in second-quarter 2016.

Meanwhile, the ITA investigation into cold-rolled steel has also yielded results. On December 16, Commerce issued a preliminary determination that exporters in Brazil, China, India, and Russia have received unfair government subsidies and so should be subject to countervailing duties. Again, China leads the pack with a 227.29% subsidy rate, with a 7.42% rate determined for Brazil, 4.45% for India, and a maximum rate of 6.33% for Russia. (Refer to Case Nos. C-570-030, C-351-844, C-533-866, and C-821-823 on Access.) Also part of this investigation, South Korea was found to have made de minimis subsidies to its domestic producers (C-580-882).

Related:

- Steelmakers Pushback against Low Price Imports

- Our monthly reports ranking the top 25 US Minerals and Metals imports and exports by value of trade include the latest available month’s data as well as cumulative statistics, all compared with the same periods a year ago. Click here to download the latest free reports.