This year’s crop of ready-to-cut firs, pines and spruce has fallen short of holiday season demand. Early trade data indicates Christmas tree imports – fresh and artificial – are rising to fill the gap.

Nearly 95 million U.S. households will deck the halls with a Christmas tree this holiday season, according to an American Christmas Tree Association (ACTA) survey. The artificial tree industry group estimates 81% will be putting up artificial trees. The remaining 19% prefer the real thing.

In 2016, U.S. consumers brought 27.4 million fresh-cut trees home for the holidays. That’s well ahead of the 18.6 million artificial trees purchased last year, according to figures from the National Christmas Tree Association (NCTA), advocates for growers.

This year, however, the hunt for the perfect, fresh-cut balsam or Fraser fir may be more daunting and the prize more pricey than ever before. There’s a shortage of Christmas trees.

The fresh-cuts grow scarcer the further you are from where the trees are grown. Top producers are Oregon, accounting for 37% of cut trees; and North Carolina, with 25%; followed by Michigan, Pennsylvania, Wisconsin and Washington. Arizona, Illinois and Florida are reported to be feeling the shortage acutely.

Blame the shortage on the Great Recession of 2008. As consumers cut back on buying trees, farmers cut back on planting them. Many exited the business altogether. Total acreage devoted to growing this crop (98% of fresh Christmas trees are farm-grown) declined by 30% between 2002 and 2012, according to the latest available data from the US Department of Agriculture.

As it takes 8 to 10 years for a tree to reach up-to-the-ceiling height, it’s just now that the full impact of reduced planting is being felt by consumers.

Back in July, market watchers were predicting tight inventories of Christmas trees for this holiday season, with available stocks of some preferred types down as much as 40%-50%.

Based on its 2014 Census of Horticulture Specialists, the USDA forecast annual declines in harvested Christmas trees from 2015’s crop of 20.3 million to a low of 17.6 million in 2020. (Data from the 2017 census will be released in 2018.) By some accounts, the Christmas tree shortage emerged in 2016, but growers filled last year’s gap with early harvests of this year’s crop.

Oh Canada! Oh Christmas Tree Imports!

The U.S. Christmas tree shortage has been an export market opportunity for growers in Central and Eastern Canada.

Tree farmers in Quebec and Nova Scotia told the Globe and Mail that big-box retailers locked in exceptionally big orders early this year. The Canadian Christmas Tree Growers Association reports its members are selling to the max. Exact numbers are hard to come by as Canada’s many independent, family-owned growers are not obliged to disclose sales data.

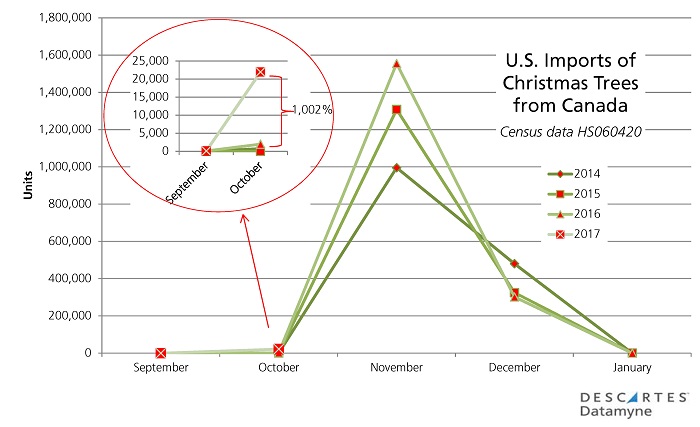

However, the trade data captured when trees cross the border indicates an early surge in U.S. Christmas tree imports from Canada. The latest available Census data clocks a 1002% increase in trees arriving in October, as shown in the inset in this chart:

Data for November, available in January, will show whether October’s orders simply moved up shipments that would have gone out the following month – or if U.S. Christmas tree imports from Canada climb to an even loftier peak in November 2017 (as they have in the past three years).

Christmas Tree Imports: China Minds the Gap

While fresh cut trees lead seasonal sales, the majority of Christmas trees displayed in U.S. homes are artificial reused on average for 6 to 11 years. Over the last 25 years, the share of households opting for artificial over fresh trees has grown steadily from 25% to 81%.

Virtually all are made in China. According to our Census data this year through October, 97% of artificial Christmas tree imports (HS9505104010, -5010) shipped from China, with another 1.3% originating from Hong Kong. The volume of artificial tree imports from all sources during the first 10 months was up 7.2% compared with the same period a year ago.

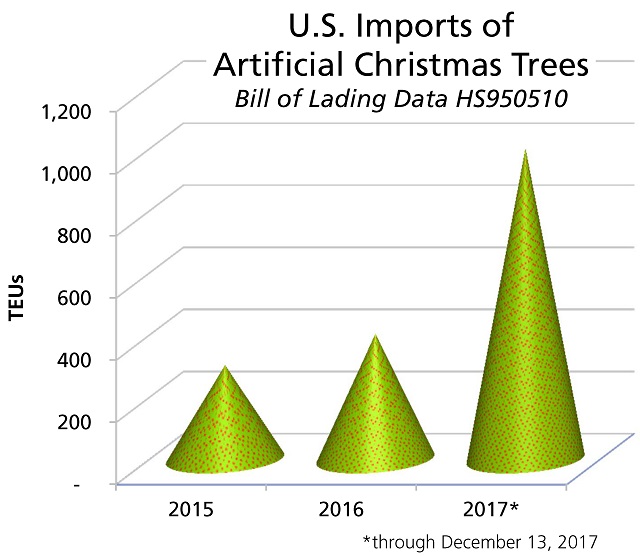

Now it looks like the homegrown Christmas tree shortage is giving an extra nudge to increasing imports of artificial trees, as the chart below shows:

Descartes Datamyne bill of lading data provides an early indication of a year-end surge in artificial tree imports. Based on our review of bills for shipments through December 13 that are solely or principally artificial Christmas trees, and are identified by tariff code HS950510, incoming volumes are on a trajectory that could result in twice as many TEUs [20-foot-equivalent units] in 2017 as last year.