The Pacific Alliance has reached a new milestone in its quest to eliminate barriers to the free flow of goods, capital and labor across the borders of the bloc’s four member nations (Chile, Colombia, Mexico and Peru) and so position itself as a hub for Asian-Latin American trade.

The Additional Protocol to the Framework Agreement defining the terms of free trade within the bloc enters into force as of July 20, 2015.

The Pacific Alliance formally launched in June 2012 with the members’ signing of the Framework Agreement setting out the principals and objectives of the Alliance. The Additional Protocol fills in the details on trade, eliminating tariffs on 92% of goods and setting a phase-out for the remaining 8%, mostly agricultural, products in trade. Sugar is excluded from the agreement. The trade protocol also aims to harmonize and simplify rules of origin, procurement and trade in services.

The national legislatures of each member must still seal the deal and – with the exception of Peru, where the president has fast-track authority on trade pacts – Congressional deliberations may well push full implementation into next year, according to an EIU analysis. But we’ll be looking for the Pacific Alliance trade pact entry into force to start boosting intra-bloc trade this year.

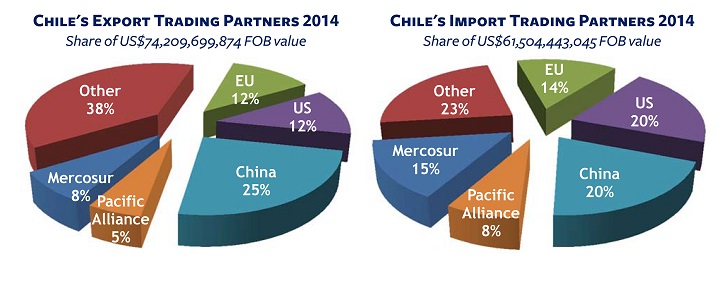

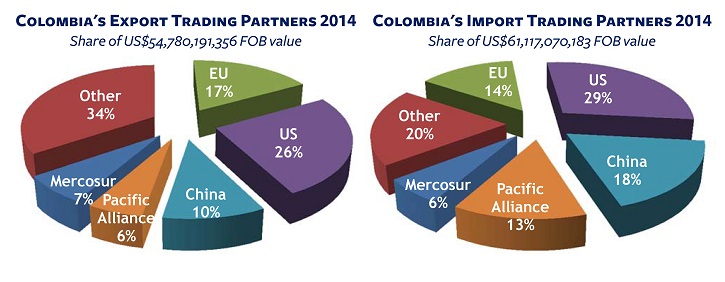

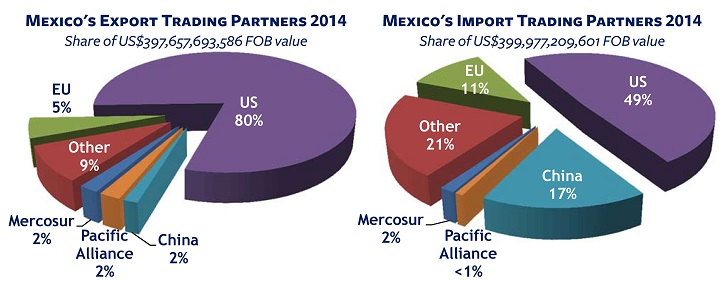

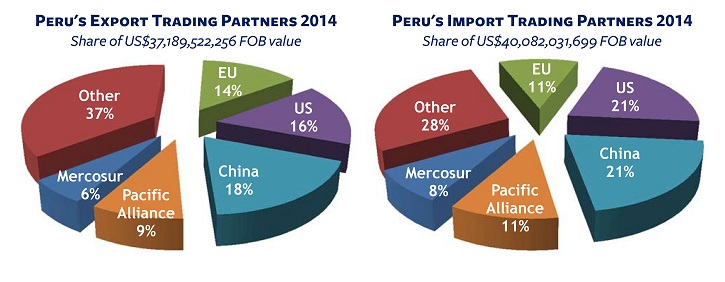

Member by member, trade with the bloc has remained relatively low, as the import-export share charts (from Datamyne’s Quick Look report on Pacific Alliance trade in 2014) below show. Note, too, that compared with 2012, Pacific Alliance share two years on has generally remained the same or fallen (with the bloc’s share of Chilean imports down 1%, Colombian imports down 5%, Colombian exports down 2%). Only the Alliance’s share of Peruvian Exports edged up (by 2 percentage points) in 2014.

Related: