Merger with Xstrata will create new mining giant

One trades and the other digs.

So tweets BBC Business Editor Robert Peston about the pending merger of Glencore and Xstrata.

The Financial Times confirms the merger, likely to be announced within days, will combine the world’s largest trading house with one of its biggest mining groups and turn the natural resources industry on its head.

We’ve followed Glencore for some time because it is a leading trader in Latin American export commodities … as well as key imports. Our trade data for Colombia, for example, shows that three of that country’s top five importers of off-highway dump trucks have ties to Glencore. The three affiliates are, at #1, Carbones Del Cerrejon; #4 Consorcio Minero Unido S.A.; and #5 C.I. Prodeco Productors de Colombia S.A. Our data also indicates the extent to which Glencore dominates that country’s coal exports, as well as an important market for US mining equipment. (See more here and here.)

Our point then and now is that you can turn to Datamyne’s trade data on the US, the EU and Latin America for information about the cross-border commerce of Glencore’s numerous affiliates, including Xstrata.

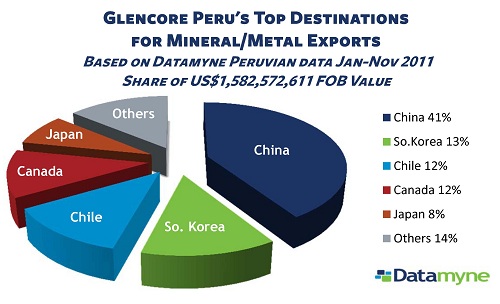

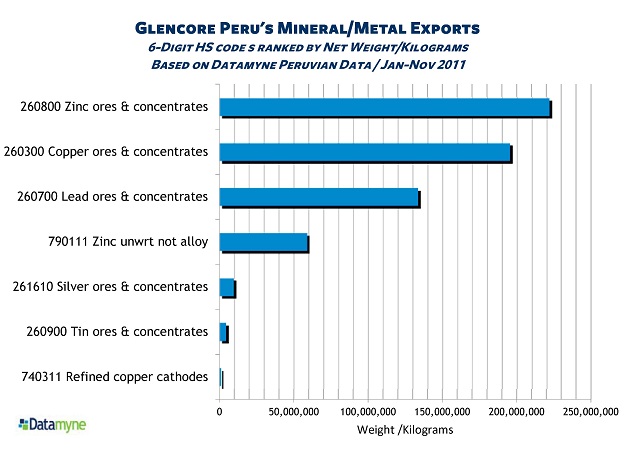

Here’s a sample of what the data reveals about Glencore’s subsidiary in Peru: