by Brian J. McCormick, guest columnist

In past columns, Chemcost has explored where in the world US chemicals purchasers can find the “New Cheap.” This month, we focus on who can deliver lower prices, with a demonstration of how Datamyne’s US bill of lading import data can be used to develop a list of potential alternative foreign suppliers.

Datamyne’s bill of lading data is a unique resource for buyers, providing details about the parties to individual transactions, including names and addresses of the companies shipping commodities to the US and other markets.

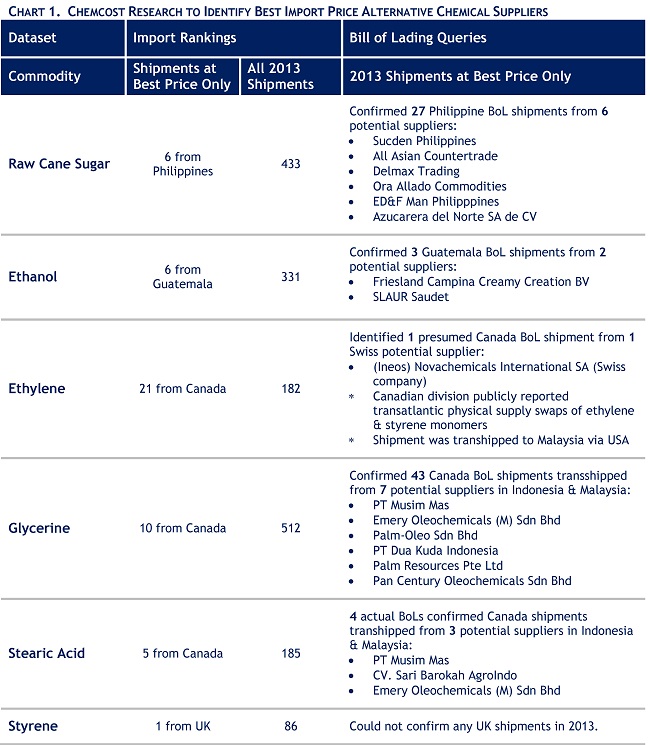

We surveyed the data on 6 out of the basket of 10 commodities that comprise our US Best Price Benchmarks posted each month to the Datamyne home page. These 6 scored their best prices in 2013 on import shipments in 2013; the best prices for the remaining 4 were on exports. We used both the rankings of Datamyne’s aggregated imports database and the commodity query function of the US import BOL database. Our results are summarized in Chart 1.

We were able to identify alternative sources for US imported raw cane sugar, un-denatured ethanol, ethylene (C2) monomer, glycerine and stearic acid in the US. We’ll take a closer look at the very interesting case of ethylene (C2) below.

First a few notes on Chart 1: Most of the shipments from Canada actually originated elsewhere, for example, from Indonesia or Malaysia. To trace the original source of Canadian imports it’s necessary to pull up the individual bills of lading for review (which the Datamyne platform supports).

The discrepancies between best prices based on rankings results versus queries results are suggestive – but not definitive evidence – of Census suppression of core BOL data. As we noted in last month’s column, the US Census suppresses selected import data in some strategic industries.

Our Census data suppression case in point was ethylene (C2).

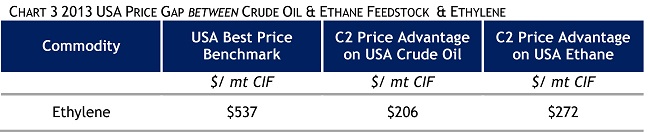

Based on year-end 2013 trade data (and keeping in mind that Datamyne gets this data in a direct feed from Census), the US Best Price Benchmarks published March 2014 (excerpted here), confirm an average import CIF price for C2 of $783, while the best price is $537 from Canada.

These C2 prices seem to be less than in many other parts of the world and perhaps less than in your reports. To see why, we need to dig a little deeper.

Start with C2 price and supply. Ethylene (C2) is the No. 1 building block monomer used in such polymers as polyethylene plastics, and as a petrochemical feedstock for modified glycols, chloro-compounds, and amines, synthetic elastomer-based adhesives, and foam industrial production. C2 is produced from ethane or crude oil feedstock in an integrated production process that includes two major conversions. In the first conversion of crude oil, volatile crude oil fractions are distilled from crude oils into primary alkane feedstock fractions for petrochemical operations. In the second, alkanes such as ethane, propane, gas oils, and naphthas, typically are catalytically steam-cracked to produce ethylene and other primary petrochemicals.

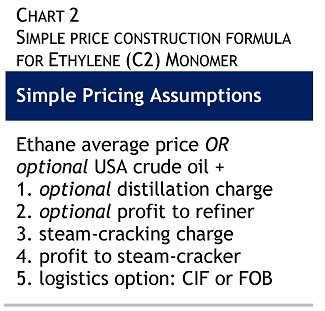

Chart 2 provides a simple production cost formula with which we can estimate expected prices C2. It is logical to infer from a production-cost basis that steam-cracked product C2 should be higher priced than ethane and crude oil as primary feedstock. Note that 75% or more of C2 feedstock slate in the US is ethane, rather than crude oil.

In Chart 3, we compare the 2013 C2 price benchmark to prevailing US ethane and crude oil average import prices – and find that C2 monomer has routinely traded at best prices comparable to and even lower than ethane and crude oil. Since the monomers are the product of ethane or crude oil + one or two conversion processes, the less-than-crude prices we actually find are strong evidence of horizontal transaction patterns in the US and Canada – for example, physical swaps or production sharing agreements of an end-to-end nature among gas producers, crude oil and monomer producers. The conclusion that horizontal transactions are involved is supported by public reports of physical transatlantic C2 swaps by Novachemicals, the company named as a potential alternative source in Chart 1 above.

Next month, watch for Chemcost’s column on “Where is the new cheap for …. the EU?”

Next month, watch for Chemcost’s column on “Where is the new cheap for …. the EU?”

Copyright © 2014 Chemcost Interactive, LLC

About Brian J. McCormick

Brian J. McCormick was instrumental in developing procurement costing and quality assurance for P&G over a 34-year career. He is the founder and managing director of Chemcost Interactive LLC© (CI), a company offering research and analysis to support cost-efficient supply chain management.

Brian J. McCormick was instrumental in developing procurement costing and quality assurance for P&G over a 34-year career. He is the founder and managing director of Chemcost Interactive LLC© (CI), a company offering research and analysis to support cost-efficient supply chain management.

Chemcost can assist Datamyne’s customers in identifying lower price opportunities through consulting and training. Chemcost also offers annual subscriptions to global and regional price bulletins on 225 commodities across 8 major chemical spend classes. Feel free to contact Chemcost for more information at www.chemcostinteractive.com

The opinions expressed in this article are those of its author and do not purport to reflect the opinions or views or Descartes Datamyne. In addition, this article is for general information purposes only and it’s not intended to provide legal advice or opinions of any kind and my not be used for professional or commercial purposes. No one should act, or refrain from acting, based solely on this article without first seeking appropriate legal or other professional advice.

* Chemcost Interactive is a trademark of Chemcost Interactive LLC