Recent agreements with South Korea to impose a quota on steel imports (instead of a 25% tariff); to lower KORUS FTA barriers to U.S. cars, trucks and auto parts. The end result may impact U.S.-South Korea trade patterns.

Just before implementing new tariffs of 10% on aluminum and 25% on steel imports from all but Canada and Mexico on March 23, the Trump administration issued a short list of countries to be temporarily exempted. Imposed under Section 232 of the Trade Expansion Act of 1962 in the interest of national security, the new duties would not apply to Australia, Argentina, Brazil, South Korea, and the EU’s member nations through April 30. During the temporary exemption period, the U.S. would hold talks with these trade partners on ways other than tariffs to address excess capacity in the metals. [See Market Changers: U.S. Section 232 Aluminum and Steel Tariffs.]

In less than a week, the U.S. announced it had reached an agreement with South Korea to limit steel imports from that country to a product-by-product quota equal to 70% of the average annual import volume from 2015 through 2017. Note that, while South Korea is one of the leading sources for U.S. steel imports, it is not among the major suppliers of aluminum.

New Terms of South Korea-U.S. Trade: FTA Negotiations

At the same time, the Trump administration announced progress in its renegotiation of the South Korea-U.S. free trade agreement. The U.S. trade representative (USTR) initiated discussions to amend the 2012 KORUS FTA last July.

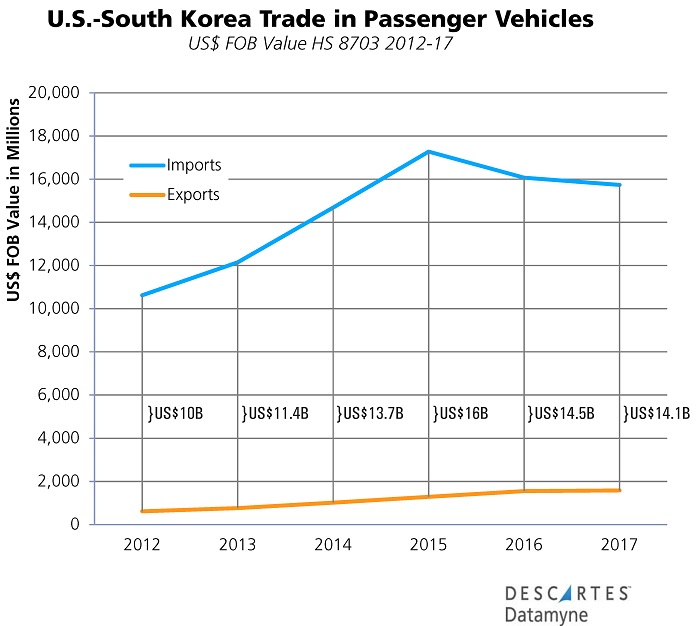

The renegotiations appear to have focused on narrowing the U.S. trade gap in passenger vehicles, which has in grown under the six-year FTA, as the chart illustrates:

According to the administration, South Korea has agreed to key gains for U.S. exporters of passenger vehicles:

- South Korea will double the annual number of American automobiles – from 25,000 to 50,000 per manufacturer per year – that can enter its market using U.S. safety standards.

- U.S. vehicles will be compliant with South Korean emissions standards based on U.S. emissions tests.

- South Korea will recognize U.S. standards for auto parts necessary to service U.S. vehicles, and will reduce labeling burdens for auto parts.

- South Korea will expand the number of “eco-credits” available for U.S. automakers to meet South Korean emissions standards.

- When setting future fuel economy standards, South Korea will take U.S. corporate average fuel economy regulations into account and will continue to include more lenient standards for smaller volume exporters.

In addition, the phase-out of a 25% U.S. tariff on South Korean pick-up trucks will be pushed back 20 years, from the current phase-out date of 2021 to 2041.

Keep in mind, these are terms agreed to in principle by the U.S. and South Korea. There may yet be changes in the terms before the FTA is ultimately finalized.

New Terms of South Korea-U.S. Trade: Currency Practice

The U.S. Treasury and South Korea’s Ministry of Finance have reached agreement on modifications to South Korea’s currency practice. As the Financial Times notes, the proposed understanding would be a side agreement to the FTA, designed to increase transparency and prevent competitive devaluations of currency.

Yonhap News reports South Korea will continue discussions with the U.S. this month and is also in talks with the International Monetary Fund (IMF) on measures to make the workings of its currency market more transparent.

Following on Section 232 Tariffs

We have been monitoring the applications for exclusions from the Section 232 tariffs on aluminum and steel products. The requests for exclusions, as well as comments from U.S. businesses on the impact of these tariffs, are being published at regulations.gov. (The steel docket number is BIS-2018-0006 and the aluminum docket number is BIS-2018-0002.)

Many submissions are from U.S. manufacturers facing tariff-driven price increases on key inputs. As one commenter noted, the 25% duty that his U.S. company will pay on specialty steel imports will be passed along to his customers. Meanwhile, competitors in Canada and Mexico are spared the 25% cost increase, enabling them to export lower-priced products into the U.S. market.

It may be that the steel quota agreed to by South Korea is a guide to similar arrangements to be made with other U.S. trading partners. Or exclusions will grant relief on a product-by-product basis.

This much is certain: Washington is leaning in on tariffs (and sanctions) as tools of economic policy and seeking to renegotiate U.S. trade agreements. For U.S. exporters and importers, the terms of U.S. trade with the rest of the world are very much in play – and along with them, the costs of buying and selling in markets in the U.S. and abroad.

Descartes Global Trade Content solutions can help companies monitor and integrate tariff, tax and other regulatory changes into business operations, benchmark and track market activities, and develop data-driven strategies for mitigating risk and leveraging opportunities. For a free consultation and online demonstration, just ask us.

Related:

From our blog:

- U.S., China Trade Tariffs

- Tariff Changes Take Center Stage for Decision Makers, by Joely Callaway

- Market Changers: U.S. Section 232 Aluminum and Steel Tariffs

- U.S. Deploys Protective Tariffs on Solar Panels, Washing Machines

From our trade content solutions:

- Descartes CustomsInfo™ Manager helps clients minimize trade barriers with a vast database of regulations, rulings, duties, and more. Learn more.

- Descartes Datamyne maritime bill of lading data captures the transactional and logistical details of U.S. import trade – including consignees, shippers, and notify parties, cargo values and volumes. Ask for a demo.