Imposed by presidential proclamations March 8, effective March 23, the new U.S. aluminum and steel tariffs do not apply to imports from NAFTA partners Canada and Mexico. Commerce Dept. is accepting applications to exclude products needed by domestic downstream industries.

President Trump has issued two proclamations imposing tariffs on aluminum and steel imports – 10% ad valorem tariff for aluminum and a 25% duty on steel – effective March 23.

Imports from Canada and Mexico, partners with the U.S. in the North American Free Trade Agreement (NAFTA), are exempt from the new aluminum and steel tariffs.

Update March 22, 2018: President Trump issued two proclamations, one concerning steel, the other regarding aluminum imports, that cite important security relationships with Australia, Argentina, South Korea, Brazil, and the member nations of the EU, and exempt imports from these countries from the new tariffs through April 30, 2018. During the exemption period, the U.S. will continue discussions of alternate ways to address excess capacity in these metals with the temporarily exempted countries, as well as Canada and Mexico.

In an effort to minimize undue impact on downstream American industries, the Department of Commerce has set up procedures to obtain exclusions from the tariffs for products that cannot be supplied in sufficient quantity or quality by U.S. producers. Processing of exclusion requests (which will be published at regulations.gov) is not expected to exceed 90 days. Application forms and information on the exclusion process are available online (click here for steel, here for aluminum products).

The steel products subject to the new tariff are covered by these 6‑digit Harmonized System (HS) codes: 7206.10 through 7216.50, 7216.99 through 7301.10, 7302.10, 7302.40 through 7302.90, and 7304.10 through 7306.90. The aluminum products affected are covered by these HS codes: 7601, 7604 through 7609, and 7616.99.51.60 and 7616.99.51.70. The changes will be posted to Chapter 99 of the U.S. Harmonized Tariff Schedule (a timelier, more efficient way to keep abreast of and integrate the changes with your business operations is a solution from Descartes CustomsInfoTM).

Aluminum and Steel Tariffs: Benchmark Trade Data

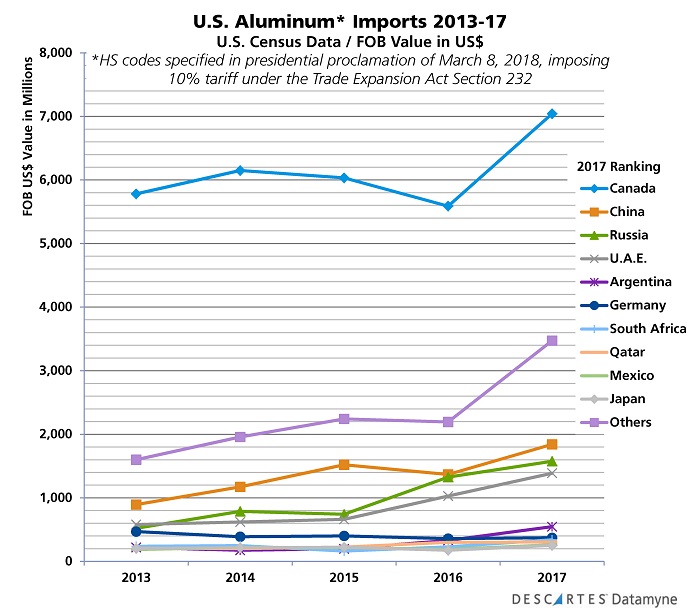

Our trade data shows Canada is the leading source for U.S. imports of the aluminum HS codes subject to the new tariffs.

In 2017, Canada shipped $7.043 billion in aluminum products across its southern border, accounting for 40.5% of the total value of U.S. imports in this product category. While aluminum imports from Canada have climbed over the last five years, Canada’s share of this trade has slipped since 2013, when it accounted for 53%.

Note that Mexico just makes the top 10 sources for aluminum, accounting for 1.5% by value of total imports.

Overall, U.S. aluminum imports increased over the last five years, finishing the period with a 32.9% year-over-year jump in 2017.

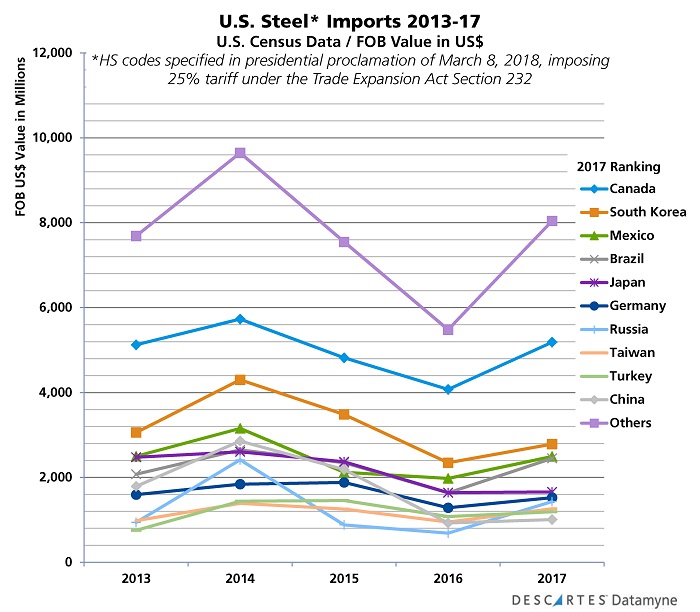

The data on U.S. steel imports also shows a big bump up in value in 2017. But the year’s 31.43% gain followed two years of declines – 20.2% in 2015 and 27.2% in 2016 – and did not restore imports to their 2014 peak. During these years, the U.S. imposed anti-dumping and countervailing duties on a range of steel products, including corrosion-resistant steel, cold-rolled and hot-roll steel, from a range of countries (but, especially, China).

Again, the data puts Canada in the lead as a source for steel imports, accounting for 17.9% by value in 2017. Mexico, ranked third, accounted for 8.6%.

Aluminum and Steel Tariffs under Section 232

The new aluminum and steel tariffs have been imposed under Section 232 of the Trade Expansion Act of 1962, which authorizes the president to adjust imports that threaten national security.

Investigations conducted by the Department of Commerce found cause for the president to take action on these grounds. Commerce reported the results of its Section 232 steel investigation to President Trump on January 11; the Section 232 investigation report on aluminum was submitted January 22. Redacted reports were released to the public February 16.

The Commerce Department last conducted a Section 232 investigation in 2001. The inquiry was focused on iron ore and semi-finished steel. While President George W. Bush did impose protective tariffs on steel imports in 2002, he invoked not Section 232, but Section 201 of the Trade Act of 1974, which authorizes executive action to stem a sudden surge in imports. [President Trump recently used Section 201 to impose tariffs on solar panels and washing machines – see U.S. Deploys Protective Tariffs.]

President Carter’s ban on oil imports from Iran in 1979, and President Reagan’s embargo on crude oil from Libya in 1982 are the most recent previous uses of Section 232 executive authority.

The new aluminum and steel tariffs are now the leading edge of the Trump administration’s trade policy.

The Steel Manufacturers Association welcomes the new steel tariffs as a means to level the competitive playing field and encourage reinvestment in a critical domestic industry. The Aluminum Association views the action as an opportunity to engage trading partners in addressing aluminum over-capacity.

However, the aluminum producers’ trade association is also looking for a more targeted approach on tariffs to protect U.S. jobs in mid- and downstream manufacturing. Other sectors sound similar concerns. For example, the Motor & Equipment Manufacturers Association worries about the potential impact on the auto parts supplier industry if the added cost of aluminum and steel tariffs is passed down-stream through the supply chain and on to consumers.

Further afield, sectors reliant on exports worry about their goods facing retaliatory tariffs in markets abroad. Reuters reports that the European Union is considering applying 25% tariffs on $3.5 billion of goods – a third steel, a third industrial goods and a third agricultural – to “rebalance” bilateral trade in the wake of steel and aluminum tariffs.

Related:

From our blogs:

- U.S. Deploys Protective Tariffs on Solar Panels, Washing Machines

- ITC Holds PET Resin Dumping Harmful

- Commerce Dept. Imposes Steep Duties on Biodiesel Imports

- Playing Whack-a-Mole with U.S. Steel Imports

- Tariff Changes Take Center Stage for Decision Makers, by Joely Callaway

From our trade content solutions:

- Descartes CustomsInfo™ Manager helps clients minimize trade barriers with a vast database of regulations, rulings, duties, and more. Learn more.

- Descartes Datamyne maritime bill of lading data captures the transactional and logistical details of U.S. import trade in steel and aluminum products – including consignees, shippers, and notify parties, cargo values and volumes. Ask for a demo.