Delivering on a promise to defend domestic industries, the U.S. raises protective tariffs on solar panels, washing machines; finds cause for new duties on alloy aluminum sheet from China.

New protective tariffs on solar panels, washing machines and (coming soon) alloy aluminum sheet imports signal a redirection of U.S. trade policy toward stepped-up enforcement of trade laws to protect U.S. industries.

U.S. Trade Representative Robert Lighthizer on January 22 announced President Trump’s approval of safeguard tariffs on solar panels and clothes washers based on the findings and recommendations of the U.S. International Trade Commission. The tariffs are the result of two Section 201 cases – so-called because they are authorized under Section 201 of the Trade Act of 1974. Known as the “global safeguard” law, it is intended to provide temporary relief when a surge in imports causes serious injury to a U.S. domestic industry.

Protective Tariffs on Solar Panels

Antidumping and countervailing duties (AD/CVD) cases have been brought, settled and tariffs imposed on solar imports before [as our blog has reported]. The first AD/CVD tariffs were imposed in 2012. However, the ITC found their effectiveness in curbing imports was limited as centers of production moved from China to Taiwan, Korea, and beyond – as the chart below illustrates:

Meanwhile, the number of U.S. solar manufacturers has dwindled: Since 2012, 25 companies have closed. Last year, one of the two remaining makers of solar cells and modules declared bankruptcy. Eight firms continue to produce modules using imported cells.

The ITC offered the administration a choice of remedies in the current Section 201 solar case on October 31 [see Split Decision]. The president chose to set additional duties on solar cells and modules of 30% in Year 1, decreasing by 5% each year to 15% in Year 4. The first 2.5 gigawatts of imported cells are excluded from the added tariff.

Protective Tariffs on Washing Machines

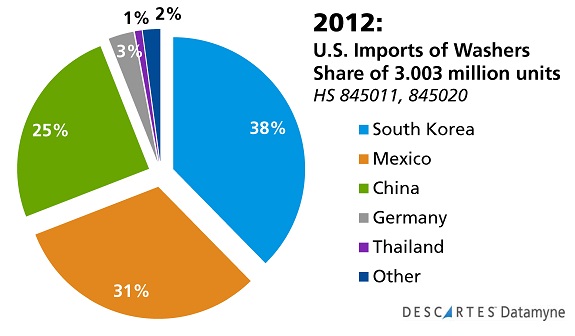

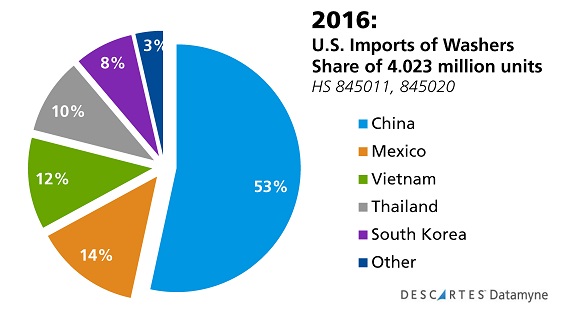

In an investigation launched June 5, 2017, the ITC identified a pattern similar to that of U.S. solar imports for washing machines: an increase in incoming volumes in the period from 2012, successive AD/CVD tariffs having limited impact as production shifted from one country of origin to another, with the result that U.S. domestic producers were running net operating losses by 2016.

Our trade data clearly illustrates (as in the following charts) a major shift in volumes and, especially, sources of washer imports. Compare the data on countries of origin in 2012 with 2016:

Digging into the data, we found that Vietnam, which ranked third by volume and was the source for 12% of the units received in 2016, sent no washing machines to the U.S. in prior years.

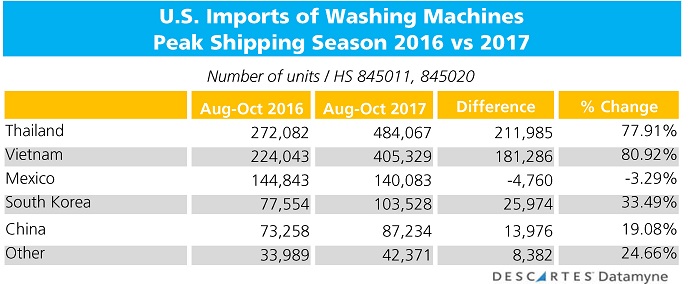

Last month our blog noted that consumers splurging on year-end purchases of white goods, including washing machines, helped drive the 2017 peak shipping season to record volumes [see Twin Peaks: Imports Pass 2M TEUs Twice during Peak Shipping Season].

Here’s a closer look at the data on peak shipping season volumes of washers in 2017 vs. 2016:

The USTR recommended and the president chose to take action by applying tariff-rate quotes on washers:

| Year 1 | Year 2 | Year 3 | |

| First 1.2M units, finished washers | 20% | 18% | 16% |

| All subsequent units, finished washers | 50% | 45% | 40% |

| Tariff of covered parts | 50% | 45% | 40% |

| Covered parts excluded from Tariff | 50,000 units | 70,000 units | 90,000 units |

U.S. law requires the exclusion of Canada or Mexico from Section 201 actions if imports from those countries do not account for a substantial share of imports and don’t contribute importantly to serious injury to domestic producers. Under this provision, washers from Canada are not subject to the new safeguard tariffs.

USITA Investigates Common Alloy Aluminum

The Commerce Dept. announced the launch of AD/CVD investigations into common alloy aluminum sheet imports from China on November 28.

The merchandise subject to current investigation is common alloy aluminum sheet, which is a flat-rolled aluminum product having a thickness of 6.3 mm or less, but greater than 0.2 mm, in coils or cut-to-length, regardless of width.

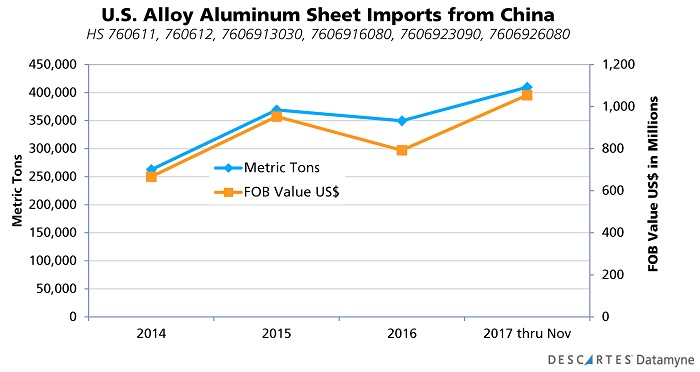

Our trade data indicates China has dominated U.S. imports of alloy aluminum sheet, ranking as the top country of origin from 2014, when it accounted for 35% of inbound volumes, to 2017, when it claimed over 40% share. Our data on U.S. import volumes and values in the HS codes specified in the AD/CVD cases indicates the value trend lagging volume in 2016:

These cases are notable because they were “self-initiated” by Commerce, invoking a rarely-used enforcement power under the Tariff Act of 1930, as amended.

AD/CVD inquiries are commonly opened in response to petitions by domestic industry representatives. The Department last self-initiated a countervailing duty investigation in 1991 on softwood lumber from Canada. The last self-initiated antidumping duty investigation occurred in 1985 on semiconductors from Japan.

The self-initiated cases will follow standard procedure: Preliminary determinations that the product imports from China have been sold in the U.S. at less than fair value and have injured the U.S. domestic industry were issued January 16.

The Commerce Dept. has said it expects that future AD/CVD investigations will be based on fully supported petitions filed by or on behalf of the industry. At the same time, the Department reserves the option of taking action to self-initiate investigations when warranted. [“USITA Taking the Initiative in AD/CVD Inquiries” is one of our 10 Bellwether Trends in International Trade to watch in 2018.]

Related:

From our blog:

- Split Decision: ITC Offers Choice of Outcomes in Solar Imports Case

- Plastics Industry Trends | ITC Holds PET Resin Dumping Harmful

- Playing Whack-a-Mole with U.S. Steel Imports

From our trade content solutions:

- Descartes CustomsInfo™ Manager offers solutions to monitor duty rates, as well as trade regulations and rulings relevant to your business – and integrate this content with your global operations systems. Ask for a demo.

- Descartes Datamyne maritime bill of lading data captures the details of U.S. import trade in these and other product in trade down to the level of individual transactions. Ask for a demo.