Commerce Dept. considers whether imports of polyethylene terephthalate (PET) from five countries harm domestic producers. Canada launches its own inquiry into PET resin imports.

The U.S. Commerce Dept. International Trade Commission (ITC) announced October 17 the opening of an investigation into whether imports of polyethylene terephthalate (PET) resin from Brazil, Indonesia, South Korea, Pakistan and Taiwan are being dumped on the U.S. market.

The ITC set a November 13 deadline for its preliminary decisions on whether PET resin imports from the five source countries are being sold into the U.S. market at less than fair value and, if so, to what extent this dumping harms U.S. producers.

Final determinations on the extent of any antidumping and countervailing duties (AD/CVD) to be imposed are scheduled for May 21, 2018 (although this deadline may be extended).

PET is a clear, strong and lightweight plastic, shipped in resin pellets, that is used to make bottles and packaging.

U.S. PET Resin Imports: What Trade Data Reveals

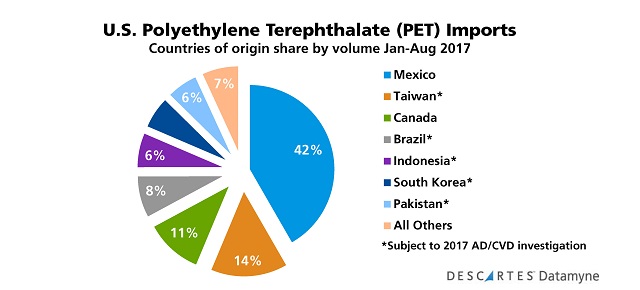

As our Census-based data shows, Mexico is the leading country of origin for PET, accounting for 42% of imports by volume, while the five countries subject to this year’s ITC AD/CVD investigation accounted for 41% of PET imports in the first eight months of this year:

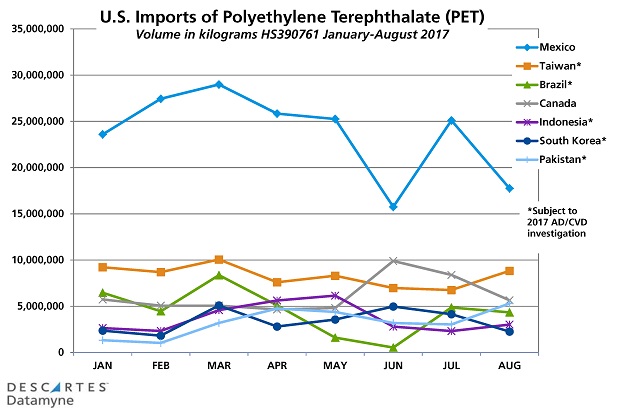

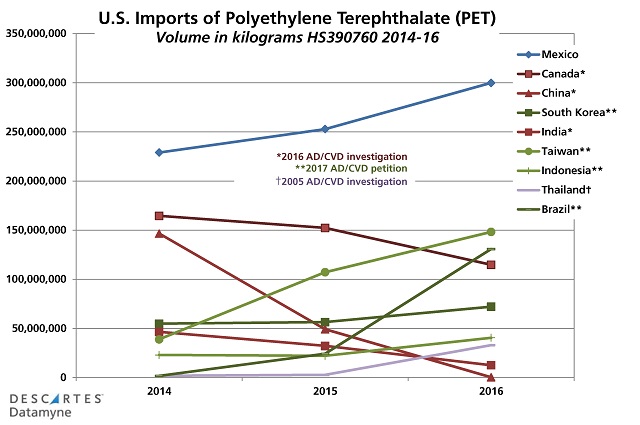

The companies that petitioned for this investigation claim that PET resin imports from the five countries surged after shipments from Canada, China, India and Oman fell under the weight of AD/CVD tariffs imposed in 2016. Instead of hoped-for relief for U.S. producers, the 2016 duties cleared the way for a new set of foreign rivals.

The graph below illustrates the declines in shipments from 2016’s AD/CVD subject countries (especially China) and the accompanying increases in PET resin imports from the countries that are the focus of this year’s inquiry. (Note that new HS code 390761 was introduced for PET in January 2017, replacing the previous HS 390760.)

The petitioners estimate dumping margins of 18.76 to 115.87% for Brazil exporters, 8.49-53.5% for Indonesia, 55.74-101.41% for South Korea, 25.03-43.4% for Pakistan, and 14.67-450% for Taiwan.

Canada Investigates PET Resin Imports

A month before U.S. PET resin producers filed for AD/CVD relief, the Canada Border Services Agency (CBSA) initiated investigations into allegations of dumping and subsidizing of PET resin exports from China, India, Oman and Pakistan.

In what seems like a global game of dumping whack-a-mole, three of the subjects of the CBSA inquiry – China, India and Oman – lost U.S. market share after AD/CVD tariffs were imposed in 2016. Also subject to the 2016 tariffs, Canada’s PET resin export volume to the U.S. fell 24% that year. Pakistan is currently subject to investigation by both the U.S. and Canada.

On October 17, the Canadian International Trade Tribunal (CITT) issued a determination that there is “reasonable indication” that the alleged dumping has caused injury to the domestic industry. The CBSA’s preliminary decision on whether PET resin is being dumped is expected by November 16.

Related:

From our blog:

- Commerce Dept. Imposes Steep Duties on Biodiesel Imports

- Playing Whack-a-Mole with U.S. Steel Imports

- China in the Crosshairs as U.S. Takes Aim at Imports

From our trade content solutions:

- Descartes CustomsInfo™ Manager offers solutions to monitor AD/CVD duty rates, as well as trade regulations and rulings relevant to your business – and integrate this content with your global operations systems. Ask for a demo.

- Descartes CustomsInfo™ Reference enables visibility to all AD/CVD details by embedding cases into the US tariff schedule, trade regulations and rulings. Register for a free 14-day trial.

- Descartes CustomsInfo™ Trade Content seamlessly loads AD/CVD cases into Enterprise Resource Planning (ERP) and Global Trade Management (GTM) systems. Learn more about Descartes CustomsInfo.

- Descartes Datamyne maritime bill of lading data captures the transactional and logistical details of U.S. import trade in PET with overseas countries of origin. Ask for a demo.