Western Digital aims to get some hard disk drive production out of Thailand

A new report from IHS iSuppli finds the global hard disk drive (HDD) industry fully recovered a year after flooding halted production in Thailand.

Not only are HDD shipments forecast to reach 524 million units in 2012 (up 4.3% from 2011), but shipments are expected to keep rising to 575.1 million units in 2016.

One after-effect of the flood, high prices for HDD, will not start to ebb until 2014, according to IHS.

Another long-term effect: As the Wall Street Journal reports, companies have once again learned that over-reliance on a single country source is risky. Many are rerouting supply lines and shifting production away from Thailand. Among them is HDD supplier Western Digital.

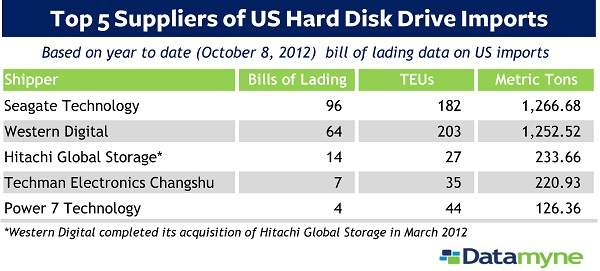

At the start of this year, we gauged the impact of the flooding in Thailand on trade with a before-and-after comparison of HDD shipments to the US by Seagate Technology and Western Digital (see Counting Flood’s Toll). As our current top 5 table shows, the two companies still lead as HDD suppliers to the US market.

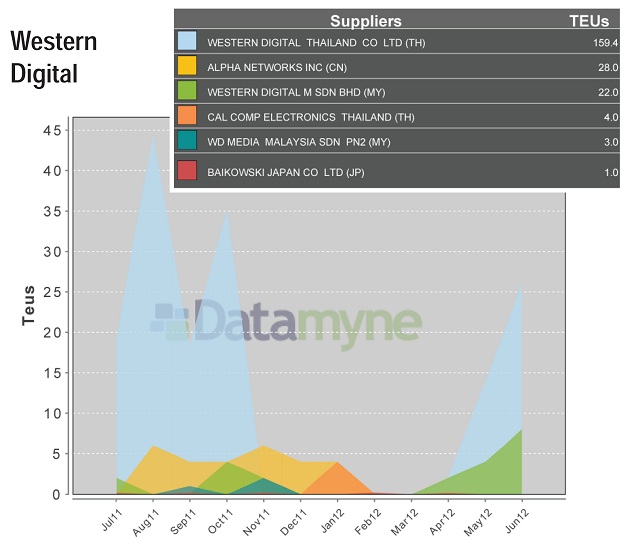

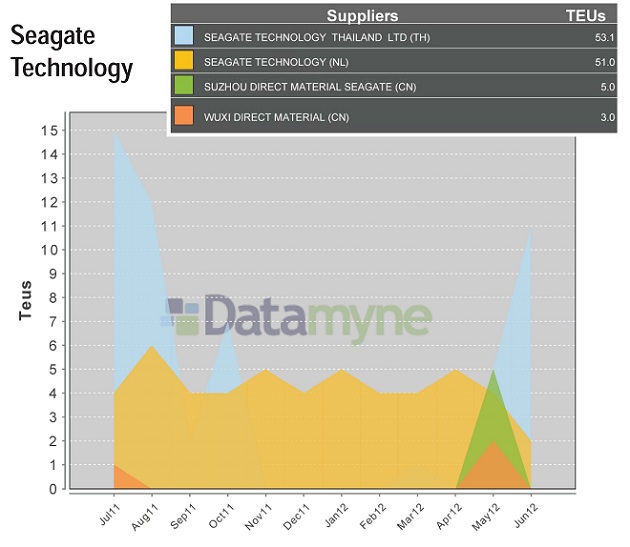

Our new Datamyne Profiles feature makes it easy to compare the two suppliers not only on shipment volumes but on diversity of sources. Following are the supplier pages from each company’s Profile (which also covers import volumes, product mixes, and ports of entry over a rolling 12-month period as well as business background and contact info).

Both multi-nationals rely on their corporate siblings for much of their supply, Seagate exclusively so in this cycle (all suppliers shown are Seagate units). But Western Digital is more at risk of disruption from events in Thailand than Seagate, with 75% of its shipments sourced from that country compared to 47% of Seagate’s.

To learn more about using Datamyne Profiles to research sourcing diversity and other supply chain risk factors, contact us.