Flooding in Thailand creates global shortages in auto parts, hard disk drives

The worst flooding in Thailand since 1942 has left a huge part of the country under water, putting the Thai people, who have already sustained more than 500 casualties, at risk for water- and insect-borne disease.

The flooding has also devastated the Thai economy, forcing shut-downs at production facilities for everything from hamburger buns to automobiles. According to a report from Aon Benfield, global reinsurance broker, nearly 15,000 industrial and manufacturing plants in 20 provinces had been damaged as of the end of October (with floodwaters still rising around the capital). The Thai government has preliminarily estimated the economic losses nationwide in excess of THB200 billion (US$6.5 billion).

The damage doesn’t stop at Thailand’s borders. A relatively small nation, Thailand plays a big role in a lot of global supply chains. At just one of Thailand’s inundated industrial parks, dozens of factories were forced to close, including plants operated by Toyota, Honda, Mazda, Nissan, Mitsubishi, Sony, Nikon, Sanyo, and Matsushita.

And so, as Bloomberg reports, Japanese automakers aiming to stage a comeback from this past spring’s earthquake-tsunami-meltdown disaster will have to wait until next year. Instead of running factories overtime to recoup production losses as planned, Honda is temporarily eliminating overtime and running North American plants at half capacity.

Global production of hard disk drives (HDDs) is especially concentrated in Thailand, the world’s largest producer of these essential computer components. Industry leader Western Digital reports that 60% of its global computer hard drive production comes from Thailand. The New York Times forecasts shortage-driven price increases of as much as 10% for external hard drives. Seeking alpha sees pain ahead for makers of computers, notebooks and digital readers who have pinned their hopes on holiday season sales.

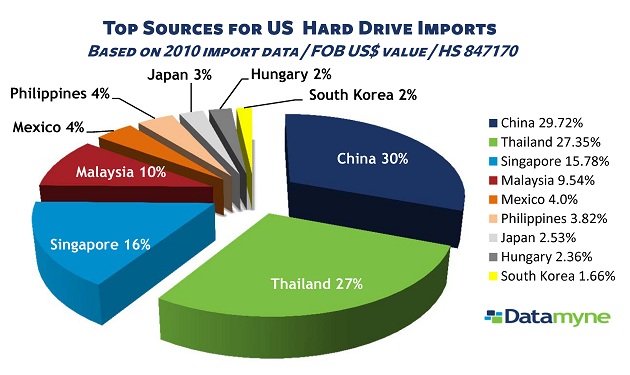

Longer term, industry analysts expect stepped up efforts to diversify global supply chains geographically. A good place to start is by looking at the current trade data for suppliers already making cross-border deliveries. For example, as the chart below shows, Thailand is a major source for US HDD imports – but so, too, are Malaysia and Singapore (where Western Digital also has factories).

A drill down to the bill of lading data on US imports leads to alternate sources such as Malaysia’s Teleplan Technology Services SDN BHD and Xyratex (Malaysia) SDN BHD, or further down the list, Taiwan’s QNAP Systems and (the delightfully named) Geniality Maple Technology Co., Ltd.

To learn more about using trade data to identify sourcing alternatives ask for a demonstration.