Sophisticated and globally connected supply chains have made the movement of goods more efficient and accessible but, at the same time, susceptible to economic crisis and natural disasters such as the financial crisis in 2008 and the Asian Tsunami in 2011.

While many lessons have been learned from past events, the uncertainty of the prolonged impact of COVID-19 has made it nearly impossible to predict the economic effect on the supply chain – from labor and supply shortages to consumer demand and changing market conditions in different regions of the globe – all as the supply and demand crisis is combined with an unprecedented public health crisis.

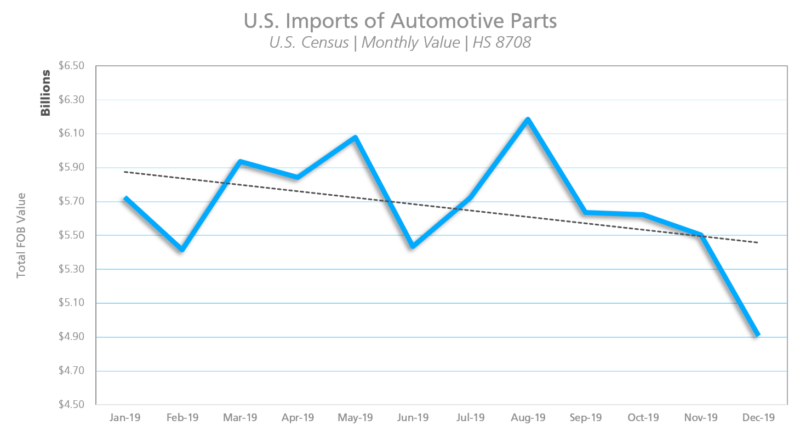

U.S. Auto Parts Imports

The automobile and auto parts industry, which, according to Descartes Datamyne’s data analytics, was already seeing a steady decline in imports from China throughout 2019, may be especially vulnerable.

There is a strong likelihood manufacturers have just weeks of supplies of critical parts, Capital Economics warns. There is real chance that many manufacturers from auto makers to electronics companies will soon begin to stop or limit production.

Many automotive plants operate on “just-in-time” delivery of parts that are whisked into the factory and assembled into vehicles. When parts dry up, companies may have to reduce or suspend production until they become available again.

Descartes Datamyne, with provides tools to help it customers know the market for better buying and selling strategies, has maintained constant monitoring of the supply chain to assist in best determining potential supply chain disruption in several markets, including the automotive industry. Among the data used for analysis is Bill of Lading receipts, which is the most immediate and fasted means of measuring the impact of disruptions, including COVID-19. This data is also combined with other information, including US census data, which provide more line of sight into the value of shipments coming into the United States.

With the first quarter still underway, the data already shows a steep decline in imports of automotive parts in 2020, continuing the decline from Q4 2019. The typical trend begins to see an uptick in March, which is not present in this year’s data so far. The most notable decline are imports from China, the largest supplier to the U.S., which shows an 18.8% decline year-over-year.

U.S. Auto Parts Exports

Outside of China, the U.S. has not yet experienced recordable declines in automotive exports; however, with factories in the U.S. shutting down and the virus spreading globally, those declines will become apparent when March figures are finalized. Fiat is shutting down its plants in Italy and Volkswagen doing the same in most of Europe. To the East, South Korea is suspending operations in its Hyundai plants (mainly due to supply disruptions from China). Plants in China are once again operating, but at minimal capacity. The US manufacturers have been operating mostly on backlogged orders, but most experts expect those to dry up in the very near future – pressuring U.S. automakers to do take similar production actions.

The Big Three auto makers are already preparing for supply chain disruptions and potentially less dealership traffic by slowing down production and making attempts to preserve cash – Ford Motor Company being the first to suspend its quarterly dividend to maintain liquidity.

While, the COVID-19 outbreak is halting production and causing supply and demand shocks in the auto industry. Large automakers are not the only ones that will be faces will massive supply chain and other disruptions. Local Dealers are seeing decreased traffic and experts predict demand for new cars to drop by more than 10% this year. Tire company and other parts producers are halting production.

Further complicating the supply chain is that there is ripple effect, as in most industries, related to aftermarket and raw materials. For example, a significant amount of auto parts imported to the U.S. comes from South Korea, specifically for radial ball bearings and roller bearings. The majority of steel necessary to produce these products is used imported by China, where there are supply disruptions. In fact, South Korea relies on China for upwards of 40% of its steel and through the first two months of the year, China’s overall exports dropped 27%.

In addition to automakers and new car dealerships, every facet of the automotive industry, from spare parts distribution services to your local repair shop, are living with the uncertainty of how widespread the impact will be felt on their business.

The message so far from auto companies to dealers and beyond has been uncertainty about the impact — the Center for Automotive Research notes that most auto parts are still produced domestically — but that appears to be more a matter of timing and total severity. The interconnected nature of the global automotive supply chain and heavy reliance on China in particular for parts production mean the widespread factory shutdowns in an effort to contain the spread of the disease will eventually send ripples to the United States.

Resources:

- Our multinational trade data assets can be used to trace global supply chains and our bill-of-lading trade data – with cross-references to company profiles and customs information – can help businesses identify and qualify new sources. Ask us for a free, no obligation demonstration of our data on a product or trade commodity of your choosing – and keep the custom research we create with our compliments.