by Bill Armbruster, blog anchor

Business executives and trade analysts generally applaud the Obama administration’s new Look South Initiative, I found. (See my related post for details on this program to boost US exports.)

“The initiative has the potential to help boost exports – particularly from small and medium manufacturers,” said Lauren Airey, director of trade facilitation for the National Association of Manufacturers.

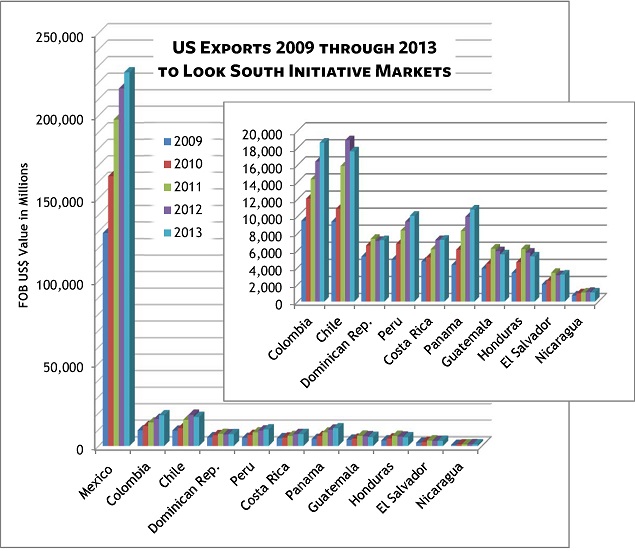

“The 11 economies highlighted in the Look South initiative are diversifying their industries, creating opportunities to sell to businesses as well as to consumers,” Airey said. “Government spending and infrastructure projects, in particular, could have positive ripple effects through these economies.” You can see the generally positive five-year trend in US exports to these 11 markets in graph below.

Irene Mia, the Economist Intelligence Unit’s regional director for Latin America and the Caribbean, said “the initiative will surely help SMEs look abroad.” Emerging and growing consumer markets in Latin America represent an appealing opportunities for US companies, she added.

Both Mia and Barbara Kotschwar, a Latin America specialist with the Peterson Institute for International Economics, noted the absence of Brazil, which is not an FTA partner, from the initiative. “It is disappointing not to see concrete actions proposed for enhancing trade and investment with Brazil – which not only has the largest South American market, but a market in which significant barriers remain which prevent US-Brazil trade and investment from reaching its potential,” Kotschwar said.

Daniel Crocker, executive director for Latin America at the Commerce Department’s Foreign Commercial Service, agreed with Kotschwar about the challenges in Brazil. But Crocker, whose previous assignments include stints in Brazil and Panama, was quick to note that even Brazilian companies have a hard time there. “It’s a very challenging and relatively slow bureaucratic and regulatory framework. The bright side is that US goods and services can still be competitive. US companies can and do sell quite a bit. It is important to note that Brazil’s challenges are not aimed at us.”

Crocker added that the Commercial Service has a larger presence in Brazil than anywhere else in the Western Hemisphere. Exports to Brazil last year totaled $44 billion – just 20% of the total to Mexico – and tailed off in the last few months.

Riordan Rhett, a Latin America expert at the Johns Hopkins School of Advanced International Studies, was skeptical about the initiative’s prospects for success. “These are certainly gestures of good will, but will probably yield little of real substance,” he said. Rhett expects that US exports to the region will remain flat or drop in 2014.

I’m more optimistic than Rhett, although economic troubles in Brazil, Argentina and Venezuela are likely to depress exports this year. Also, the new business connections resulting from Look South may not produce much fruit for US companies this year. But I recommend that companies looking to grow their exports investigate the new opportunities offered by Look South.

Bill Armbruster, the anchor for the Datamyne Blog has covered shipping and trade for 30 years as a reporter and editor with The Journal of Commerce and Shipping Digest. “I’ll be blogging on headline news and current issues in oceangoing commerce, trying to shed some light on the backstories and, wherever I can, supply some sound advice for shippers.” Write Bill care of [email protected]

Bill Armbruster, the anchor for the Datamyne Blog has covered shipping and trade for 30 years as a reporter and editor with The Journal of Commerce and Shipping Digest. “I’ll be blogging on headline news and current issues in oceangoing commerce, trying to shed some light on the backstories and, wherever I can, supply some sound advice for shippers.” Write Bill care of [email protected]

The opinions expressed in this article are those of its author and do not purport to reflect the opinions or views or Descartes Datamyne. In addition, this article is for general information purposes only and it’s not intended to provide legal advice or opinions of any kind and my not be used for professional or commercial purposes. No one should act, or refrain from acting, based solely on this article without first seeking appropriate legal or other professional advice.