Buyers seem indifferent to country-of-origin labeling, say USDA researchers

This is counter-intuitive. The US Department of Agriculture reports that its researchers have been unable to detect any shift in the pattern of consumers’ purchases of shrimp from 1998 through 2006 – that is, before and after April 2005, when rules requiring country-of-origin labeling (COOL) went into effect for fish and shellfish.

The USDA looked at Nielsen Homescan purchase data for three products: random-weight shrimp purchased from the fish counter, frozen bagged shrimp, and frozen bagged and breaded shrimp. And they controlled for price, consumer budgets, seasonality, and other demographics. They also zeroed in on college+ households, the more likely food label readers … and found no COOL-driven changes.

The findings might mean that consumers are confident enough in their food delivery system and its safeguards to find the COOL labels superfluous, says the USDA.

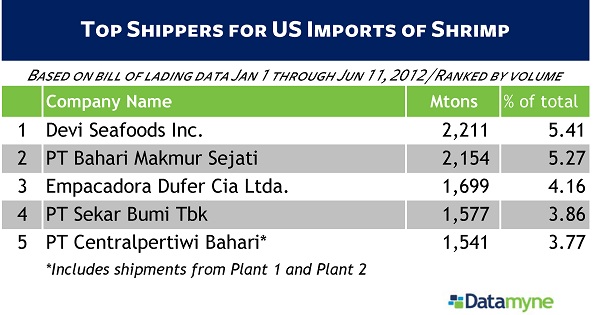

If so, they are trusting in a global industry’s ability to police itself. One such self-regulatory initiative, about which we’ve written before, is the Global Aquaculture Alliance’s certification of fish farms that have adopted Best Aquaculture Practices (BAP). Our research indicates that US imported shrimp is mostly farmed shrimp. Of the top five sources for US imported shrimp (table below), three – India’s Devi Seafoods, and Indonesia’s Bahari Makmur Sejati and Centralpertiwi Baharai – are concerns running BAP-certified aquaculture operations.

Or maybe US consumers recognize that if they want shrimp (or tomatoes and avocados for Cinco de Mayo, or tropical fruits in the dead of winter), they will have to rely on multinationals to deliver.

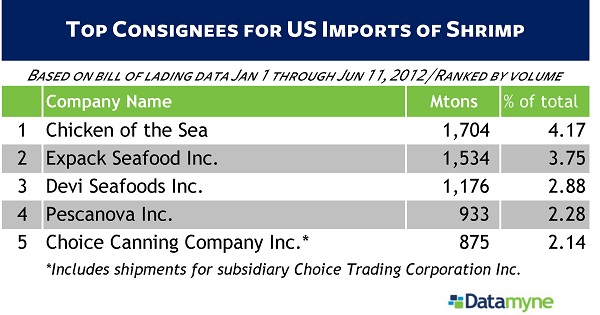

Note that top shrimp shipper Devi Seafoods also makes the list of top US shrimp importers (next table). The US division is a subsidiary operation of one of the leading exporters of Indian black tiger shrimp. US-based Choice Canning Company, on the other hand, has a subsidiary operation in India, Choice Trading Corporation.

Of the top 5, only Expack Seafood is not part of a multinational: its parent is the California-headquartered H&N Foods International

A member of Spain’s Grupo Pescanova, Miami-based Pescanova USA is a top customer for shrimp exported from Ecuador by Promarisco S.A., another Grupo Pescanova affiliate. At Number 1, Chicken of the Sea is a well-recognized US brand-name; it belongs to Tri-Union Seafoods, which is a subsidiary of Thai Union International Inc.

Not surprisingly, Chicken of the Sea’s top suppliers are fellow affiliates based in Thailand. See the last table below, which covers all imports (not just shrimp) and is just one of the added dimensions of background information available through our new Datamyne Profiles feature. (We also used Datamyne Profiles to trace the corporate pedigree of our top consignees.)

Datamyne Profiles also provides D-U-N-S* Number® identification and links to a range of information resources, including D&B background and Jigsaw contacts. To request a free demonstration, click here.

* D&B D-U-N-S Numbers are proprietary to D&B, are licensed from D&B and are for internal use only.

D-U-N-S is a registered trademark of D&B.