Italy’s standing among the top-ranked countries of origin for US footwear imports rests on pricier, higher-end brand products, Datamyne’s bill-of-lading data shows.

Almost all footwear bought by US consumers is imported, with China far and away the leading source – although rising labor costs there are driving production to other Asian countries (see US Footwear Imports Step up; Vietnam, Indonesia Step Forward).

Ranked by the value of shipments in 2013, the top sources for US footwear imports are China, Vietnam and Italy. Ranked by volume, China and Vietnam remain No. 1 and No. 2, while Italy slips to fifth behind Indonesia and Mexico. Based on the FOB value of shipments, the average price per pair is about $13 for footwear from Vietnam, $69 for Italian imports.

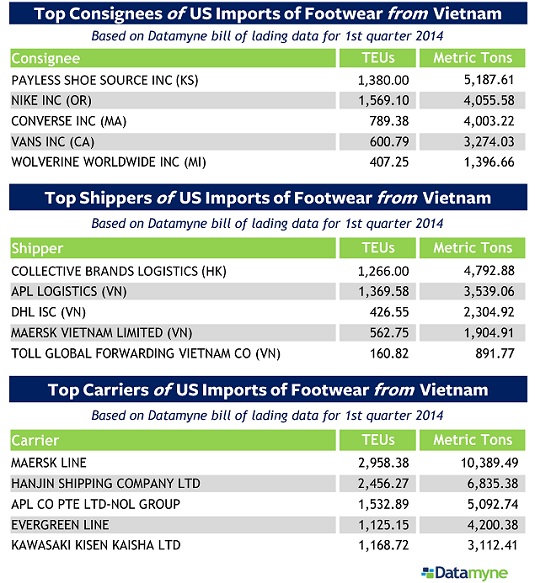

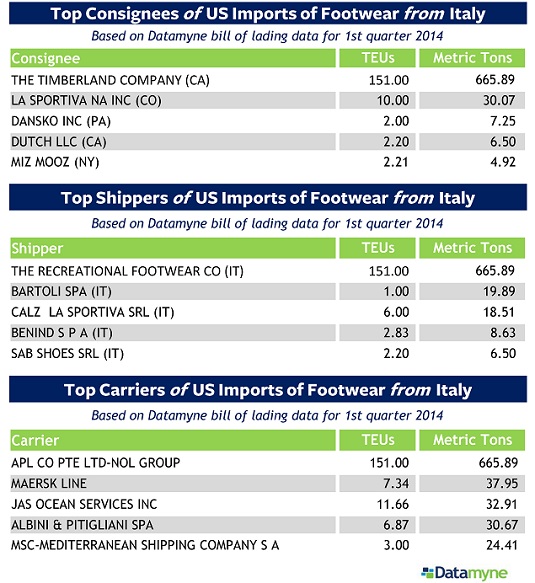

Drawing on our bill-of-lading data for first-quarter 2014, we’ve ranked the top consignees, shippers and carriers of footwear imported from Vietnam and Italy (see the tables below). The top customer for footwear from Vietnam, taking delivery on 1,380 TEUs, is Payless ShoeSource, a discount retailer. Italy’s most important consignee is The Timberland Company, with a much lower volume of 151 TEUs, all of it leather footwear.

Not immediately clear from the tables (but information that can be dug out with help from our trade Profiles of consignees and shippers, with links to D&B information): Much of this higher-volume commerce is related-party trade. The Recreational Footwear Company, top Italian shipper, is a subsidiary of The Timberland Company, top consignee of Italian imports.

Similarly, Collective Brands Logistics, top shipper of product sourced from Vietnam, is a subsidiary of Payless ShoeSource, top consignee for Vietnamese footwear. Note, too, that Payless was acquired by Wolverine Worldwide in 2012.

To find out what else you can learn about US imports of footwear – or any other consumer product – from our trade data, just ask us.