U.S. import volumes continued to run at a record pace in November 2021. Despite this overall success, retail inventories are not catching up to pre-pandemic levels as a percentage of sales. The ultimate takeaway: as long as the high demand for goods continues in 2022, there will not be a break from the shipping delays we are currently seeing. This, in turn, points to longer lasting effects on global supply chains.

For further reading, including getting tips on how to handle supply chain disruptions, be sure to check out Descartes’ Global Shipping Crisis Resource Center.

November was an even stronger month for U.S. Import Volume

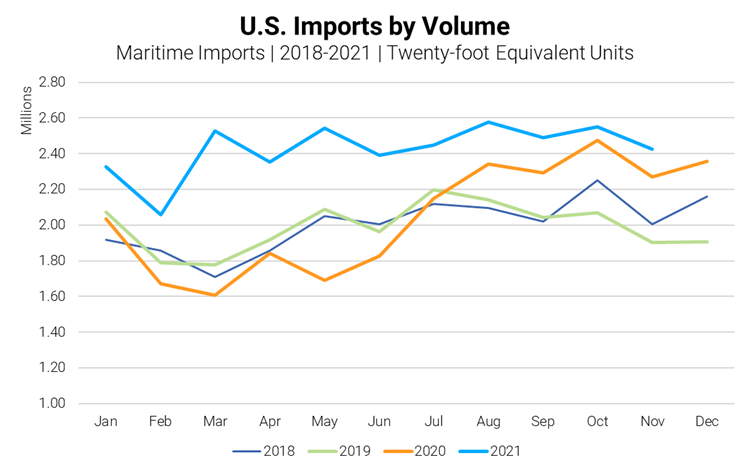

November traditionally records a lower import volume than October, because ahead of the beginning of the year-end holiday season many goods have already been imported and stocked. This remained true for 2021; however, comparing year-over-year importers for 2020 and 2019, last year’s volume was up 12% and 34%, respectively. For comparison, only one other month in the prior two years (October 2020) saw a higher container import volume.

Many retailers have been accelerating their imports to address strong demand, the supply chain crunch and reduced inventories, but this hasn’t translated to a decline so far at year-end. The ongoing expectation is for December 2021 TEU volumes to be between 2.4M and 2.6M which will continue to stress ports and inland logistics.

Figure #1: U.S. Container Import Volume Year-over-Year Comparison

Increasing Port Delay Times Point to a Prolonged Crisis

Port delays are not easing as of November 2021. Using Descartes Datamyne™ to track delay times at the Port of Los Angeles since August reveals that the average delays for the month of November actually increased to 14.4 days.

Reviewing the Port of New York/New Jersey and The Port of Savannah also shows longer delays in November by 2.4 days to 10.8 days and one day to 10.7 days. respectively. The Port of Long Beach was 15.0 days in November and even smaller ports such as Oakland (11.9 days), Seattle/Tacoma (11.9 days) and Norfolk (8.0 days) have relatively long delay times.

Another key observation is that container volume processing growth is occurring away from the two largest ports, Los Angeles and Long Beach. The number of TEUs processed in equal length months of May and October shows that the Port of Los Angeles and the Port of Long Beach both declined by over 3%. However, overall, the U.S. imported more TEUs in October versus May. This may indicate importers and LSPs possibly shifting to alternate ports to avoid the West Coast bottleneck.

Keep Ahead of the Global Shipping Crisis

Descartes has been tracking the global shipping crisis in an effort to provide you with the most up-to-date data and analysis available.

Updated regularly, our Global Shipping Crisis Resource Center is your critical resource when facing ongoing disruptions and delays at port.

Some Things Change, Most Stay the Same

Unless consumer behavior changes or the economy stalls, demand for goods and the associated logistics services to get them to market will continue to remain at record levels through 2022. In an effort to track the ongoing challenges, Descartes Datamyne will continue to highlight key U.S. government and industry data in coming months to provide insight into the global shipping crisis. Our perspectives and recommendations are:

Businesses Cannot Treat Shipping Delays as a Short-Term Problem

The Global Shipping Crisis has been impacting supply chains for almost a year now. There is nothing in the logistics and economic data that indicates the crisis will end soon and can be waited out. There is a need for risk mitigation strategies as well as adjustments in long-term supply chain strategies.

As we have in the past several months, Descartes Datamyne will highlight US shipping and industry data to provide insight into the global shipping crisis. Our recommendations remain the same:

Short-term:

- Shipping capacity constrained? Prioritize shipping higher velocity and higher margin goods to maximize profitability.

- Focus on keeping the supply chain resources you have, especially drivers. Driver retention is now more important than possibly ever before.

Near-term:

- Redirect the flow of goods to less congested transportation lanes to not only improve transit times, but also help ensure supply chain predictability.

Long-term:

- Evaluate supplier location density to reduce the reliance on congestion-prone trade lanes. While density provides companies with economy of scale, the downside is logistics capacity crunches in times of mass disruption such as that brought on by the pandemic.