Chilean, Peruvian copper fetches record prices as shipments slip in 1H11

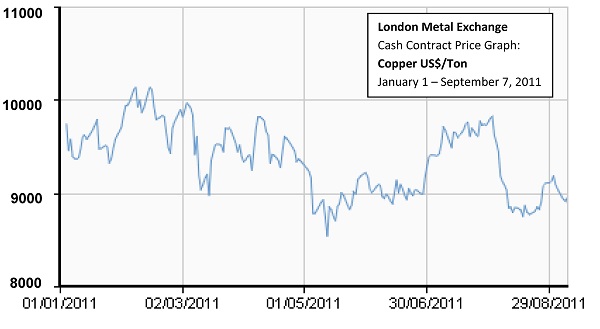

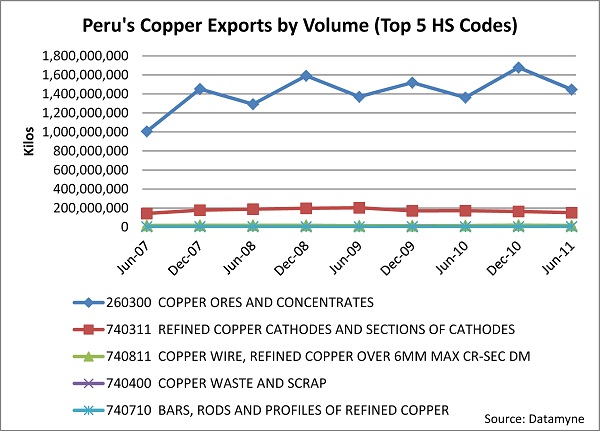

End of July, we looked at copper exports from top source Chile and top comer Peru through year-end 2010, when the price of copper began its climb toward a record US$10,000/ton [Copper Benchmark]. We promised an update with trade data from first-half 2011 … and here it is.

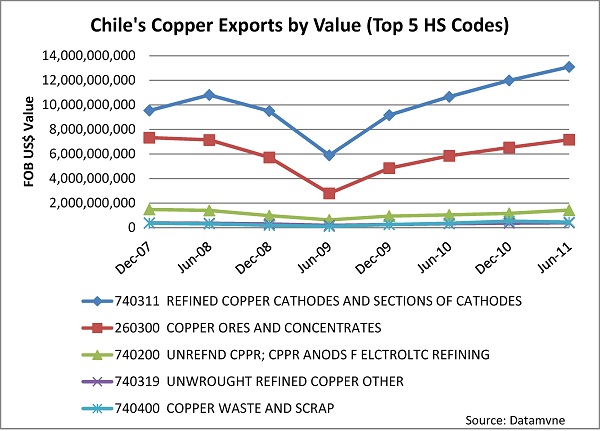

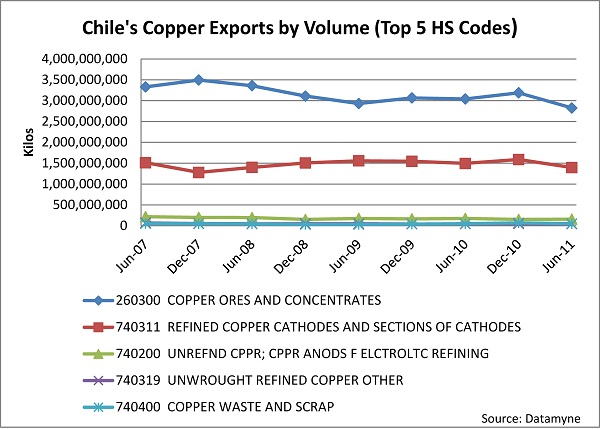

Where the rise in value was steeper than the growth in volume of copper exports for both countries in 2010, the value and volume trend lines now run counter to each other. With Chilean production slowed by bad winter weather and strikes, export volumes of its copper ore (HS 260300) fell 11.4% in first-half 2011 compared to second-half 2010. But concerns about supply shortages helped bolster price and so the value of Chilean copper exports rose. The value of copper ore shipped in first-half 2011 increased 9.7% compared to second-half 2010.

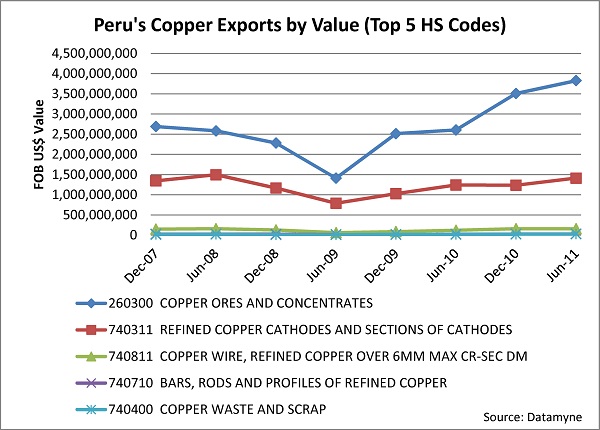

Similarly, striking miners and protests against mining operations by its indigenous people and their supporters reduced Peru’s copper exports while causing the kind of supply worries that drive up the price the commodity commands. So as the volume of copper ore shipped from Peru fell 13.8% in first-half 2011 compared to the preceding half, the value of those shipments rose 9.1%.