We called it a new HS code for Tesla – the new Harmonized System tariff code that distinguishes lithium-ion batteries imported to run electric vehicles from all the rest of Li-Ion batteries destined for digital devices, appliances and power tools.

But, of course, Tesla’s game plan is not to import, but to make all the Li-Ion batteries it needs at the gigafactory it’s building near Reno. The Li-Ion batteries made here will not only run Tesla cars, but also be used in Tesla’s Powerwall system for storing solar energy (or off-peak-rate energy from the grid) to power homes.

According to Nevada officials, the gigafactory is on track to start production in 2016. Tesla has projected that by 2020 the gigafactory would be producing more Li-Ion batteries annually than were produced worldwide in 2013. Tesla’s source for Li-Ion batteries (as well as its partner in the gigafactory), Panasonic will continue to supply batteries as production ramps up. But Tesla is going to need a lot of lithium and soon.

In August, Tesla signed a conditional lithium hydroxide supply agreement with Bacanora, which is developing a mining operation in Sonora, Mexico. In September, it entered into a similar agreement with Pure Energy Mineral, developers of a mining project in Clayton Valley, Nevada. Note, however, that these close-to-home sources are years from producing.

How Tesla will meet the gigafactory’s need for lithium (estimated at 17% of global supply when it hits full production) is the subject of much market speculation. It’s a critical question, because the gigafactory’s purpose is to reduce battery costs – and, ultimately, EV sticker prices – a purpose that can be easily frustrated by scarcity driving up the price of lithium, or expensive transport from distance sources.

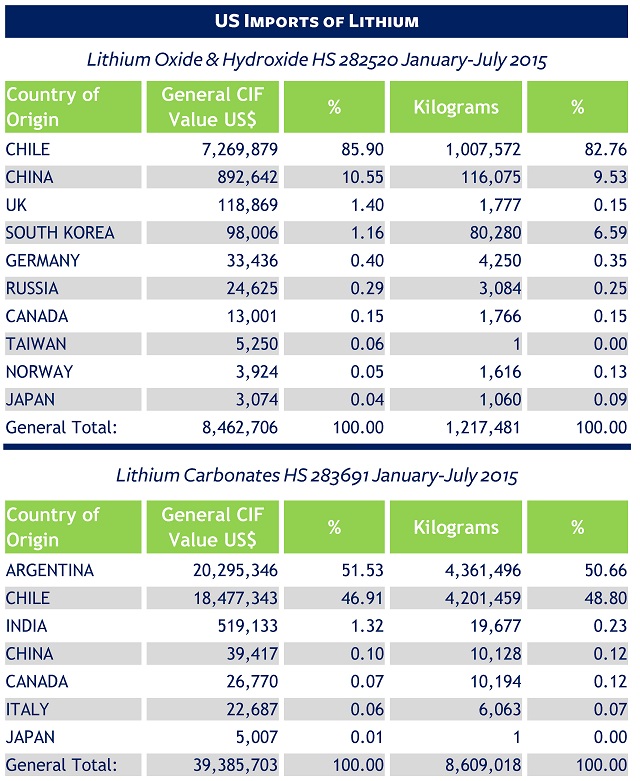

Right now, the majority of lithium used in the US is produced abroad – an estimated >50% in 2014, according to the US Geological Survey’s 2015 summary. Our trade data shows where it comes from, with Chile the top source:

Note that Mexico, which will be a COO for lithium when Bacanora’s Sonora project comes on line and starts to feed the gigafactory, is not currently among the countries of origin. Top producers, led by Australia (which exports much of its lithium to Asia), Portugal and Zimbabwe are not represented in the US trade. There are other countries that would like to be on the list, but have not been able to exploit their lithium reserves. Bolivia, for example, with estimated reserves of 5.4 million tons (compared with 3.3 million in Chile and 2.7 million in Argentina), aspires to be the “Saudi Arabia of lithium.”

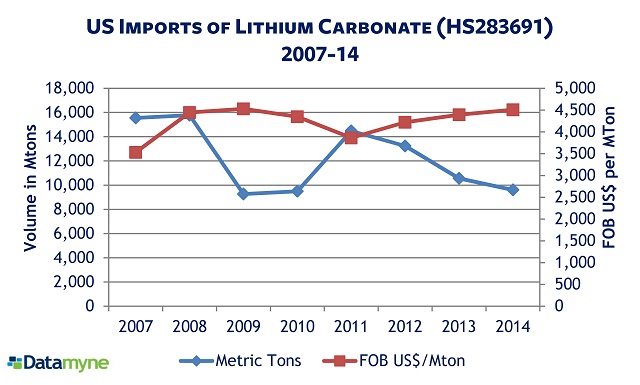

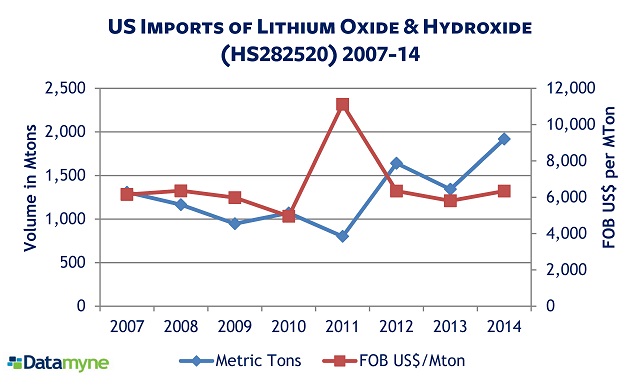

The data also tracks US demand for these lithium compounds and the downward pressure on volumes of price increases:

The only current US domestic production is going on at the Albemarle Corporation’s Chemetall-Foote lithium brines at Silver Peak, Nevada. (The Albermarle brine project – part of Rockwood Holdings, which Albermarle acquired in January 2015 – is in the same basin as Tesla’s other potential source, Pure Energy Mineral’s Clayton Valley project.)

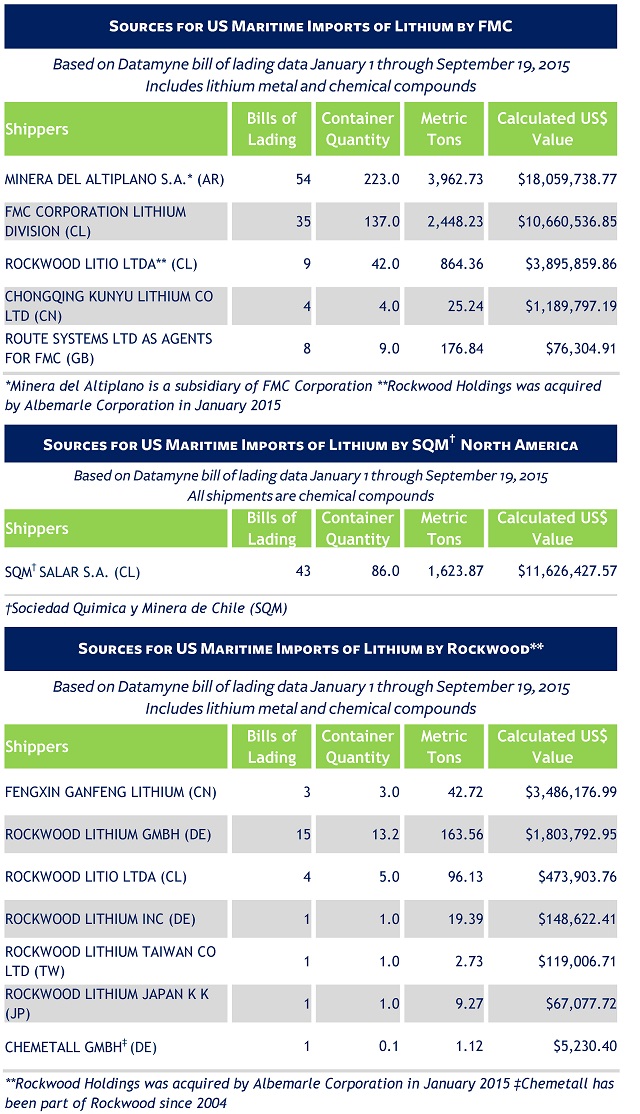

Albermarle is one of three companies that dominate the industry – the others are Sociedad Quimica y Minera de Chile SA (SQM), and FMC. Together they are reported to provide more than 90% of the world’s lithium. Not incidentally, FMC has just announced it will be increasing lithium product prices across all global regions. That will have a big impact in the US: our bill of lading data shows FMC is the top US importer of the lithium compounds used in Li-Ion batteries, followed by (SQM). The various divisions of Rockwood taken together rank third – not surprising given their access to Silver Peak’s output.

Following is a summary of the bill of lading data on maritime imports of lithium by FMC, SQM and Rockwood. Clearly, most of this trade is between related parties. Note that the shipments from China are lithium metal.

It does seem likely that Tesla will have to do business with one or more of these providers to assure the gigafactory can start turning out batteries next year. Even then, rising prices for lithium may undo Tesla’s plan to lower the cost of its products. The so-called lithium oligopoly is in good position to call the terms of any deals.

If you would like to see more data on lithium, graphite or any other commodity in play in global markets, just ask us.

Related: