Lithium, last year’s hottest metal, looks set to be even hotter in 2017. With the new year barely a day old, mineral exploration company Birimian announced the sale of its Bougouni lithium project in southern Mali to China’s Shandong Mingrui Group.

The deal signals the start of a scramble for lithium assets, led by Chinese companies that want to ensure supplies of the raw material for lithium-ion batteries, according to the Financial Times.

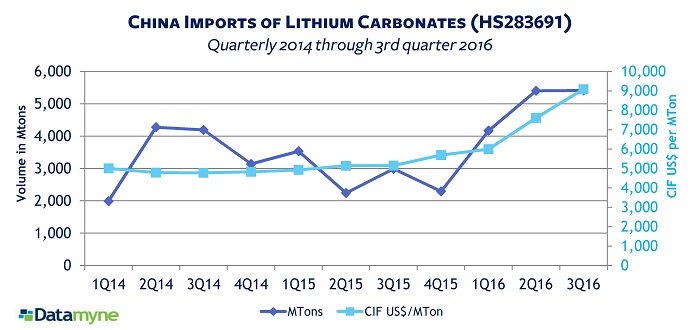

Our trade data shows Chinese lithium imports [HS283691] on the rise, even as demand drives up prices.

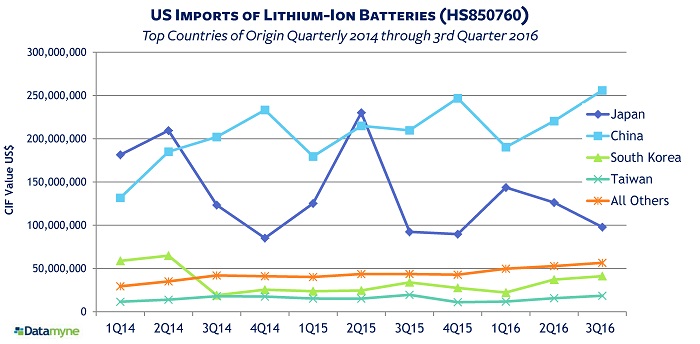

As Chinese lithium imports climb, so do battery exports

As China amasses lithium assets, it is moving aggressively to capture share of the global market for Li-ion batteries. The FT cites Benchmark Mineral Intelligence estimates that almost 70% of new Li-ion battery cell production capacity is being built in China. Our Chinese trade data shows China’s widening its lead as a source for Li-ion batteries [HS850760] imported by the US.

Meanwhile, Tesla flipped the switch at its Gigafactory on January 4.

As Comstock Magazine comments, the start of mass production at the Nevada facility is not only a huge milestone in Tesla’s progress toward electrifying transportation. The Gigafactory brings Li-ion manufacturing, which has been dominated by China, Japan and South Korea, to the US.

Still, betting on batteries is risky, says Comstock: prices worldwide fell 22% in 2016 and are forecast to drop as far as 20% in 2017. What will put the brakes on the downward trend? Unyielding raw-material costs.

Related:

From our blog:

- Hot Metal: Lithium in Global Trade

- Fueling Speculation: Gigafactory’s Need for Lithium

- A New HS Code for Tesla (and Other EV Makers)

From our free report library:

You may also be interested in our Lithium Import Market Insight: