S&P restores Uruguay to investment grade, while Fitch boosts outlook to positive

After raising its sovereign credit rating on Uruguay to BBB-/A-3 from BB+/B1 on April 3, S&P followed up with the same boost to Citibank Uruguay’s global scale counterparty credit rating, and an affirmation of the national scale counterparty credit rating at uyAAA on April 11. S&P pronounced the outlooks for all three as stable.

The ratings upgrades return Uruguay to investment grade, a status it held from 1997 until the financial crisis of 2002.

The rationale, according to this ratings announcement, is Uruguay’s “sound economic growth prospects and improving external and fiscal indicators, as foreign direct investment has strengthened and improved its economic diversification.”

S&P approves the country’s “prudent economic policies” while slipping in a mild reproof that Uruguay has managed rapid growth (6% between 2006 and 2011) “without significantly improving its trade policies.”

Now Fitch Ratings has followed suit, revising its outlook rating for Uruguay from stable to positive. Fitch warns on risk from inflation and economic policies – although the policies in question are not Uruguay’s but Argentina’s.

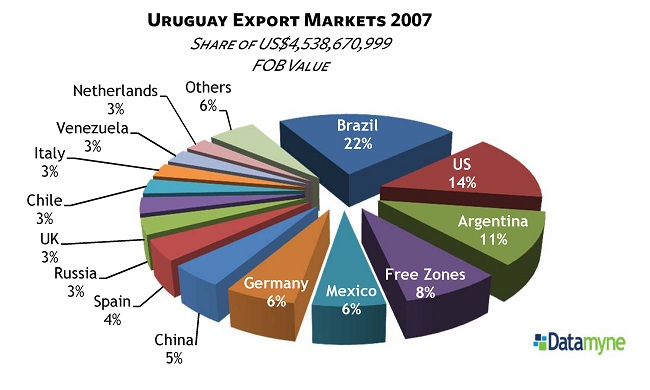

Indeed, Argentina’s protectionist policies are causing concern among all its trading partners. But as a neighbor and fellow member of the Mercosur bloc, Uruguay is especially reliant on the Argentine market – though not so much now as in the past, as the charts below show.

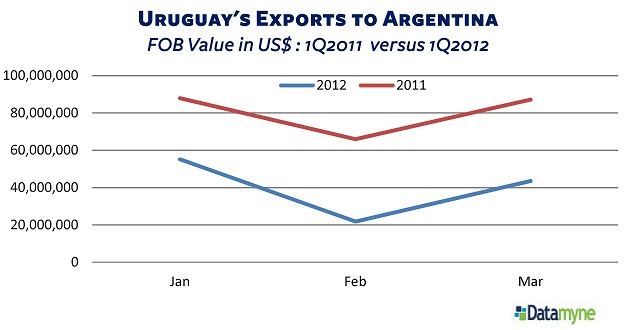

Still, Uruguay is feeling the pain as Argentina’s import restrictions cut its exports to that market by half (see the graph below).

To learn more about how Datamyne can help you monitor trade in Uruguay, Argentina, as well as other Latin American markets, contact us.