Early signs indicate a substantial effect on frozen U.S. beef exports to Japan as the one of the largest U.S. beef destinations looks to other suppliers.

Late July, Japan announced that they would be using a safeguard measure that allows for raising tariffs should import volumes exceed a predetermined limit. In early August, Japan’s tariff on frozen beef exports from the United States and others was raised from 38.5% to 50%.

2017 was a successful year for U.S. beef exports to Japan – with a 45% increase in volume over the same period in 2016. This increase has solidified Japan as one of the largest U.S. beef export markets. The volume uptick, however, also assisted in triggering Japan’s safeguard threshold, specifically with frozen beef, and the elevated tariff will remain at 50% for the remainder of the fiscal year – through March 31, 2018.

U.S. Beef Exports Overview

U.S. beef is big business. The United States is the world’s largest beef producer, representing 19% of the world’s production (11.7 million metric tons). The export of U.S. beef has been a steadily increasing market over the past several years as international demand has increased, growing 11% over 2016 and performing even better in 2017. Traditionally, these exports were comprised of cuts not highly valued by American consumers but very much in demand internationally.

However, exports have steadily grown in emerging markets with frozen U.S. beef exports among the top gainers due to decreased shipping costs. Among these markets for U.S. beef exports, Japan is the largest with a market share of ~24%.

Initial Effect on Frozen U.S. Beef Exports Due To Tariff Increase

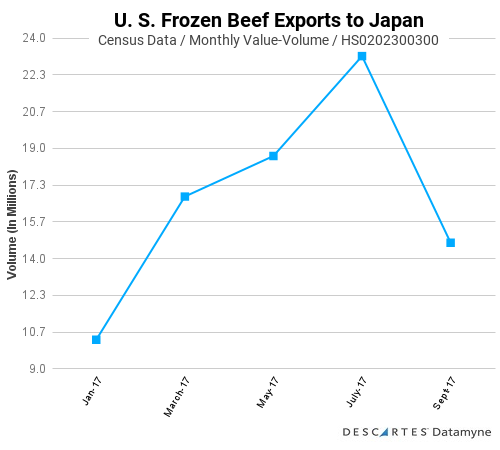

The tariff increase took effect on August 1st and, through the trade data gleaned from Descartes Datamyne™, the early impact can already be observed. During the third quarter of 2017, U.S. beef exports continued its increase in value globally, with a 34.77% increase over the third quarter of 2016 and an 8.5% increase in August-September over the previous two months of June and July.

While still showing a slight increase in value over the third quarter, 2016 (6.88%), the value of frozen U.S. beef exports to Japan fell dramatically (35.29%) in the bimonthly comparison. Since frozen beef is significantly preferred over chilled, this represents a dramatic decline in U.S. beef exports to Japan as a whole. This is an early warning sign of a substantial effect the tariff increase could have.

Another effect of the tariff increase is the rise in duties paid on these exports. Comparing the same two-month periods as above, the amount paid in duties on frozen beef imports to Japan grew 30.85%. This is a substantial duty increase that presents a much higher cost to importers which, in turn, affects their decisions on where to look for frozen beef suppliers.

Japanese Beef Imports, Trends & Options for U.S. Beef Importers

Following the tariff increase, Japanese importers and consumers are left with a difficult decision to pay more for a product they undoubtedly want. Beyond the obvious, paying more for U.S. frozen beef or searching for other beef suppliers, importers could make the switch to chilled beef rather than frozen. This, however, does come at a higher product and shipping cost and carries a possibility of triggering another tariff hike on chilled beef later this year.

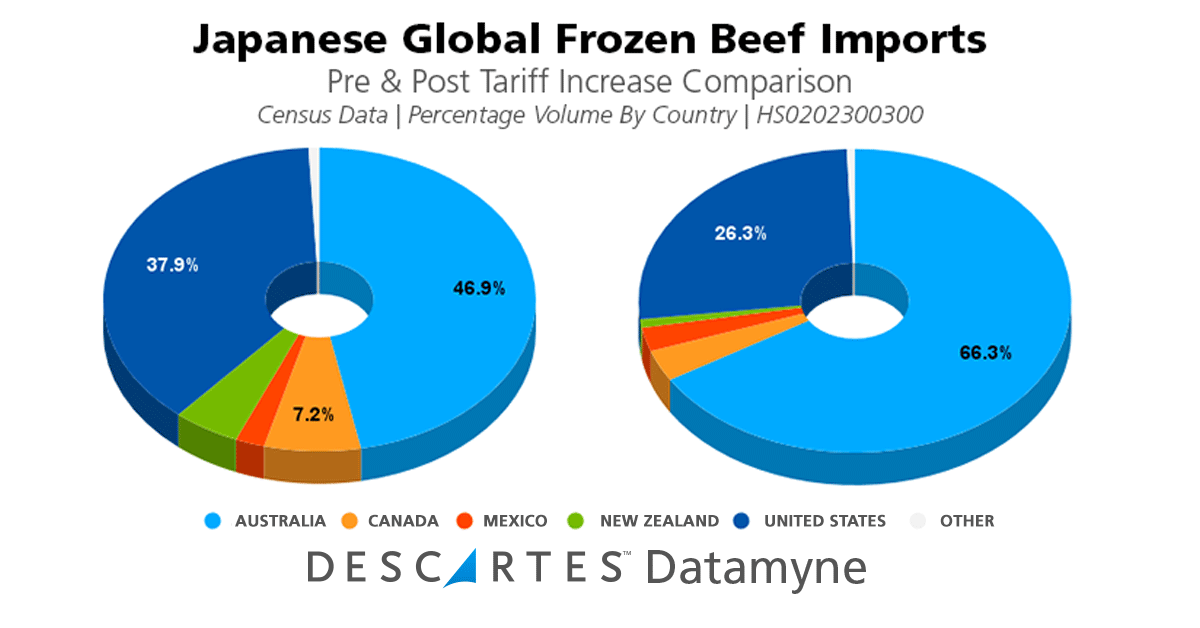

The initial data reveals that Japanese beef importers are looking to other markets for frozen beef. The volume of imports from the rest of the world rose 11.11% over the two-month period after the tariff increase, resulting in an overall 34.35% increase in volume over that same period last year with a 9.28% increase in value.

The primary beneficiary of the Japanese tariff increases has been Australian exporters. Research through Descartes CustomsInfo™ shows that, due to the Japan-Australia Economic Partnership Agreement (JAEPA), Australian beef exports are not affected by the tariff increase and retain the duty rate of 27.2% through the fiscal year.

The initial two-month comparison of June-July to Aug-Sept indicate a sizable increase in Australian frozen beef exports to Japan, rising almost 29% (and 54.33% when compared to the same period last year). The lingering question is whether Australian suppliers can keep pace with growing Japanese demand.

Without Japan, U.S. Beef Suppliers Search for Valuable & Growing Markets

For U.S. exporters and frozen beef suppliers, there are still many available options for their product. Both Hong Kong and South Korea have been markets where the value of frozen beef has been steadily increasing alongside the rest of the world.

For Japan, a few major questions need to be addressed moving forward, particularly, whether Australia can keep up with demand. Prior to raising the tariff, the U.S. was the second-largest supplier of frozen beef to Japan, behind Australia, and whether another country can step into that position is the primary concern for Japanese importers. The countries that are most likely, Canada, New Zealand, and Mexico, do not currently have combined frozen beef exports equal to the U.S.’s; however, both Mexico and Canada have a prior trade agreement with Japan that allows those countries to avoid the tariff increase.

Lastly, what will happen after the end of the fiscal year? Will U.S. exports increase following the reduction in tariffs to match the current demand or will U.S. suppliers limit exports to avoid triggering the safeguard again?

Keeping Pace with Market Trends and Changing Tariffs

The quick and simple rationale for understanding changing tariffs is, initially, to manage and decrease duty spend and reduce the cost of a organization’s global supply chain. Beyond that, recognizing that raising tariffs can have a dramatic effect on market trends and demand is equally critical. While a U.S. supplier of frozen beef may not be paying the increased Japanese tariffs, those tariffs impact the Japanese importer’s decision to buy from U.S. beef suppliers.

Staying up-to-date on global trends and tariff changes is imperative to sustain and increase a company’s competitive position. Generating profit depends on effective execution in several areas: having quality products, fulfilling customer requirements, understanding where the demand exists, complying with regulations, and operating a cost-effective supply chain.

Descartes offers a wide suite of solutions to assist businesses achieve higher trade compliance rates, increase insight and leverage market research, perform due diligence with denied party screening, minimize duty spend.

Resources and Global Trade Content Solutions:

- Descartes Datamyne: Descartes Datamyne maritime bill of lading data captures the transactional and logistical details of U.S. import trade in this or any season. Ask for a demo.

- Descartes CustomsInfo: With a vast database of data relating to regulations, rulings, duties and more, Descartes CustomsInfo helps clients minimize trade barriers. Ask for a free trial.