U.S. beef exports to South Korea passed a billion-dollar milestone in year 5 of the KORUS FTA. Beef exports are primed for more growth as the Chinese and Brazilian markets re-open.

U.S. Beef Exports: KORUS FTA Trajectory

No market provides a better example of the fall and rise of U.S. beef exports than South Korea.

In 2003, a cow in Washington State tested positive for Bovine Spongiform Encephalopathy (BSE) – and kicked off a major market disrupter for U.S. beef exporters.

From 2001-2003, the U.S. was Korea’s leading beef supplier, with $815 million in exports in 2003. Korea stopped accepting U.S. beef in December 2003. Subsequent market opening agreements weren’t enough to restore exports to pre-BSE levels. U.S. industry groups joined in endorsing a free trade agreement that would phase out tariffs on U.S. beef exports to South Korea – a market that the National Cattlemen’s Beef Association estimated at the time could amount to over $1 billion in value.

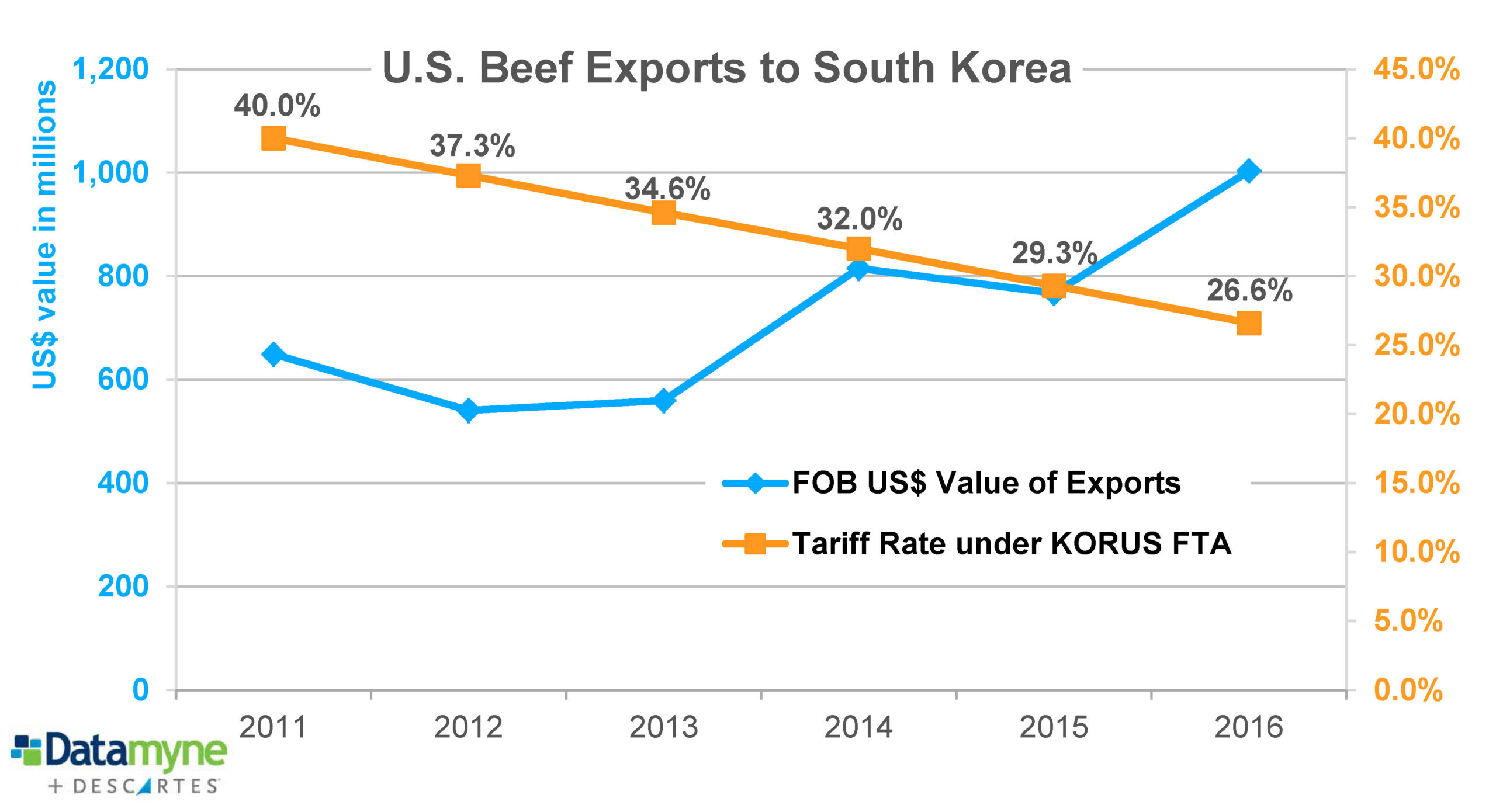

In 2011, the South Korea-U.S. (KORUS) FTA entered into force and began dialing back the tariffs on beef from a base rate of 40% to 26.6% as of 2016 – the year U.S. beef exports passed the $1-billion mark, as the chart below shows. The 15-year phase-out schedule will make U.S. beef duty-free in 2026.

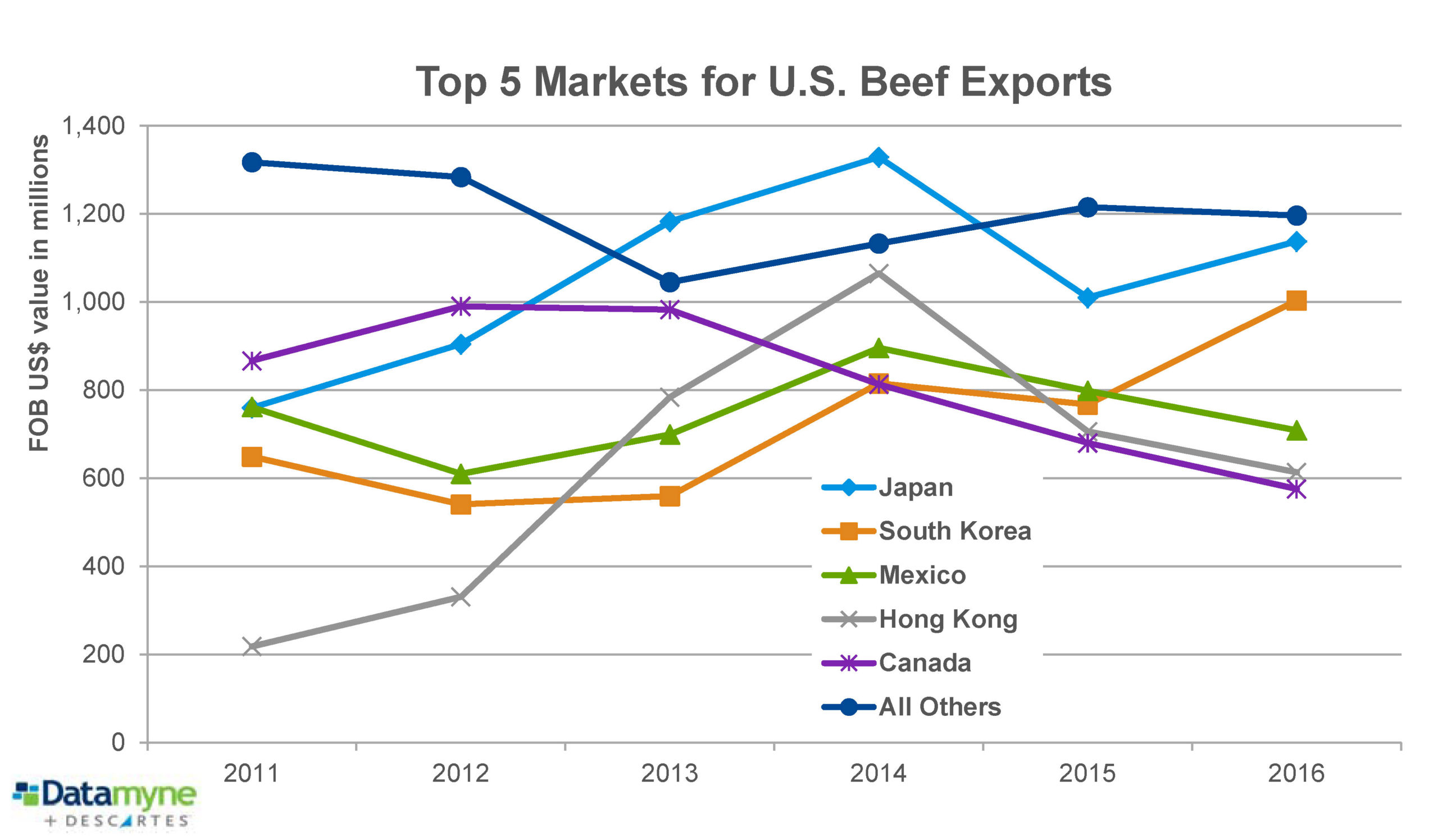

Since the KORUS FTA, South Korea as climbed from fourth- to second-ranked market for U.S. beef, as the next chart indicates.

Barriers to U.S. beef exports are set to fall in other markets, including China.

U.S. Beef Exports: China Readies for Re-Opening

In May, the U.S. and China agreed to a 100-day plan for economic cooperation aimed at clearing the way for trade in products and services. Top of the list: after a final round of technical consultations between the two countries, China will once again be open to U.S. beef imports, beginning as soon as possible but no later than July 16, 2017.

In the wake of China’s 2003 ban on U.S. beef, consumer demand there has driven a grey market through Hong Kong. Chinese importers are reported to be keen to buy premium grain-fed U.S. beef.

Still, assessing the Chinese market opportunity for U.S. beef exporters will have to wait until the tariffs and import standards are spelled out, according to the US Meat Export Federation (USMEF). This may yet take some time, as the Brazilian market’s reopening illustrates.

U.S. Beef Exports Are Back in Brazil

U.S. Dept. of Agriculture’s Foreign Agricultural Service (USDA/FAS) on May 4 announced the first shipments of U.S. beef arriving in Brazil after a 13-year hiatus.

Brazil also banned beef imports following the 2003 BSE scare. Brazil officially announced the reopening of its market in August 2016. But it wasn’t until December 2016 that the USDA and Brazil’s Ministry of Agriculture, Livestock, and Food Supply worked out the food safety protocols and label approval process for U.S. firms wanting to ship to Brazil.

U.S. beef is subject to a 10% tariff in Brazil. Its competitors are Brazil’s duty-free Mercosur partners, Paraguay, Uruguay and Argentina. Still, the FAS believes the premium price need not keep up-market consumers from buying U.S. beef. The FAS Agricultural Trade Office in São Paulo has launched a #USFoodExperience marketing campaign to promote high-quality cuts to Brazil’s foodservices and high-end retailers.

U.S. Beef Exports: Tipping Point

Joel Haggard, USMEF senior vice president for the Asia-Pacific, discusses (in this audiocast) how the KORUS FTA is making U.S. beef price competitive in South Korea.

He adds that marketing aimed at winning consumers over has reached a tipping point: At first USMEF campaigns focused on rebuilding trust in the safety and reliability of the product. Now the message is the high-quality attributes of the product (carried on rolling billboards, like the one pictured below). The current “World Class Beef” campaign made headlines in Korea as beef consumption continued to climb in first-quarter 2017.

Related:

- USDA Halts Imports of Fresh Beef from Brazil

- Brazilian Beef Exports | Sharp Cuts in Top Markets

- Where US Beef Comes From

Resources: