Mattel and Hasbro have always been rivals in the US toy market. But the Mattel vs Hasbro rivalry was across the toy store aisle, with Mattel ruling the girls’ side of the aisle, under the leadership of its star Barbie, while Hasbro worked the boys’ side with games, Nerf, the Transformers and Star Wars.

Not any more.

In an industry coup, likened by Adweek to the Chicago Cubs winning the World Series, Disney in 2014 declined to renew Mattel’s license to sell its Frozen dolls, handing the franchise to Hasbro. Frozen’s Anna and Elsa dolls were soon followed to Hasbro by the Disney Princess dolls (11 of them and counting, each the star of her own animated film and inspiration for an array of fashions, accessories and branded merchandise).

The Hasbro take on the Princesses debuted with the new year. What parents might have noticed is that Snow White, Mulan, Jasmine, et al., no longer appear to be Barbie in costume. (Take a look at the side-by-side comparisons in this Bloomberg story.)

What investors definitely noticed was the impact on earnings of Disney’s switch.

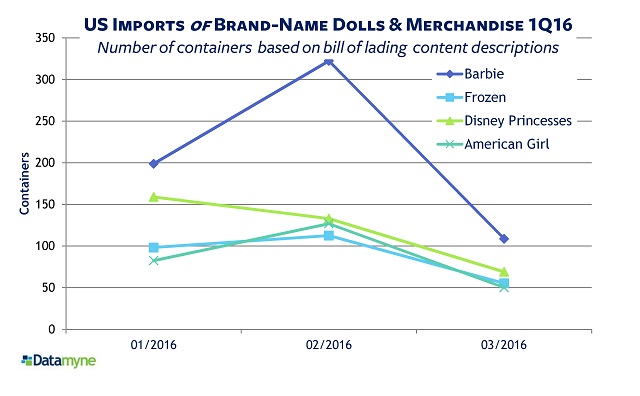

As Hasbro reported, first-quarter 2016 marked the on-shelf date for Hasbro’s line of Disney Princess and Frozen fashion and small dolls – just in time to help drive revenue growth up 16% (41% in the girls category).

Meanwhile, Mattel reported bigger than expected losses in first quarter 2016. Gross sales for Barbie were flat (in constant currency), American Girl-branded product sales were down 11%, and sales of its other girls brands were down 58%.

Both toy makers have moved most production abroad. Mattel’s makes its toys in both company-owned facilities and through third-party contractors, with its principal manufacturing facilities in China, Indonesia, Thailand, Malaysia, and Mexico. The substantial majority of Hasbro products are made by third-party manufacturers in China.

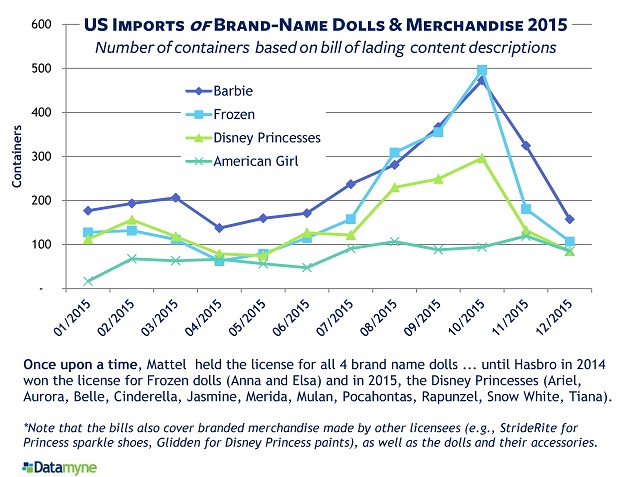

Our US import bill of lading data provides a comparative indicator (albeit not an exact measure) of toy product volumes bound for the US market. Here are the monthly container counts for 2015 and, below that, first-quarter 2016:

It looks like Barbie aims to push back against team Princess as the Mattel vs Hasbro rivalry rolls into 2016. And good news for Mattel: Its Game Developer Barbie debuted in June to enthusiastic reviews (Mattel redeems itself after the “rather cringey Barbie: I Can Be a Computer Engineer” according to Forbes).

Children’s play things are big business. The US market for toys saw robust growth of 6.7% and generated $19.4 billion in 2015, according to The NPD Group. Most of those toys are imports – learn more in our infographic A Toy Story of US Imports