Commerce finds countervailable subsidies, but will tariff help US industry?

The Department of Commerce last week announced its preliminary determination that certain Chinese producers/exporters of crystalline silicon photovoltaic (CSPV) cells have indeed received countervailable (albeit low) subsidies, with 2.90% going to Wuxi Suntech Power Co., Ltd., and 4.73% to Changzhou Trina Solar Energy Co., Ltd. The other Chinese companies subject to the investigation were found to have received a subsidy rate of 3.61%.

Based on its preliminary determination, Commerce will instruct Customs and Border Protection to collect a cash deposit or bond for countervailing duties on all China solar cells entering the US as of 90 days prior to the determination.

Still to come: a preliminary determination on the companion antidumping investigation into Chinese solar cells, scheduled for May 17; a final determination that Chinese imports materially injured, or threaten injury to, the domestic industry from Commerce, due in June; and a final injury determination by the International Trade Commission, due July 19. (There are more details about the preliminary determination in this fact sheet.)

Bottom line: While the final the size of antidumping tariffs and countervailing duties on the Chinese products won’t be settled until summer, the cost of the imports is rising.

So, score one for the US domestic solar industry, right? Not exactly.

As the Wall Street Journal reports, US importers are already scrambling for sources of supply beyond China. Securing product from other countries has been expensive – one solar developer, Recurrent Energy, is paying over 10% more, says the WSJ. The Coalition for Affordable Solar Energy (Recurrent is a member) argues that any tariff large or small will hurt American jobs and prolong our world’s reliance on fossil fuels.

Moreover, as the USITC preliminary investigative report concluded, many US module producers are subsidiaries of large, foreign CSPV producers that ship their cells to the US for assembly into modules.

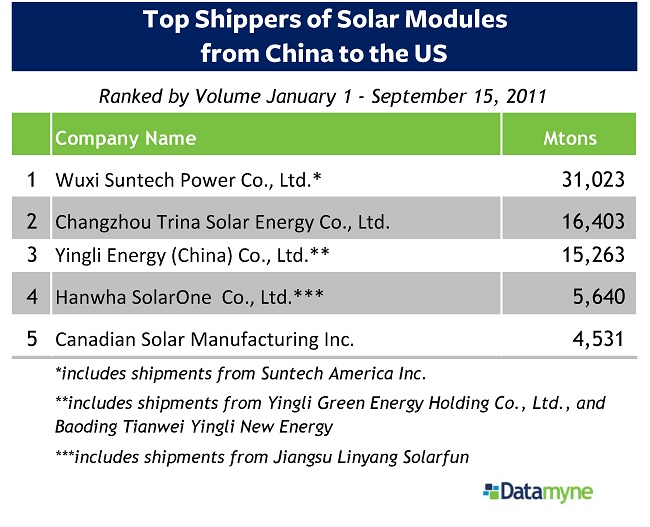

Wuxi Suntech and Changzhou Trina ranked first and second among the top five shippers of solar modules from China to the US last year – as we covered in October’s Datamyne Top 5.

Compare the top ranked Chinese exporters (we’ve reproduced October’s Top 5 table) with the top US importers table below. Top-ranked importer Suntech America is affiliated with top-ranked Chinese exporter Wuxi Suntech under the umbrella of Suntech Power Holdings, which also has cell production capability in Japan (the former MSK Corp.) The US arm of second-ranked exporterTrina Solar is the fourth-ranked importer.

Suntech’s Andrew Beebe made the point to industry analysts in November: “The reality is nobody wins from trade wars in solar. The industry is now truly globalized and highly interdependent as many of our silicone suppliers, equipment suppliers and customers are US-based companies. … Whatever the outcome, as a global company with global supply chains we will do everything in our power to ensure business as usual for our customers in the US and around the world.”