A trade complaint concerning hot-rolled steel filed with the Department of Commerce and US Trade Commission Tuesday is the latest move in a US steelmakers pushback against low price imports that “have been flooding our shores, substantially reducing selling prices, shipment volumes, and earnings,” says James L. Wainscott, Chairman, President and CEO of AK Steel.

AK Steel is one of six US steelmakers that filed a petition alleging hot-rolled steel imported from Australia, Brazil, Japan, Korea, the Netherlands, Turkey and the UK is being sold at less than fair value – and that the governments of Brazil, Korea and Turkey are providing countervailable subsidies to their steel exporters. The petitioners claim the unfairly traded imports have caused material injury to the US industry and ask that they be subject to anti-dumping and countervailing duties (AD/CVD).

In addition to AK Steel, the petitioners are ArcelorMittal USA LLC, Nucor Corporation, SSAB Enterprises, LLC, Steel Dynamics, Inc. and United States Steel Corporation.

[The petition and supporting documentation are filed under Case Nos. A-351-845, A-412-825, A-421-813, A-489- 826, A-580-883, A-588-874, A-602-809, C-351-846, C-489- 827, C-580-884 on the ITA’s Access site.]

This is the coalition’s third petition in as many months.

On June 3, the steelmakers filed a trade complaint seeking punitive tariffs on imports of corrosion-resistant steel from China, India, Italy, Korea and Taiwan. [See Case Nos. A-570-026, A-580-878, A-533-863, A-475-832, A-583 856, C-570-027, C-580-879, C-533-864, C-475-833 and C-583-857 on Access.]

On July 28, they filed a request for relief from alleged dumping of cold-rolled steel by Brazil, China, India, Japan, Korea, the Netherlands, Russia and the UK, as well as countervailable subsidies by the governments of Brazil, China, India, Korea and Russia. [See the petition documents under Case Nos. A-570-029, C-570-030, A-351-843, C-351-844, A-533- 865, C-533-866, A-588-873, A-580-881, C-580-882, A-421-812, A-821- 822, C-821-823, A-412-824 on Access.]

According to AK Steel, imports of hot-rolled steel from the seven countries targeted in the latest filing increased by approximately 73% from 2012 to 2014, rising from 1.9 million tons to 3.3 million tons.

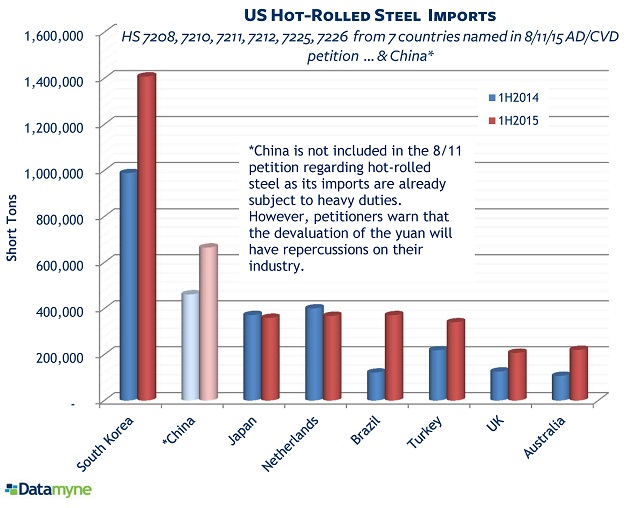

Our trade data on the HS tariff codes cited in the filing confirms the surge in imports from the seven has continued in first-half 2015, with the exceptions of Japan and the Netherlands, as the graph below shows. We included the data on China, which is not named in the hot-rolled steel petition, but is in the petitions regarding cold-rolled steel and corrosion-resistant steel. More to the point, on the same day that the steelmakers filed their latest petition with the USITC, China’s central bank devalued its currency, a move that seems aimed at (among other objectives) strengthening its export sector – including steel exports.

Related:

- From our blog: Trade Data on China: US Exports Take a Hit

- In our new monthly report ranking US Minerals and Metals imports and exports by value of trade, HS 720839 – hot-rolled steel, ≥ 600mm wide, <3mm thick – ranked No. 24 among June imports. Click here to download this free report, which includes June values as well as January-May cumulatives, all compared with the same periods in 2014.