Mercosur is looking for opportunities to do more cross-border business both within the five-member trade bloc and beyond.

Foreign ministers are set to meet March 9 to discuss lowering barriers to trade among the countries that make up the “Common Market of the South” – Argentina, Brazil, Paraguay, Uruguay, and Venezuela.

Also on the agenda is outreach to Mexico which is “now looking south” for its own new trade opportunities, as Mercopress reports.

Meeting last month in Brasilia, Argentine President Mauricio Macri and Brazilian President Michel Temer signaled a shift away from their countries’ protectionist stance of recent years and toward more open market policies. They agreed on the need to eliminate tariffs within Mercosur. They also agreed on the need to draw closer to the Pacific Alliance (Chile, Colombia, Mexico, and Peru).

The presidents’ new policy course comes as trade between their countries has fallen to an historic low not seen since the beginning of Mercosur, notes the Buenos Aires Herald.

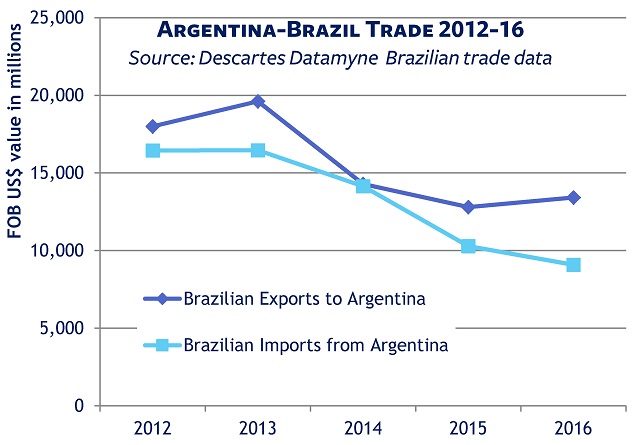

Our trade data (here, from our Brazilian data) confirms a decline in Argentine-Brazilian trade over the past five years, with an upward turn in Brazilian exports to Argentina just last year:

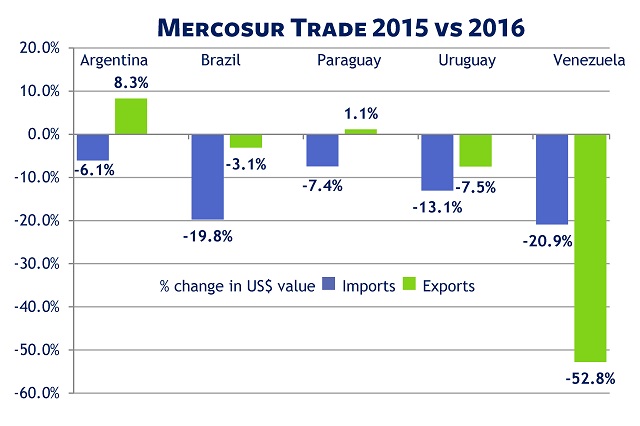

This is against the backdrop of declining trade across the Mercosur bloc – with the exceptions of Argentine exports and, to a lesser extent, Paraguayan exports, as our trade data shows:

The Argentine and Brazilian presidents’ stated commitment to expand trade relations has been backed by concrete action in the first months of this year.

In January, Mercosur opened trade talks with EFTA, the European Free Trade Association of countries outside the EU – Switzerland, Norway, Iceland and Liechtenstein (and, perhaps some day, the UK).

In February, Mercosur ironed out technical issues in advance of a new round of trade negotiations with the EU to be held in Buenos Aires in late March.

On March 3, Mercosur and South Korea signed a memorandum of understanding clearing the way to negotiate a free trade agreement. The first round of talks is set for June.

The ties that bind Mercosur members limit their ability to negotiate unilateral trade deals with other countries. It may be all-together or not at all in negotiating with the Pacific Alliance or the EU – which begs the question of Venezuela’s role in future trade talks.

In December, it was reported that Mercosur’s four founding members had decided to suspend Venezuela from the trade bloc, in part because Venezuela had not adopted existing treaties as promised.

Then, in February, the Mercosur Parliament, Parlasur, determined not to accept the sanction against Venezuela. Venezuela’s status within Mercosur promises to become a long legal wrangle. How this will effect trade negotiations is not clear. According to the EU, Venezuela is an observer, not a party to the trade negotiations between Mercosur and the EU.

We’ll keep following Mercosur’s quest for new trade ties. If you would like to dig deeper into the trade data for individual Latin American countries or products, down to the underlying records, just ask us.

Related:

- Download our free report Quick Look @ Mercosur Trade in 2016 for stats on each member’s top imports and exports, top markets and countries of origin, and top regional trade partners, based on our Latin American trade data.

- From our blog: Pacific Alliance and Mercosur: Moving at Two Speeds?

- Learn more about our Latin American import-export data.