China hitches its growth to emerging market economies

The recent HVAC Online story (in which Datamyne stats are cited) on the heat-driven spurt in Colombian imports of Chinese mini split ACs reminds us again just how much and how quickly China has invested itself in Latin American markets.

The region is part of China’s strategy for hitching its growth to the fast-expanding emerging market economies, which are expected to account for as much as 70% of global GDP growth in the next 10 years, according to Deutsche Bank.

Certainly, the growth forecast from the Economic Commission for Latin America and the Caribbean continues to be rosy – for South America, at least, which is projected to grow by 5.1%, with the fastest growth rate coming from Argentina (8.3%). Central America is expected to grow by 4.3% and the Caribbean, 1.9%.

As the Financial Times comments (in a story about Peru becoming the first LATAM country to open renminbi-denominated settlement accounts), it’s hard to exaggerate how important China has become to the region. LATAM’s annual trade with China increased fivefold in the last decade from $57bn to $310bn, while China’s direct investment in the region rose from $2.7bn to $59bn.

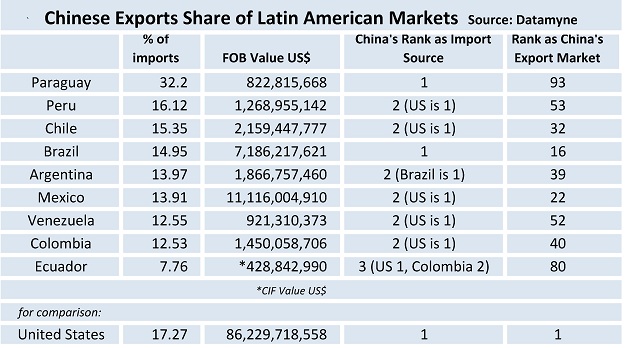

Based on our first quarter 2011 trade data on China’s top 100 export markets, here’s how the LATAM markets compare on China’s share: