M&A activity within the third party logistics provider (3PL) sector in 2015 continues at last year’s brisk pace, with global companies betting not only on growth in shipping, but on more shippers wanting to outsource their logistics.

In November, French logistics provider GEODIS announced its acquisition of US 3PL OHL (Ozburn-Hessey Logistics). This will mean a name change for OHL, whose Barthco International subsidiary, acquired by OHL in 2006, currently ranks 88th by volume among NVOCCs (non-vessel-operating common carriers) handling US imports. Note that this ranking is based on our maritime trade data as of November 21 – as are all the rankings that follow.

Meanwhile, DSV A/S has closed a deal to acquire UTi. NVOCC DSV Ocean Transport ranks 14th by US import TEUS; UTi United States Inc. ranks 22nd. As reported by Transport Intelligence, Denmark-headquartered DSV will now have the 7th largest air freight and 6th largest sea freight forwarder operation in the world, with much increased exposure to the Americas and Africa.

XPO Logistics now lays claim to being the 7th largest global 3PL provided (behind the DSV-UTi combination) based on its acquisitions of New Breed Logistics, Norbert Dentressangle, UX Specialized Logistics and Con-way this year, according to Material Handling & Logistics. (This ranking does not factor in Con-way trucking operations, notes MH&L.)

XPO NVOCC Ocean World Lines [NVOCC code OWLN] ranks 162nd in US import TEUs so far this year, while XPO Ocean World Lines Inc. [XOWL] ranks 622nd.

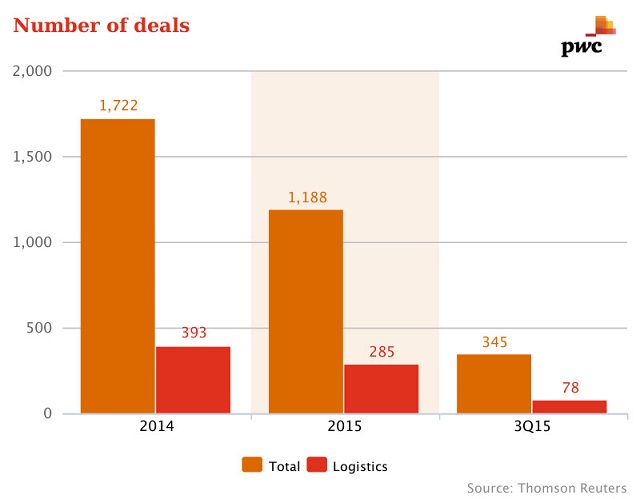

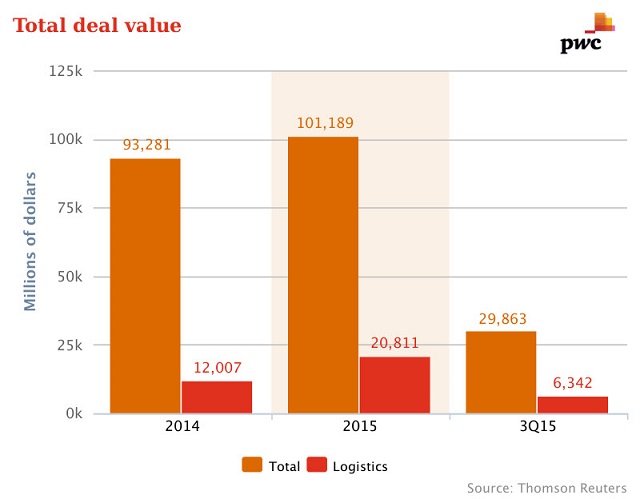

According to consultants PwC, logistics companies are a significant driver of the overall trend in the transport sector toward consolidation. In the first three quarters of 2015, logistics M&As accounted for 24% of deals, and 21% of deal value. While there have actually been fewer deals struck during the first three quarters of 2015 compared with the same period in 2014, total deal value has increased:

And the driver for 3PL mergers and acquisitions is the growing numbers of shippers opting to outsource logistics to specialists.

XPO Logistics CEO Brad Jacobs (in an interview with American Trucking Associations’ Transport Topics) explains why he expects more outsourcing: “Whether it’s a retailer, or a manufacturer, or some other type of business, it’s not their core competency to manage their goods and supply chain — that’s not what they do for a living. They maybe have a small division that does that. Whereas 3PLs, like XPO Logistics and like some of our great competitors, this is what we do for a living. This what we have experts in. We have people who have been doing it for decades. This is a real core competency of ours, and it makes sense for people to outsource their logistics, in my opinion.”

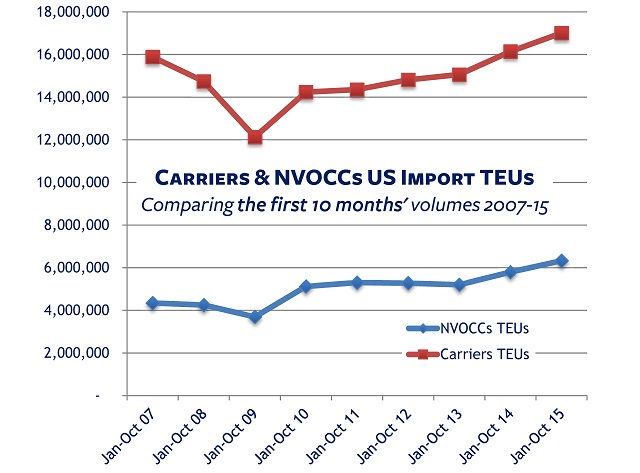

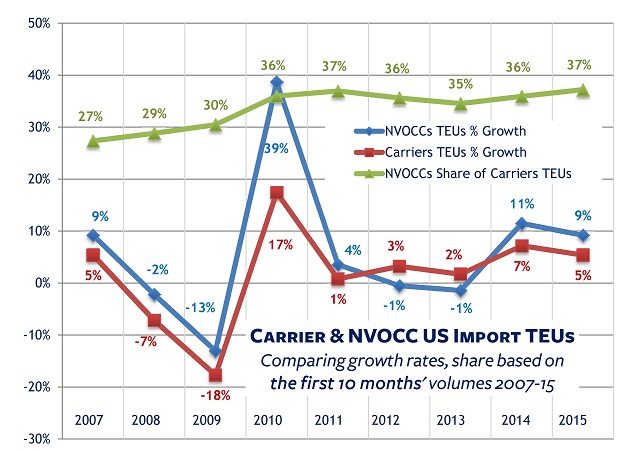

Our bill of lading trade data confirms the outsourcing trend in US imports, with NVOCCs’ share of US import TEUs growing from 27% in 2007 to 37% in 2015. Note that the comparisons here are based on each year’s first 10 months – January through October.

For more data on NVOCCs, click here to download our quarterly report (third-quarter 2015 is currently available) ranking the top 20 NVOCCs by US import TEUs and providing a break-out of TEUs handled by top carriers MSC-Mediterranean, Maersk and Evergreen.

For a closer look at our maritime data – including the opportunity to dig into the details of the bills of lading that document each shipment – just ask us.

Related:

- Hot Properties: Freight Forwarder, NVOCC M&As Stoked

- See more free maritime data reports, including rankings of top carriers, US ports and NVOCCs, in our Free Report Library