Call it Latin America’s controlled experiment in economics (as the Wall Street Journal did recently): Along the Western seaboard, Chile, Colombia, Mexico and Peru embrace free trade and are working to lift restrictions on the movement of capital, goods and services, and people within their Pacific Alliance. Facing the Atlantic, the Mercosur bloc’s members – Argentina, Brazil, Paraguay, Uruguay and Venezuela – tend toward more government intervention in markets and protectionist trade policies.

There are, of course, distinct differences in economic policy and practice among the nine individual countries that make up these two trade blocs. And there are different ways to measure a nation’s economic health.

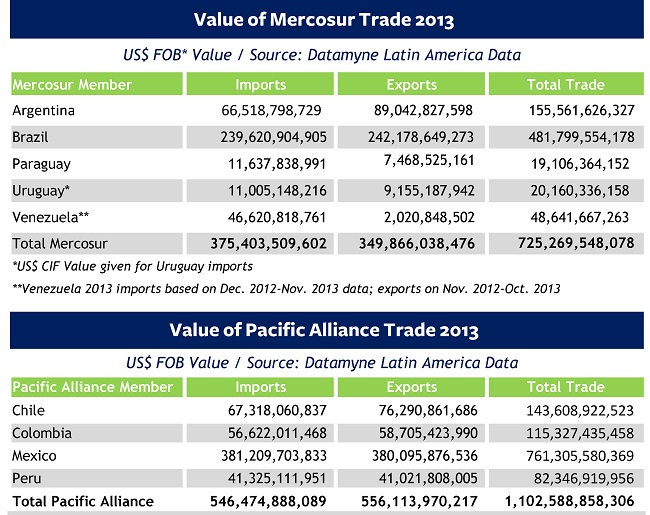

But trade data gives a good measure of trade policy. Last year, we compared the 2012 data for Mercosur and the new Pacific Alliance (see Suffering by Comparison). Here is the score card for 2013:

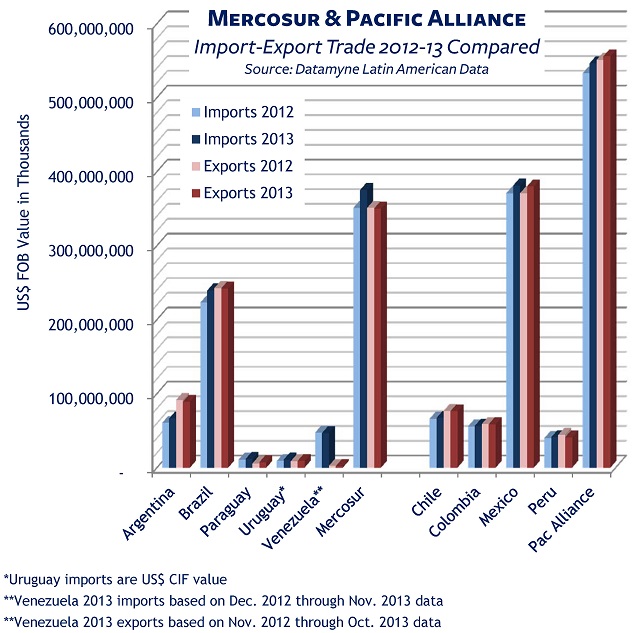

And here, separately and together, are the import and export trade values for Mercosur and the Pacific Alliance in 2013 compared to 2012:

In 2013, Mercosur imports jumped 6.95%, while exports decreased -0.34%, for a 3.3% expansion of trade, compared to 2012. Pacific Alliance imports rose 2.54% while exports increased 0.92%, for a 1.71% expansion of trade.

The controlled experiment has really just begun. The Pacific Alliance agreed to eliminate tariffs on 92% of goods and services in trade only last month. Politics will likely reshape at least some national economic policies in the year ahead. Members of both blocs face economic headwinds in 2014, including falling prices for key commodities, weakening currencies, the lackluster recoveries of the US and EU markets, and the uncertain outlook for China. Meanwhile, Costa Rica is set to join the Pacific Alliance, while Bolivia is completing the process of incorporation in Mercosur. We will be following the trade data here.

For a view of Mercosur and Pacific Alliance members’ trade in 2013, including the top imports, exports, country sources and markets, and key partners’ shares of trade, download our free “Quick Look” reports based on our Latin American data.

To download a Quick Look @ Mercosur Trade in 2013, click here.

To download a Quick Look @ Pacific Alliance Trade in 2013, click here.