Economic downturns, trade conflicts, a pandemic, the shipping crisis, and a hot war in Europe – global supply chain disruptions now come in rapid-fire, tsunami-scale waves. Global trade intelligence can help companies reroute and rebuild supply chains today and craft nimble resiliency strategies with ready options for dealing with whatever comes next.

First, some encouragement from two sources.

From WTO Director General Ngozi Okonjo-Iweala, speaking at last month’s Global Supply Chains Forum: “It’s worth taking a moment to remember that the issues we are working to solve are problems born of success. Many of the problems we were grappling with are the result of more goods moving across borders than ever before.” Indeed, the spread of predictable market conditions fostered by the WTO, combined with advancing communications, enabled the rise of global value chains that account for almost 70% of total merchandise trade.

Acknowledging that the trading system was not built for the shocks of today’s world, Okonjo-Iweala called for renewed effort to make sure “the supply chain infrastructure remains fit for purpose.” She added, “I always say that the global trading system of the 21st century needs to deliver for people everywhere. Making supply chains work better is part of that.”

From Jackson Wood, Director, Industry Strategy, Descartes Global Trade Intelligence, responding to a question in a recent SupplyChainBrain Webinar, on lessons-learned from the pandemic and global shipping crisis as well as a discussion on strategies to alleviate port congestion: “On the negative side of the ledger, we’ve learned that we live in a volatile world where ‘black swan’ events are not just academically possible, they do actually happen. As our world becomes more interconnected and as information flows more quickly, from many more directions, it is only going to get more volatile.”

Wood continued: “On the positive side, there are things we can do today to make our businesses more resilient. Not just from a supply chain perspective, but from a due diligence perspective, and from a modeling and strategic planning perspective. We are talking about very practical steps you can take today to build resiliency into your business. Our ability to access information, our ability to slice and dice this information to generate hyper-local insights for organizations, makes it all possible.”

What is Supply Chain Resilience

A resilient supply chain is one that can withstand shocks to the system or minimize the negative effects of sudden, disruptive forces. Such a supply chain also has the ability to rapidly recover. Shocks include pandemics, wars and natural disasters – everything we have experienced in recent years. They can also be more everyday business challenges like new market trends, unexpected competition, changes in consumer behavior, and so on.

The ultimate objective for organizations is to be able to continue to effectively serve their markets in times of stress, keeping their customers happy and meeting growth targets. Companies possessing this attribute have a clear and significant competitive edge over their rivals.

Supply Chain Resilience Strategy Considerations

The SupplyChainBrain webinar heard that supply chain disruptions will be the norm for some time to come. Chris Jones, Executive Vice President, Industry and Services, Descartes Systems Group, said that a confluence of factors was contributing to port congestion including continued strong growth in U.S. demand for goods, the ongoing impact of COVID-19, and geo-political conflicts, such as the Russian invasion of Ukraine and the resulting trade sanctions imposed on Moscow.

Jones said that supply chain resilience strategies include how to shift the conveyance of goods to less congested shipping lanes and to search for alternative sources of supply away from over-utilized ports. The second approach is a longer-term option, but Jones stressed: “It’s longer term, not waiting for it to happen, but having to make it happen and avoid putting all your eggs in one basket. We saw this with the pandemic in China. You could have had five suppliers there but it didn’t matter if they shut the country down.”

He added that global trade intelligence formed the backbone of a supply chain resilience strategy for any organization in conjunction with the following four points:

- Trade Lane Optimization: Streamlining the supply chain by shifting to less congested shipping lanes.

- Alternative Supplier Sourcing: Putting in place alternative sources of suppliers to maximize supply chain efficiency.

- Landed Cost Calculations: Assessing the suppliers and the supply chain paths that make the best sense economically.

- Denied Party Screening: Screening trade chain partners to make sure they are not on any government watch list.

1. How Global Trade Intelligence can help – Trade Lane Optimization

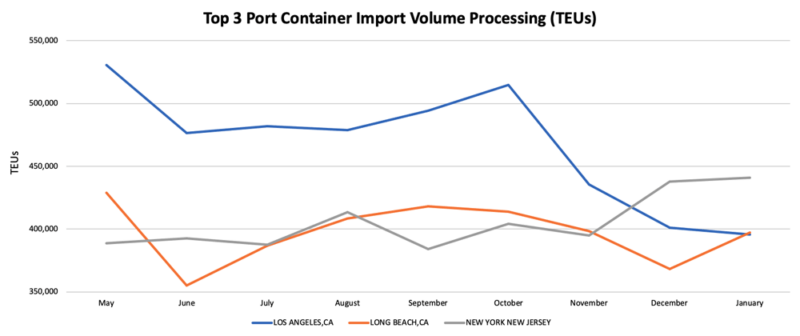

In the same webinar, Mark Segner, Vice President, Global Sales, Descartes Datamyne, demonstrated how global trade data can be used to monitor trade flows as a means to strengthen supply chain resilience. It is information that you have to drill down to get to. The Port of Los Angeles, for example, is known to be the busiest port in the U.S., he said, but if you were to have examined the month-by-month figures for the past year, you would have seen declining container throughput as shippers and their LSP providers shifted to other less congested ports, such as New York-New Jersey (See Figure 1).

Figure 1: U.S. Port Capacity Analysis (Month-by-Month, 2021)

Source: Descartes Datamyne

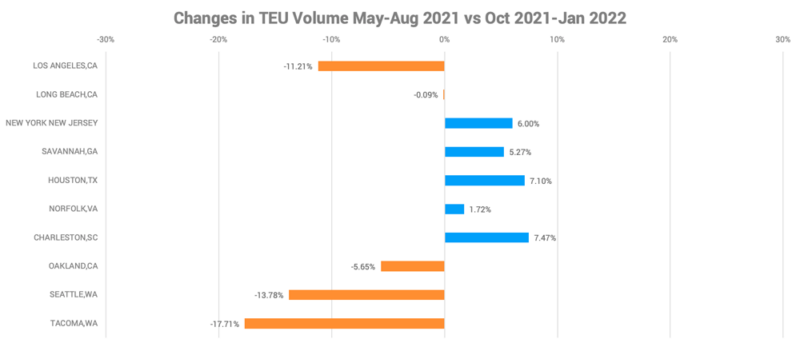

If the analysis were extrapolated to cover even more ports, and volumes compared at the beginning of 2021 with that of the end of the year, we can discern which ports were better able to handle surging throughput. (Refer to Figure 2). Segner said: “The analysis using the Descartes Datamyne application demonstrates that while LA was without a doubt the leading port by volume in the first part of last year, it declined significantly in the later months. The big gainers were New York-New Jersey, Savannah, Houston, Norfolk and Charleston. If you were searching for a place to shift your shipments to, these would be the ports to be added to a shortlist.”

Figure 2: Congested Ports Versus Those Able to Manage Excess Capacity

Source: Descartes Datamyne

2. How Global Trade Intelligence can help – Alternative Supplier Sourcing

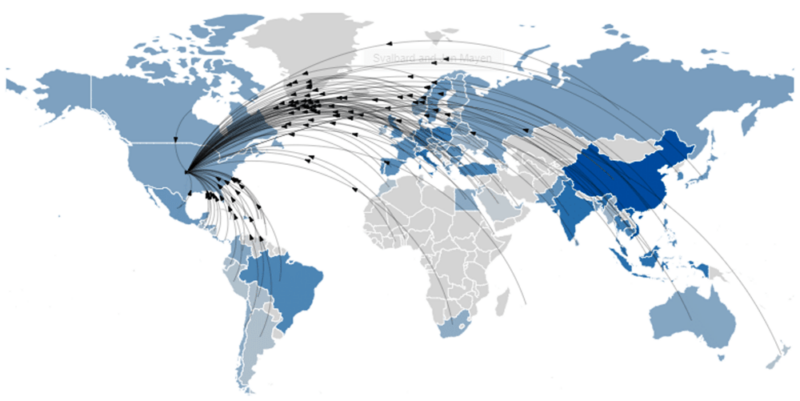

Segner also provided an overview of how to use Datamyne to search for new and alternative suppliers as a strategic means to optimizing an organization’s supply chain. “If your main source is Vietnam, which potentially ships to West Coast ports, you might see advantage in cultivating alternative suppliers in Latin America or Europe with trade lanes to the Gulf Coast or Eastern seaboard. And as an alternative to Vietnam in Asia, you might think about sources in China or India,” he said.

The analysis here, based on data gathered from the bills of lading for waterborne imports (roughly 90% of all merchandise imports) and made available a day after arrival, can be expanded to include every U.S. port. Similar analyses can be done on trade lanes, regions and countries of origin. The focus can be narrowed to individual products, suppliers or importers of, say, furniture which can also generate company names and contact details (See Figure 3).

Figure 3: Furniture Suppliers to the U.S.

Source: Descartes Datamyne

3. Landed Cost Calculations

Businesses can use global trade intelligence to evaluate supply chain vulnerabilities – perhaps an overreliance on a single market or trade lane – and avenues for diversifying sources and optimizing logistics. With access to the underlying transaction records, value chain strategists can drill down to locate shippers, their customers and sources, and logistical details.

According to Segner, the best practice is to monitor key data points and re-evaluate risk exposure periodically. Once candidates for a supply chain solution are identified, global trade intelligence can be used to assess trading partners. An essential step is to calculate the total cost of doing business with a supplier, taking into account not just the quoted price of goods, but shipping costs, insurance, and tariff treatment. Descartes global trade intelligence specialists have developed an estimator that enables businesses to calculate and compare side-by-side the landed costs of importing from multiple countries.

4. Denied Party Screening

Organizations also need to make sure that their trade chain partners are not listed on any government watch list of entities for breaches of international trade, or involvement in criminal activity, money laundering, terrorism, human rights abuses etc.

This is underlined by the current Russia-Ukraine crisis which adds urgency to the need to clear any cross-border business transaction through a Denied Party Screening process to reduce the risk of non-compliance with sanctions. But, as Wood emphasized in the SupplyChainBrain webinar, keeping up with restrictions imposed in pursuit of geopolitical agendas is not the only due diligence challenge companies face.

The ESG Factor in Supply Chain Resilience

Increasingly, global trade intelligence will be required to comply with regulations aimed at environmental, social and governance (ESG) goals. Citing the EU’s February 23 directive on corporate sustainability due diligence as a recent example of regulatory expectations, Wood said that companies must be prepared to “know, at a very granular level of detail, not only who they’re doing business with, – and not only the company and the country that it’s located in – but also the ownership structure of the company, the contractors they’re associated with.”

To watch a recording of the SupplyChainBrain Webinar, Strategies to Mitigate Congestion on Your Supply Chain, click here [registration required].

How Descartes Can Help to Strengthen Your Supply Chain Resilience

Descartes Datamyne delivers global trade intelligence with comprehensive, accurate, up-to-date, import and export information that helps companies save significant time in spotting supply and demand shifts, optimizing trade lanes, expanding into new markets and identifying new buyers and suppliers.

Datamyne features the world’s largest searchable trade database covering 230 markets across five continents. Gathered directly from official filings with customs agencies and trade ministries, including bills of lading, our data is detailed (down to company names and contact details), timely and authoritative.

Descartes software solutions include a landed cost tool to calculate the economic viability of importing from a range of markets. Our applications can also screen against multiple denied parties lists simultaneously to help ensure organizations are not doing business with entities named on official government watch lists.

Ask us for a free, no obligation demonstration.

You can also visit our Global Shipping Crisis Resource Center, which is updated regularly to provide the latest trade data and insights from Descartes Datamyne.