… with a few course adjustments: a new deadline, more inclusive definitions

The US International Trade Commission has announced some key changes in its inquiry, launched February 11, into whether seven countries – China, Ecuador, India, Indonesia, Malaysia, Thailand, and Vietnam – have provided countervailable subsidies to their exporters of frozen warmwater shrimp.

One change – pushing the deadline for reaching a preliminary determination on the existence of the subsidies back from March 23 to May 28 – was sought by the group that petitioned to start the CVD case, the Coalition of Gulf Shrimp Industries (COGSI).

One change – enlarging the defined scope of the domestic industry which may be affected by the subsidies to include shrimp harvesters and farmers as well as processors – overrules COGSI’s request that this case be limited to shrimp processors. Instead, the ITC went with arguments for a more inclusive industry definition presented by the Ad Hoc Shrimp Industry Committee, clearing the way for their participation in the investigation. The ITC also has expanded the definition of domestic “like product” affected by the subsidized competition to include fresh as well as frozen warmwater shrimp.

The arguments over the changes can seem arcane. (Public – i.e., redacted – versions of all the documents in the case are posted on IA-Access.)

But the decision on whose ox is being gored can have a material impact on the outcome of the case. COGSI’s advocacy for the narrower definition led some commentators to suggest the coalition might be interested in reaching a settlement with exporters in advance of a final CVD determination. (As, for instance, Florida and Mexican tomato growers recently agreed on reference prices for Mexican tomatoes and so suspended antidumping proceedings. See Floor Rises under Mexican Tomatoes.)

Meanwhile, the ITC investigation has proceeded with the collection of information from the seven national governments about their subsidies for shrimp exporters. According to COGSI, a total of 117 programs aimed at developing domestic production and boosting sales to the US are suspect. The ITC has also selected the exporters, one in China, two in each of the other countries, as mandatory respondents to its requests for information. The companies are:

- China: Zhanjiang Guolian Aquatic Products Co., Ltd.

- Ecuador: Promarisco S.A. and Sociedad Nacional de Galápagos C.A. (SONGA)

- India: Devi Fisheries Ltd. and Devi Sea Foods Ltd.

- Indonesia: PT. First Marine Seafoods and PT. Central Pertiwi Bahari

- Malaysia: Kian Hut Aquaculture Sdn. Bhd. and One-East Marketing Sdn. Bhd.

- Thailand: Marine Gold and Thai Union

- Vietnam: Minh Qui Seafoods Co. Ltd. and Nha Trang Seaproduct Company

These were the highest volume exporters during the period of investigation, calendar year 2011, based on US Customs and Border Protection import data.

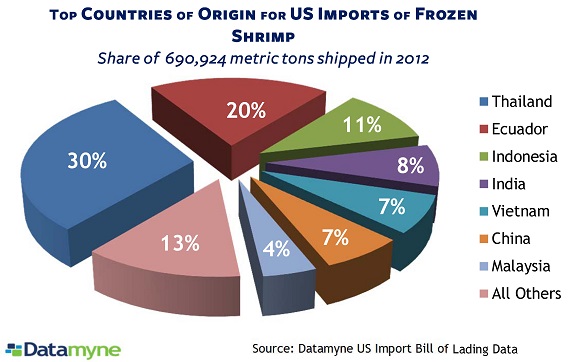

We turned to Datamyne’s bill of lading data for a closer and more current look at the seven countries’ trade in frozen warmwater shrimp which, as the COGSI petition asserts, accounted for 85% of US shrimp imports and more than three-quarters of the US shrimp market in 2011. Our 2012 data finds 87% of imports originated in these countries. (Note, however, that overland shipments from Mexico, which ranked sixth as a source for frozen shrimp in 2012, are not captured by the maritime BOL data.)

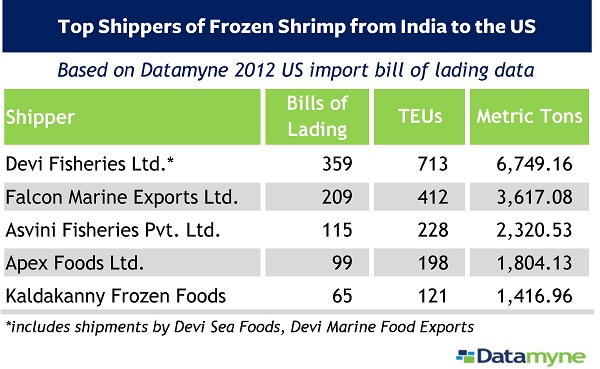

With the BOL data, we can identify the parties to this trade – consignees, shippers and carriers. Here, for example, are the top shippers and consignees by volume of frozen shrimp imported from India:

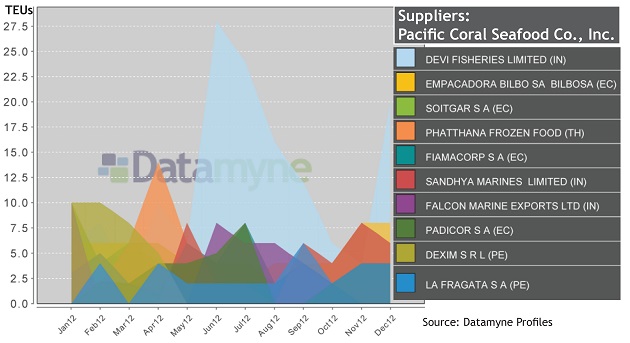

We can also use the Datamyne Profiles feature to learn more about the consignees, including their suppliers and trading activities. Here, for instance, are Pacific Coral Seafood’s 10 offshore suppliers, including Devi Fisheries, top Indian exporter (and CVD respondent), and 7 other companies based in countries subject to the CVD investigation.

We will continue to follow the CVD case here. To learn more about what the Datamyne BOL data and Datamyne Profiles can reveal about trade in frozen shrimp – or any other product – ask us.