It’s a textbook case in the need to diversify sources of supply: The US imports about 97% of its limes from Mexico and, right now, limes are a scarce and expensive commodity in Mexico. Disease and bad weather have combined to reduce crop yields, shortages have boosted prices to record highs, and drug cartels are seizing the opportunity to hijack truckloads of limes and extort growers.

By the end of last week, 40-pound crates of Mexican limes were commanding $100 wholesale, four times the typical seasonal price, the Wall Street Journal reported in a story that goes on to describe how US bars and restaurants plan to cope with limes in short supply for margaritas, guacamole and other Cinco de Mayo party fare.

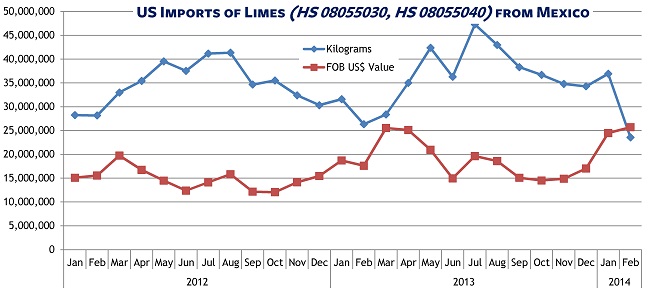

The latest US import data shows the low-supply/high-price problem shaping up in the first quarter. US Census data for March won’t be available until after May 5.

There are some limes coming into the US from Mexico … and, via waterborne carriers, from Central and South America, with Guatemala the leading alternative source.

There are some limes coming into the US from Mexico … and, via waterborne carriers, from Central and South America, with Guatemala the leading alternative source.

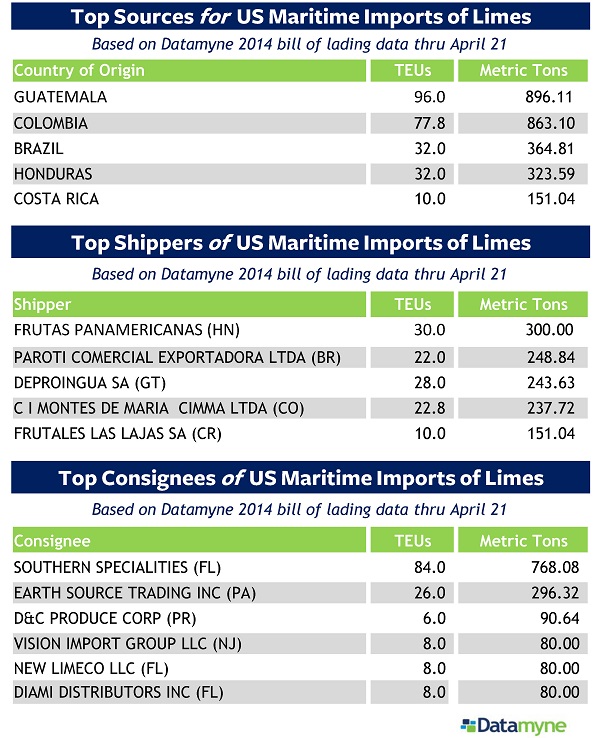

Here are the top source countries, shippers and consignees (importers) of limes, based on our bill of lading data on maritime shipments to the US from January through April 21:

These alternative suppliers (from a list of about 20 shippers) can’t possibly make up this year’s shortfall in limes. Guatemala is the source for less than 2% of US limes.

These alternative suppliers (from a list of about 20 shippers) can’t possibly make up this year’s shortfall in limes. Guatemala is the source for less than 2% of US limes.

But, keeping in mind that Mexico’s producers moved quickly to fill the gap when Florida’s lime groves were wiped out following an attack of citrus canker, it may be that Central and South American growers will be seeing more global market interest.

Indeed, just last September, Southern Specialties, top of the list of importers above, announced that it would be expanding production in Guatemala.

If you would like to see additional data on shippers or importers of limes – or any other agricultural commodity – just ask us.