The Year of the Goat (or, by some interpretations, the Year of the Sheep) challenges China’s economy to sustain a steady climb over some rough terrain, at a slower but not too-slow rate (it’s now forecast at 6.8% by the International Monetary Fund). And, all the while, it must keep “rebalancing” by shifting away from exports and investment and toward domestic consumption and innovation as drivers of growth.

Whether the world’s second biggest economy will be nimble enough is of intense interest to the global market where, according to Datamyne’s global ranking data, China accounted for 12% by value of world trade January through September 2014. The US, which the IMF projects will grow at a rate 3.6% in 2015, accounted for 11% of trade during the same period.

China edged out the US on a couple of other measures last year. China’s gross domestic product based on purchasing-power-parity surpassed US GDP based on PPP, at US$17,632.01 billion compared with US$17,416.25 billion, according to IMF estimates.

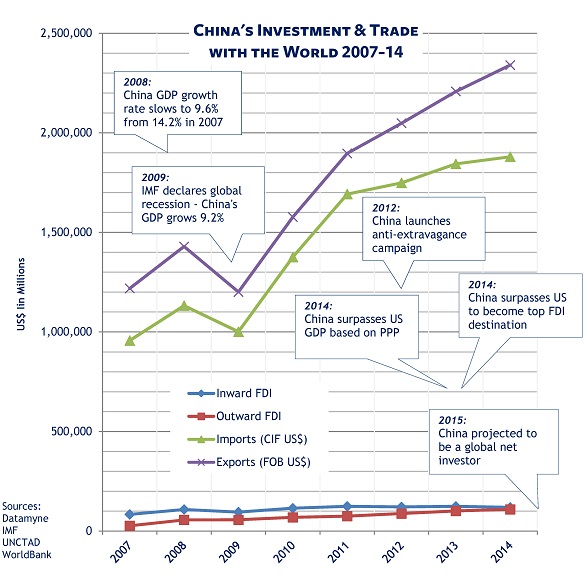

China also overtook the US as the top destination for foreign direct investment (FDI). Note that, in the chart below, the lines for inward and outward FDI appear to meet in 2014. The figures are close: an estimated US$119 billion inbound against US$109 billion outbound. Various Chinese government officials have forecast outward FDI will surpass inward FDI within the next year, making China a global net investor.

As the chart’s trade data indicates, imports have been slowing, with a 1.91% increase in 2014 compared with 5.17% in 2013, a reflection of government policies discouraging luxury consumption and falling commodities prices, as well as flagging domestic demand. Exports, meanwhile, grew 5.66% in 2014 compared with 7.23% the year before.

Early reports (see Reuters, for instance) on January trade indicating Chinese exports fell 3.3% and imports 19.9% are troubling – and well below analysts’ expectations. Still, the numbers may not be entirely reliable indicators, having been skewed by (what else?) the disruption of the week-long Lunar New Year holiday.