An eight-day strike by the National Association of Customs Officers in Chile ended yesterday, clearing the way for shipments of Chilean salmon to resume.

The strike affected all Chilean exporters, but the exporters of perishables – seafood, fruits and vegetables – were hit hardest by the embargo.

The interruption in Chilean salmon exports has roiled markets, with prices rising for Canadian Atlantic salmon. As reported in Undercurrent News, Chile’s salmon sector lost $6 million per day in fresh salmon sales, $8 million daily in frozen salmon sales through the strike.

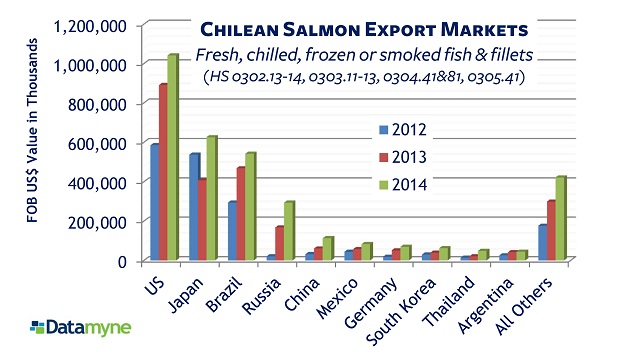

Industry group SalmonChile also worries about the “loss of confidence” in Chile as a source of supply. In the US, its top market (see the bar graph), Chile is facing competition from Canada and Norway. Just two months ago Costco announced that it is switching its fresh farmed salmon purchases from Chile to Norway.

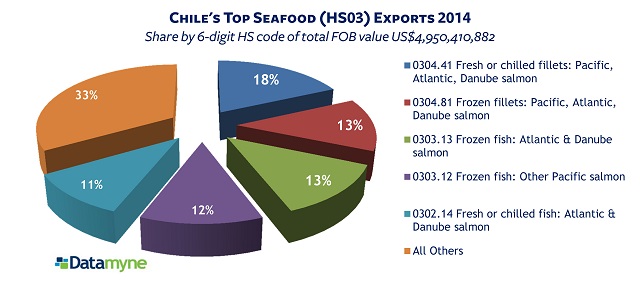

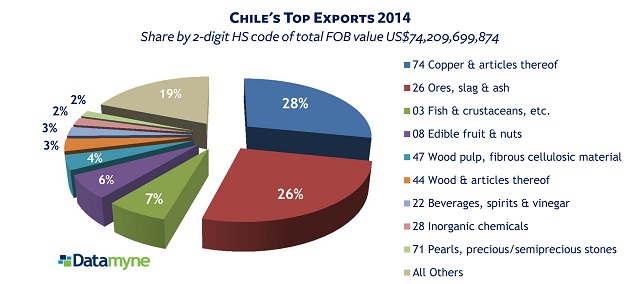

Damage to the Chilean salmon sector can ripple through the country’s economy: Chile’s salmon exports account for 68% of its seafood exports (in fact, salmon products make up the top 5 Chilean seafood exports) … and seafood ranks third among its top-valued exports (as the pie charts show).

Related: