by Brian J. McCormick, guest columnist

Chemcost’s approach to global price discovery is based on the theory that volumes shipped point the way to competitive pricing. Call it a volume-centric approach. And we typically find in using this approach that global shipment volumes reflect best price benchmarks.

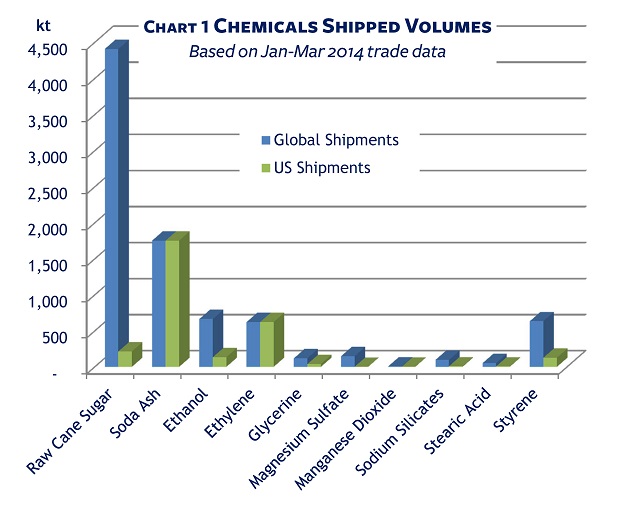

Here’s how it works: Start with recent volumes shipped for the 10 chemical commodities that comprise the Datamyne US Best Price Benchmark (posted each month to the Datamyne home page).

Notes: “Global” = the 50 countries (not including the US) whose trade is covered by Datamyne. It is possible that there are lower prices beyond the covered markets. US and EU volume data have been normalized in preparing Chart 1.

Notes: “Global” = the 50 countries (not including the US) whose trade is covered by Datamyne. It is possible that there are lower prices beyond the covered markets. US and EU volume data have been normalized in preparing Chart 1.

As Chart 1 makes plain, global shipment volumes surpass US shipment volumes with the notable exceptions of soda ash, where US exports are on a par with global volumes, and ethylene, where US imports from Canada achieve parity. This indicates there’s a probability for 8 out of 10 commodities that there are better average and best prices to be had from global sources outside the US.

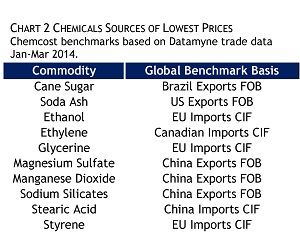

Where are the best chemical prices? The current sources (as of 1Q14) identified by Chemcost are listed in Chart 2.

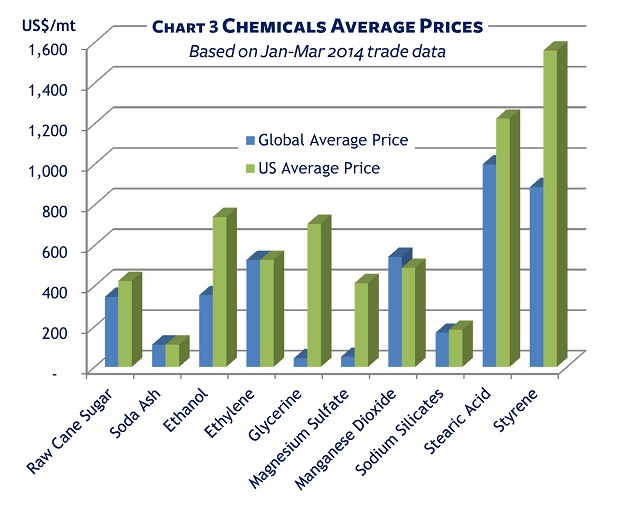

Chart 3 compares global and US average prices in these commodities …

Chart 3 compares global and US average prices in these commodities …

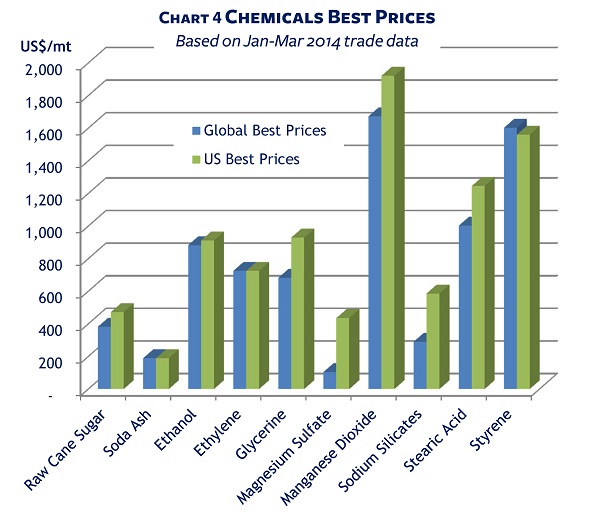

… while Chart 4 compares global and US best (or cheapest) prices for the same 10 chemicals.

… while Chart 4 compares global and US best (or cheapest) prices for the same 10 chemicals.

In these comparisons, the unconstrained size of opportunity prize estimate is 37% for the basket of 10 commodities purchased at best global prices to 16% for the same commodities at the better global average prices.

In these comparisons, the unconstrained size of opportunity prize estimate is 37% for the basket of 10 commodities purchased at best global prices to 16% for the same commodities at the better global average prices.

Keep in mind that these opportunities to save were identified by a volume-centric focus – the Chemcost approach. It is often not enough to know pricing alone. Locations with the highest trading volumes at best price are the real sourcing keys when searching for the new cheap.

Next month, I’ll be introducing Chemcost’s Commodity E-Bulletins. They covers the 10 chemical commodities that make up the Datamyne Best Price Benchmark index … as well as 215 more!

Chemcost Interactive LLC© 2014

About Brian J. McCormick

Brian J. McCormick was instrumental in developing procurement costing and quality assurance for P&G over a 34-year career. He is the founder and managing director of Chemcost Interactive* LLC (CI), a company offering research and analysis to support cost-efficient supply chain management.

Brian J. McCormick was instrumental in developing procurement costing and quality assurance for P&G over a 34-year career. He is the founder and managing director of Chemcost Interactive* LLC (CI), a company offering research and analysis to support cost-efficient supply chain management.

Chemcost can assist Datamyne’s customers in identifying lower price opportunities through consulting and training. Chemcost also offers annual subscriptions to global and regional price bulletins on 225 commodities across 8 major chemical spend classes. Feel free to contact Chemcost for more information at www.chemcostinteractive.com

The opinions expressed in this article are those of its author and do not purport to reflect the opinions or views or Descartes Datamyne. In addition, this article is for general information purposes only and it’s not intended to provide legal advice or opinions of any kind and my not be used for professional or commercial purposes. No one should act, or refrain from acting, based solely on this article without first seeking appropriate legal or other professional advice.

* Chemcost Interactive is a trademark of Chemcost Interactive LLC