Miami Herald taps Datamyne to gauge impact of Colombia-Venezuela feud

The Miami Herald’s Jim Wyss writes today about the likelihood that Venezuela and Colombia can end the rift that’s caused commerce between the erstwhile trading partners to tumble 70%.

As Wyss notes, a series of political squabbles came to a head in 2008 when Colombia attacked a rebel camp in Ecuador. Venezuela retaliated with a virtual boycott of Colombian imports, and so on…

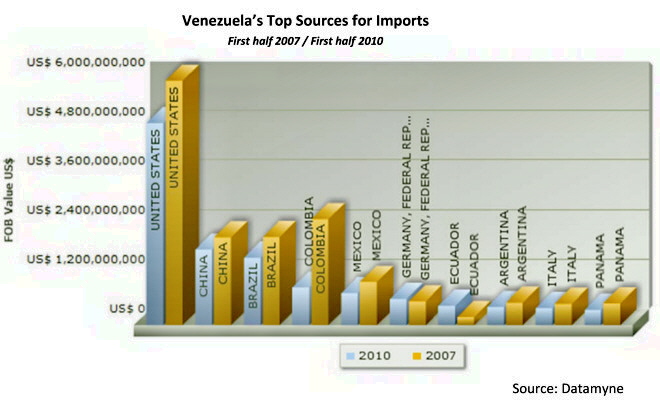

The result has been economic pain on both sides of the border. Colombian exporters have been forced to scramble for new markets, while Venezuela has had to cope with shortages of food and other basics. The resulting shifts in trade are captured in the data provided to the Miami Herald by Datamyne. For example, the U.S., Brazil and Mexico have gained share in Venezuela at Colombia’s expense (see the bar chart below).

Now the leaders of the two countries are re-engaging, but when and to what extent their cross-border commerce can be restored is not clear. According to the Herald, it will take more than political will to get trade moving again. There’s an outstanding debt owed by Venezuela to about 250 Colombian exporters, for instance. Read the full article here: http://bit.ly/d2twys

You can learn more about Venezuelan and Colombian current trade with each other, and with the rest of the world, including what (at 2-, 4-, 6-, or 8-digit HS code levels) is being bought and sold, from Datamyne. Ask us to show you how.

Updated 9/13: El Universal reports that Venezuela is about to pay US$120 million (against the total debt of $786 million) to Colombian exporters.