ITC determination in AD/CVD investigation finds PET resin imports dumped on U.S. market materially injured domestic producers, paves the way for new tariffs. Meanwhile, build-out of PET production for export stalls.

The U.S. International Trade Commission (ITC) has decided that imports of polyethylene terephthalate (PET) resin from Brazil, Indonesia, Korea, Pakistan and Taiwan, dumped on the U.S. market at less than fair value, have materially injured domestic producers of this product.

The ITC determination clears the way for the next phase of its investigation during which antidumping tariff rates for these imports will be set. The final decision is expected in May 2018. [See U.S. Opens AD/CVD Investigation.]

As the ITC reports, most U.S. PET resin producers’ output goes to domestic customers who use it to make, first and foremost, beverage bottles and other food packaging. The plastic is also used in household cleaners, cosmetics and carpets fibers.

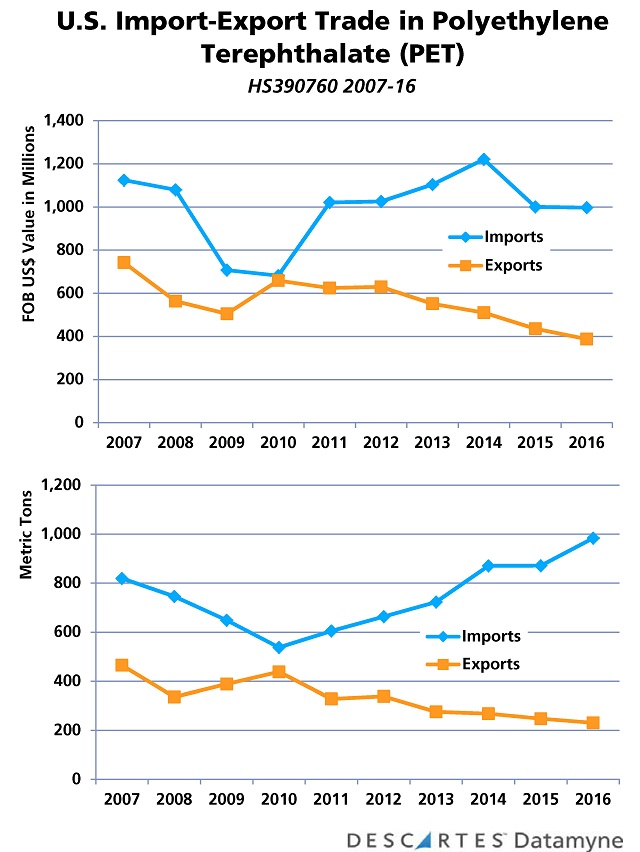

As the trade data summarized in these charts shows, the U.S. has been a net importer of PET over the last decade – with a near exception in 2010:

The near balance between imports and exports in 2010 followed on 2009’s drop in the price of natural gas and its by-product ethane, the feedstock for U.S. plastic production. Meanwhile, the price of oil was moving up and with it the cost of naphtha, feedstock for Asian and European PET producers.

Earlier this year, observers of plastics industry trends were forecasting that 2018 would see a similar intersection of U.S. PET imports and exports – and for similar reasons. As the Wall Street Journal reported, U.S. companies made big investments in new petrochemicals production, betting that U.S. plastics will remain price competitive thanks to shale and that global demand for plastics will continue to rise into the future.

As the year winds down, it is not so clear when that new production will come on line. Bankruptcy has indefinitely postponed a major Corpus Christi project. Hurricane Harvey played havoc with Houston-area construction project timelines, pushing start-ups slated for 2017 into next year.

The active hurricane season also disrupted transport, constraining supplies and boosting prices of PET (and other petrochemicals) – further redirecting market dynamics.

Still, it’s likely that the stalled build-out of production only postpones an inevitable rise in U.S. exports.

There are over 300 petrochemicals projects now underway in the U.S., according to the American Chemistry Council. The WSJ cites consultant PCI Wood Mackenzie estimates that U.S. ethylene production capacity will have increase 50% by 2020. Somewhere along the way, the U.S. will shift from net importer to net exporter of PET and other plastics.

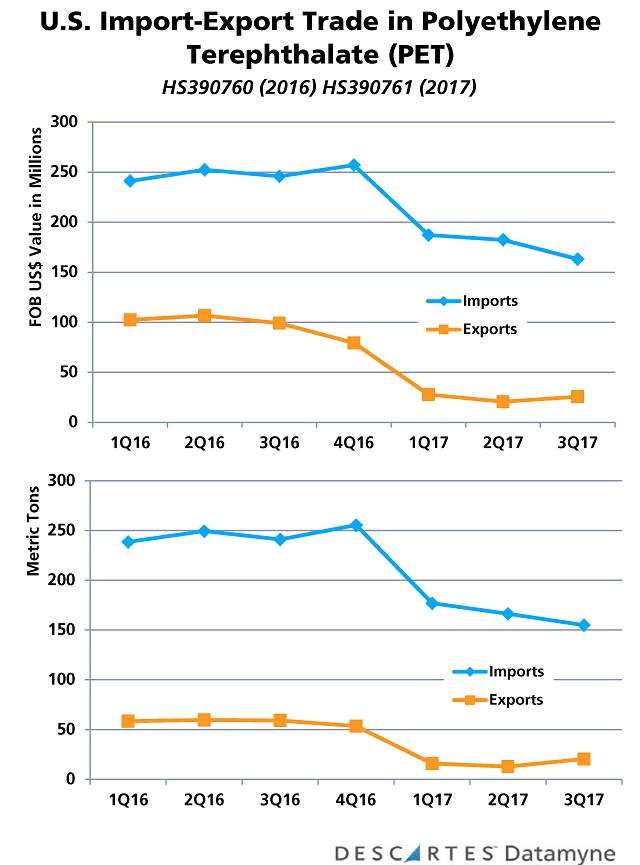

The trade data through third-quarter 2017 reveals some small changes in the direction of PET imports and exports that may signal the start of the shift:

Related:

From our blog:

- U.S. Opens AD/CVD Investigation into PET Resin Imports

- Can U.S. Polyethylene Net Exports Expect a Lift from Shale?

From our trade content solutions:

- Descartes Datamyne maritime bill of lading data captures the transactional and logistical details of U.S. trade in PET, as well as other plastics industry trends. Ask for a demo.

- Descartes CustomsInfo™ Manager offers solutions to monitor AD/CVD duty rates, as well as trade regulations and rulings relevant to your business – and integrate this content with your global operations systems. Ask for a demo.

- Descartes CustomsInfo™ Reference enables visibility to all AD/CVD details by embedding cases into the US tariff schedule, trade regulations and rulings. Register for a free 14-day trial.