We are pleased to publish Descartes’ Annual U.S. Port Report, covering the top 20 U.S. ocean ports ranked by import Twenty Foot Equivalent Units (TEUs). Ports are the lifeblood of trade, and the goods that flow in and out of ports can speak to key patterns and the health of an industry.

Our targeted trade statistics and analyses quickly get to the heart of trends in an easy-to-understand, visually-driven format. The report profiles each port location, covering year-over-year volume and market share patterns as well as top importing companies, carriers and countries of origin. Findings reveal the top products imported through each port by Harmonized System (HS) code as well as Bill of Lading (BOL) shipment counts and values.

Top 20 Busiest Ports in the U.S.

Keep Pulse on Port Trends with Deep Insights from Descartes Datamyne

Monitoring port volume cargo through put is critical for businesses looking to examine changes in demand, gain insight into competitive activity, and view trends in trade on a macro basis. As ports are often a focal point for overall market changes, fluctuations in volume and commodities are both key indicators of industrial developments.

Types of Data Analyzed:

- Port Location

- Year-Over-Year Comparisons in Volume

- Market Share Trends

- Top Importing Companies, Carriers, and Countries of Origin.

Data Insight from the Top U.S. Ports

Descartes’ Annual U.S. Port Report analyzes the top 20 U.S. ocean ports ranked by import Twenty Foot Equivalent Units (TEUs). Findings reveal key products imported through each port by Harmonized System (HS) code as well as Bill of Lading (BOL) shipment counts and values.

Click here to register to download a free PDF copy of the report and analysis.

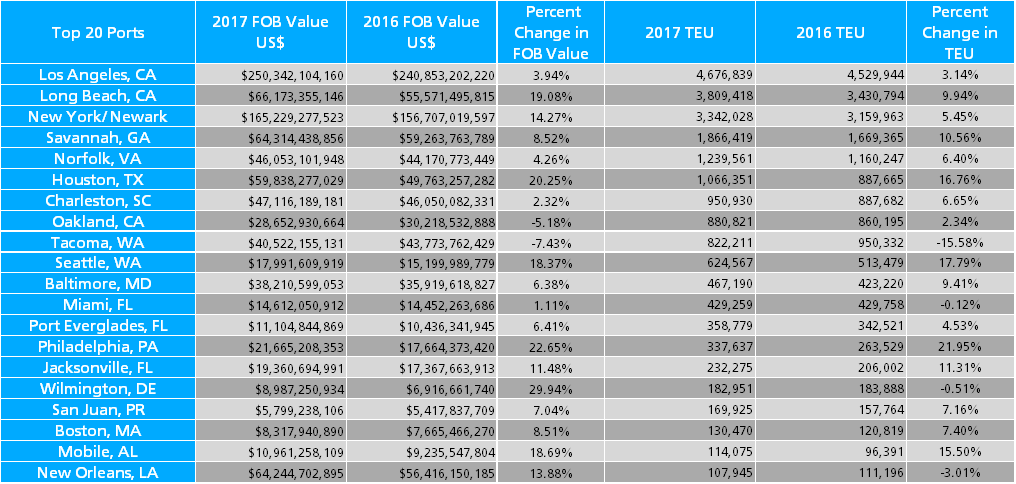

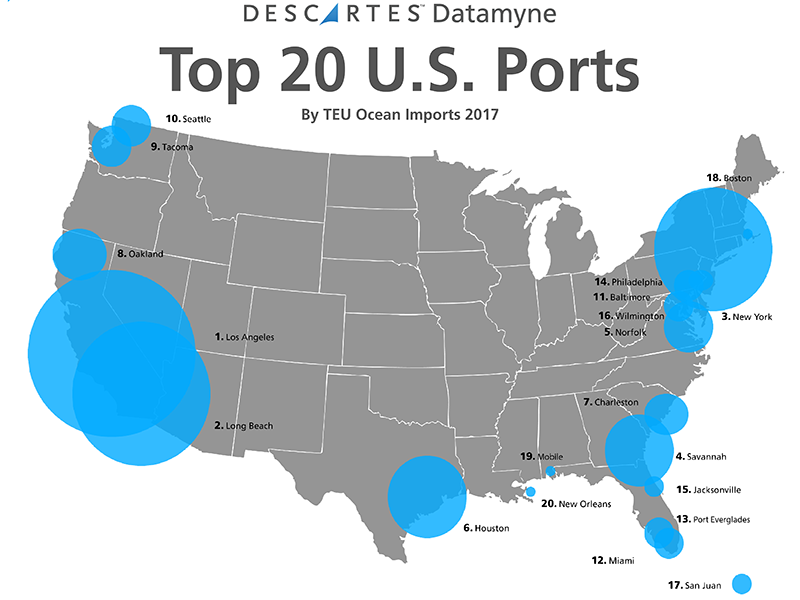

In 2017, the top 20 ports handled nearly 98 percent of U.S. import volumes as measured in 20-foot equivalent units (TEUs), the standard measure for containerized cargo. In the last five years, a number of these ports realized a 30 percent increase in import volume, compared with growth in U.S. imports overall, which has risen more than 18 percent since 2012.

Top 20 U.S. Ports Ranked by Import TEUs

Factors Contributing to Port Volume

Working with a highly specialized labor force, receiving ever larger ocean vessels and delivering into an exceedingly dynamic logistics supply chain, the top U.S. ports have had to adapt to stay competitive and meet increasing volume demands year over year.

- The Panama Canal expansion continues to be a prime driver of infrastructure investment across the country. To prep for the larger “post-Panamax” vessels calling on their docks, ports across the country have launched billions of dollars’ worth of development projects.

Import TEU Volume and Market Share

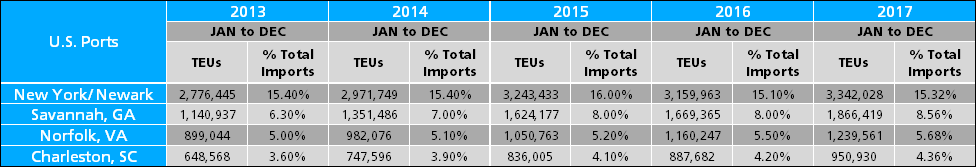

Select East Coast ports have captured import market share in the last five years. In 2012, the Port of New York/Newark accounted for 9.6 percent of U.S. import TEUs. Since then, that share has grown to a steady 15 percent as the port increased its import volumes 86.8 percent over five years, from 1.69 TEUs annually in 2012 to 3.34 million in 2017.

Similarly, the Port of Savannah held a 6.2 percent stake of U.S. imports in 2012; in 2017, the port’s share is over 8 percent, based on an increase of nearly 600,000 TEUs for a total of 1.87 million in 2017.

West Coast port volumes are shifting as well. The Port of Los Angeles is still ranked as the top port in the nation in import volume, with 4.68 million TEUs imported in 2017, up 3.9 percent from 2016; however, the port’s 23.2 percent share of U.S. imports in 2012 has further receded to 20.8 percent in 2017.

Top 20 U.S. Ports Year-Over-Year Analysis

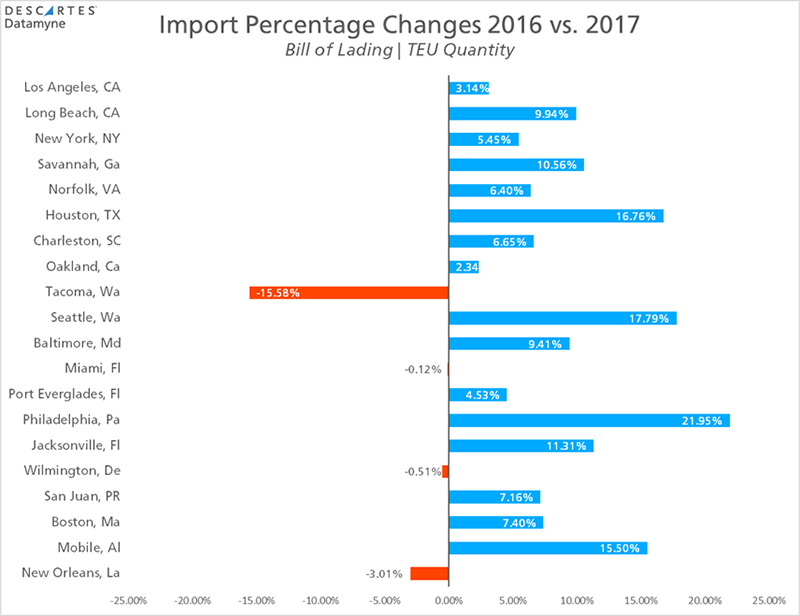

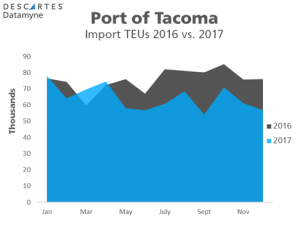

Comparing year-over-year data, the majority of the top 20 ports displayed steady growth in 2017 with Tacoma, Wilmington, and New Orleans as the only outliers.

The Port of Tacoma, after showing a strong 8.9 percent increase in import volume in 2016, fell 15.9 percent in 2017. This drop in Tacoma is offset by a 17.8 percent increase in volume by its sister port in the Northwest Seaport Alliance, the Port of Seattle. Since merging in 2015, the two ports have collectively seen an increase in volume by 10.9 percent.

The Port of Mobile, a newcomer to the top 20 list, saw its import volume increased 15.5 percent as the port completed Phase 2 of its five-part expansion project. The multi-billion-dollar long-term plan is designed to increase the port’s throughput volume to 1.5 million TEUs. The $49.5 million, Phase 3, expansion was approved in late 2017 with specific plans for a 400 ft. dock extension and Post-Panamax crane rails.

How Descartes Can Help

Descartes Datamyne offers a comprehensive database of accurate, up-to-date import-export information, and delivers business intelligence for market research, sales insight, supply chain management, enhanced security and competitive strategy.

The solution is powered by the world’s largest searchable trade database, covering the global commerce of 230 markets across 5 continents and provides access to market data faster than any other source in the industry. U.S. maritime import data is refreshed daily with information sourced directly from Customs 24-hours after shipment arrival; monthly for international data sources.

Click here to register to download a free PDF copy of Descartes Annual Top 20 U.S. Port Report.