China’s currency devaluations aimed at making its goods more attractively priced for global markets have prompted the Obama administration to urge the world’s leading exporter to rely less on foreign sales and more on domestic consumption to stabilize and grow its economy, as the Wall Street Journal reports.

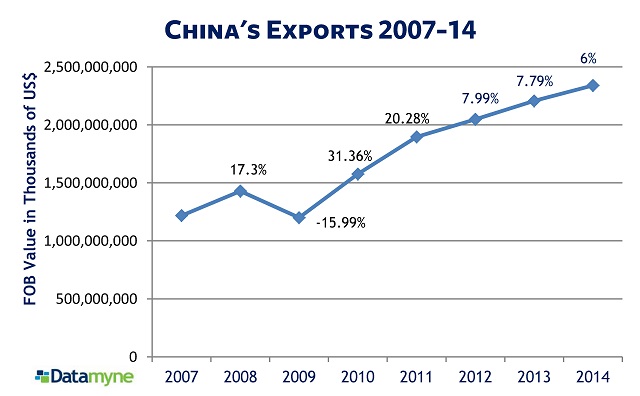

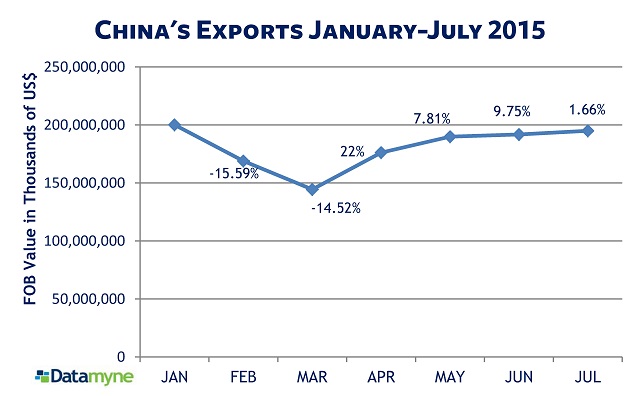

Actually, there are some who reject the notion that China is trying to spur exports by weakening its currency (including Standard & Poor’s, as reported by the South China Morning Post). But, with or without encouragement from the US (its biggest overseas market), China has had to confront the fact that its exports are no longer the engine of economic growth they once were. As our trade data on China shows, the pace of export growth has slowed significantly in recent years … almost to a standstill in recent months.

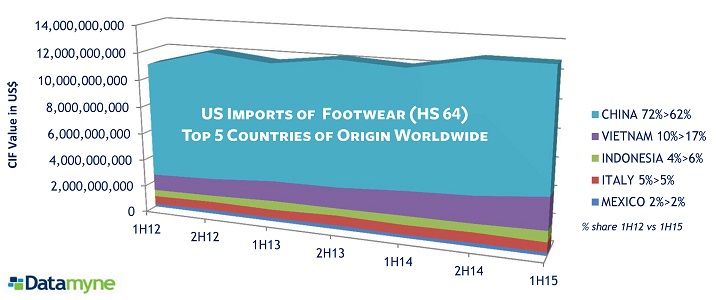

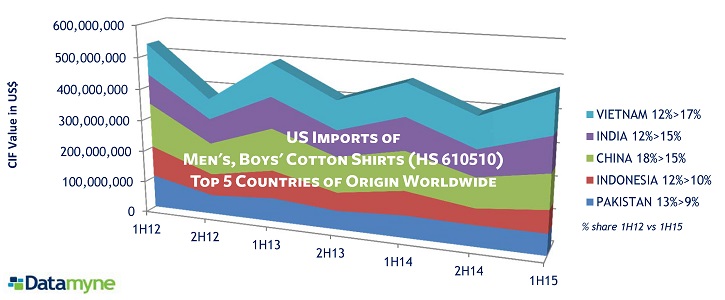

Partly this is because China is facing competition from countries that offer lower-cost production. For example, our data (below) shows that while China remains the top country of origin for US footwear imports (as it has been for years), it has lost 10% of its market share, largely to Asian rivals Vietnam and Indonesia. China had a less commanding lead as top COO for US imported men’s and boys’cotton shirts, but has now slipped behind Vietnam and India in a much more competitive field.

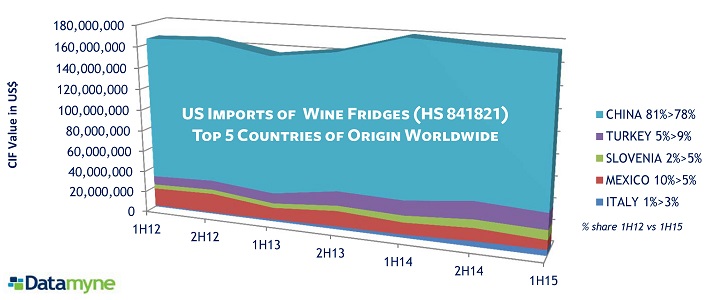

But, generally, the rising competition is not (yet) eating China’s lunch. Take, for instance, wine refrigerators. Top Chinese brand Haier entered the US appliance market on the strength of its electric wine cellar (wine refrigerator) in the early 2000s (as the New York Times reported in 2005), leading the way for other Chinese manufacturers. As of first-half 2015, China continues to dominate US imports of wine fridges, although its share is being nibbled at by Turkey and Slovenia. But the 3-point loss in share is not so alarming as the 3.28% drop in total exports of this product to the US in first-half 2015 compared with 1H14.

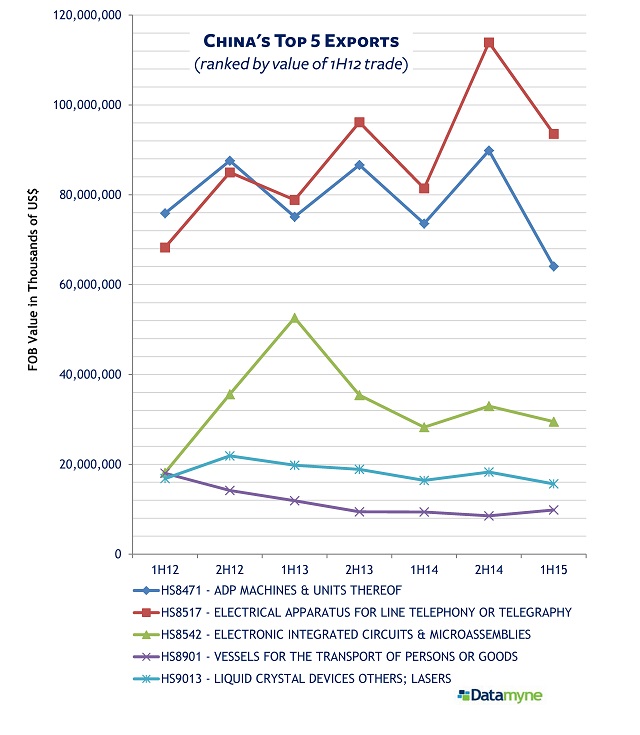

China’s bigger problem is overall weakened global demand for its products. Here are the downward trendlines for its top 5 exports:

As the Financial Times points out, lackluster global demand is affecting exports across Asia. China’s slowdown is partly to blame, with its declining imports – especially commodity imports – helping to reduce its trading partners’ purchasing power.

As the Financial Times points out, lackluster global demand is affecting exports across Asia. China’s slowdown is partly to blame, with its declining imports – especially commodity imports – helping to reduce its trading partners’ purchasing power.

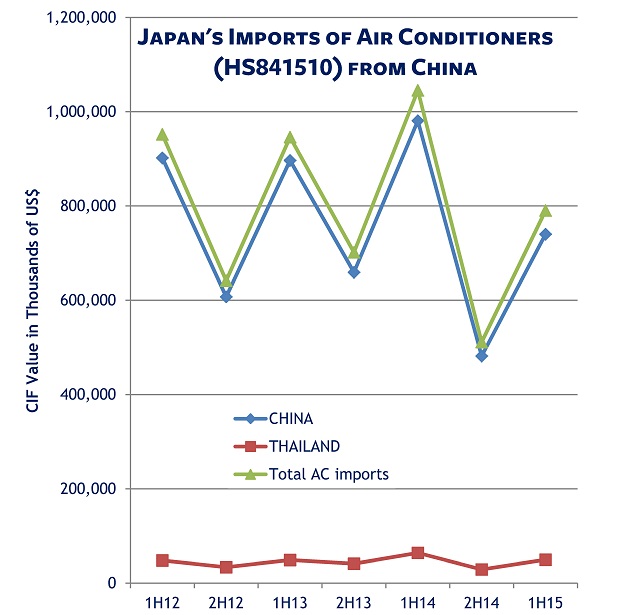

For example, Japan, China’s third-ranked export market (after the US and Hong Kong), still buys most of its window air conditioner imports from China, but it’s buying far fewer of them.

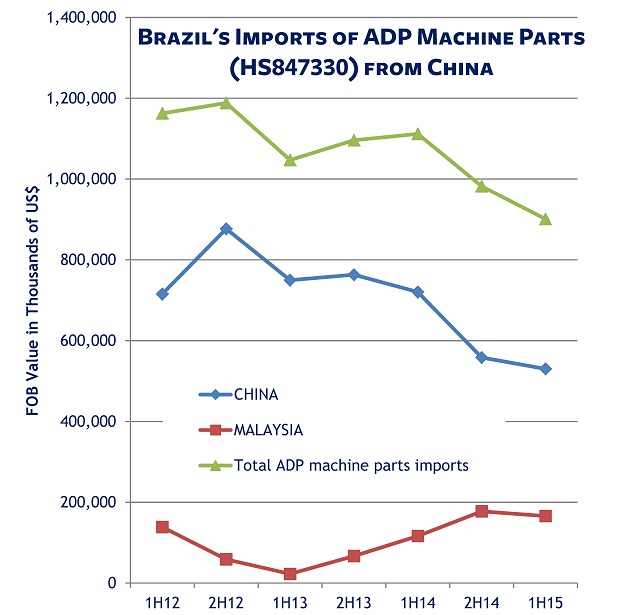

Brazil is China’s top export market in South America. To be sure, China has conceded share of the Brazilian market for automatic data processing machine parts and accessories to Malaysia. But it’s likely less worried that its slice has been shaved than that the pie as a whole seems to be shrinking.

So, perhaps China would be well-advised to heed the Obama administration’s urging that it boost domestic consumption after all, or find some other means to reignite market demand.

If you would like to see more data on Chinese exports or imports, or monitor the impact of China’s economic rebalancing on trade in a particular product or market, just ask us.

Related: