Public policy, private investment, and technological advances are making electric vehicles (EV) a practical alternative for more car owners. While the market is bullish on accelerating EV sales, there are worries, global trade data shows, about assuring supplies of the metals used to make the batteries “under the hood.”

These worries come as President Biden signed an executive order initiating a review of critical supply chains, including those that fuel the electrification of transport along with semiconductors, pharmaceuticals, and strategic minerals. The aim is to strengthen the resiliency of U.S. supply chains, which in turn would prevent shortages of critical materials and products and maintain America’s competitive edge and national security.

In 2016, BloombergNEF forecast that electric vehicles (EVs) would account for 35% of global new car sales by 2040. Just four years on, Bloomberg is boosting its market outlook for EVs to 58% of all cars sold in 2040.

Recent developments may push the projections higher. On the one hand, more governments, intent on achieving zero-net emissions sooner rather than later, are shaping policies to make EVs a more affordable and practical option for consumers. Strategies include providing incentives for buying EVs, as well as tightening standards for internal combustion engine (ICE) vehicles. In the U.S., the Biden Administration has committed to stepped up support for electrifying road transport. California goes further with a plan to restrict new car sales in the state to zero-emission vehicles by 2035, as the LA Times reports.

Meanwhile the private sector is readying for a near-future transition to electrified transportation. Oil companies are planning to roll out chargers at their filling stations (as in these reports from the U.K. and the U.S.). Automakers are targeting 2035 to phase out gas and diesel engines and offer all-electric product lines.

There has been substantial progress in bringing down two big barriers to widespread EV adoption: range anxiety and sticker shock. In the U.S., New York and Florida are among the states that have announced major investments in building out recharging infrastructure. Thanks to steady advances in EV battery technology, refueling will soon be very much faster (with charging times as short as five minutes).

Current R&D promises battery packs, now accounting for 21% of the cost of an EV, will soon be lighter weight, more energy dense, and less pricey. Consultants Wood-Mackenzie expect the US$100/KWh threshold at which EVs will become cost-competitive (without government subsidy) with gas-powered vehicles to be crossed as soon as 2024.

Growing demand runs into limits on supply

EVs would seem to offer an open road to reducing emissions and the ultimate goal of mitigating climate change impacts. But there may be detours ahead. Too many upstream raw materials needed to make EV batteries downstream are available from relatively few producers. Which makes the Biden Administration’s initiative to strengthen critical supply chains resiliency over the long term all the more timely.

Lithium-ion (Li-ion) batteries power most EVs on the road today as well as provide storage for energy systems. They work as all batteries do, transferring charge between a negative electrode, or cathode, and a positive electrode, or anode.

In Li-ion batteries, the lithium ions move through an electrolyte solution to pick up and release charge. The anode is made of graphite and the cathode is a combination of metals – with a lithium-nickel-manganese-cobalt (NMC) formulation the most common. While other metals can fill the bill – aluminum replaces manganese in NCA batteries, for instance – NMC batteries are expected to command market share into the 2030s.

Projected EV-driven demand for battery metals has sent their prices soaring in the past (as we reported most recently here). The latest EV sales forecasts look likely to lift metals prices again, especially for cobalt, lithium, and nickel. Even graphite – both mined natural graphite and synthetic graphite (derived from petroleum coke) are used in batteries – is expected to be in short supply versus anticipated demand.

Equally concerning: very few countries control production of these vital resources.

According to the U.S. Geological Survey (USGS), last year:

- China was the world’s leading graphite producer, producing an estimated 62% of total world output.

- Five mineral operations in Australia, two brine operations each in Argentina and Chile, and two brine and one mineral operation in China accounted for the majority of world lithium production.

- The leading countries for manganese ore were, in order, South Africa, which accounted for a little over a third of production in 2020, Australia, and Gabon.

- The Democratic Republic of the Congo continued to be the world’s leading source of mined cobalt, supplying approximately 70% of world cobalt mine production.

The risk of shutting down EV value chains any or everywhere by turning off the upstream flow of, say, cobalt is very real. Consider that China, which controls about 80% of the world’s supply of 17 rare earth minerals, is reported to be weighing curbs on their export to U.S. defense industries.

COVID-19 previews supply chain disruption on a global scale

Concerns about over-dependence on cross-border supply chains have also been stoked by the COVID-19 pandemic. Breaking in the U.S. with alarming shortages of personal protective equipment (PPE), the coronavirus went on to disrupt production across a range of industries.

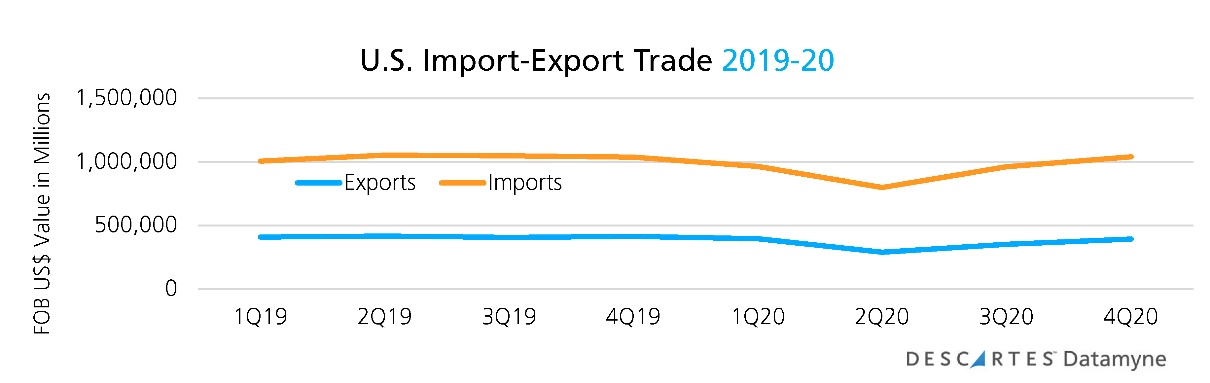

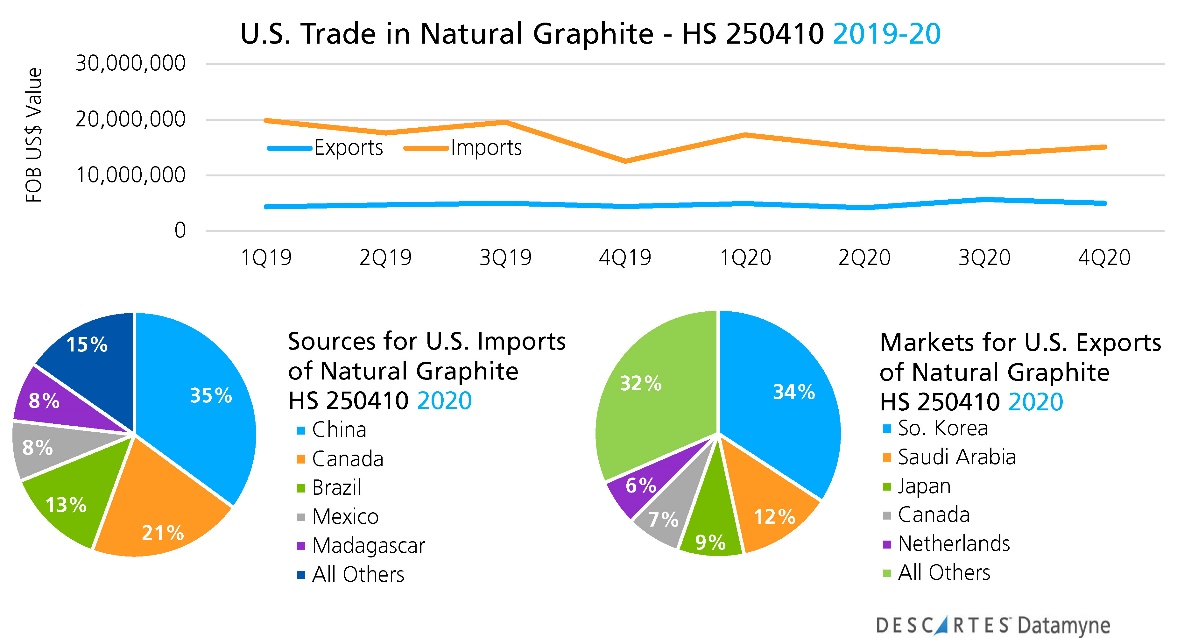

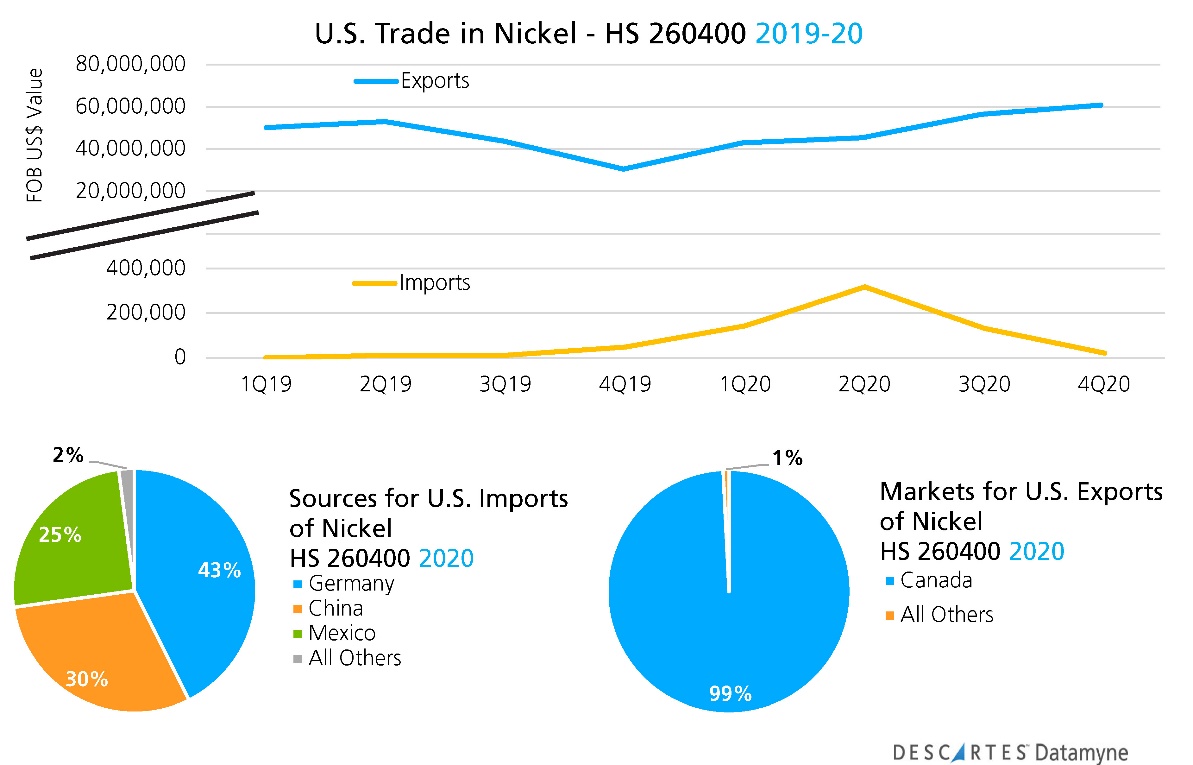

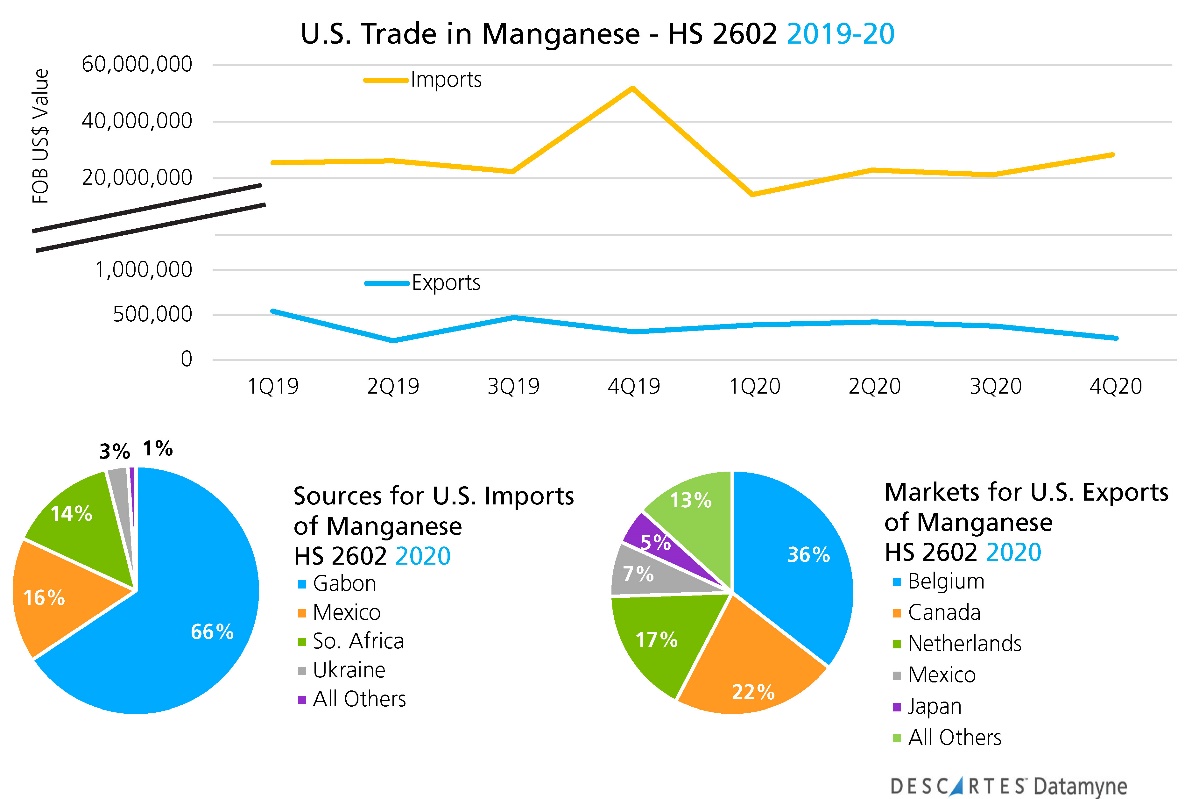

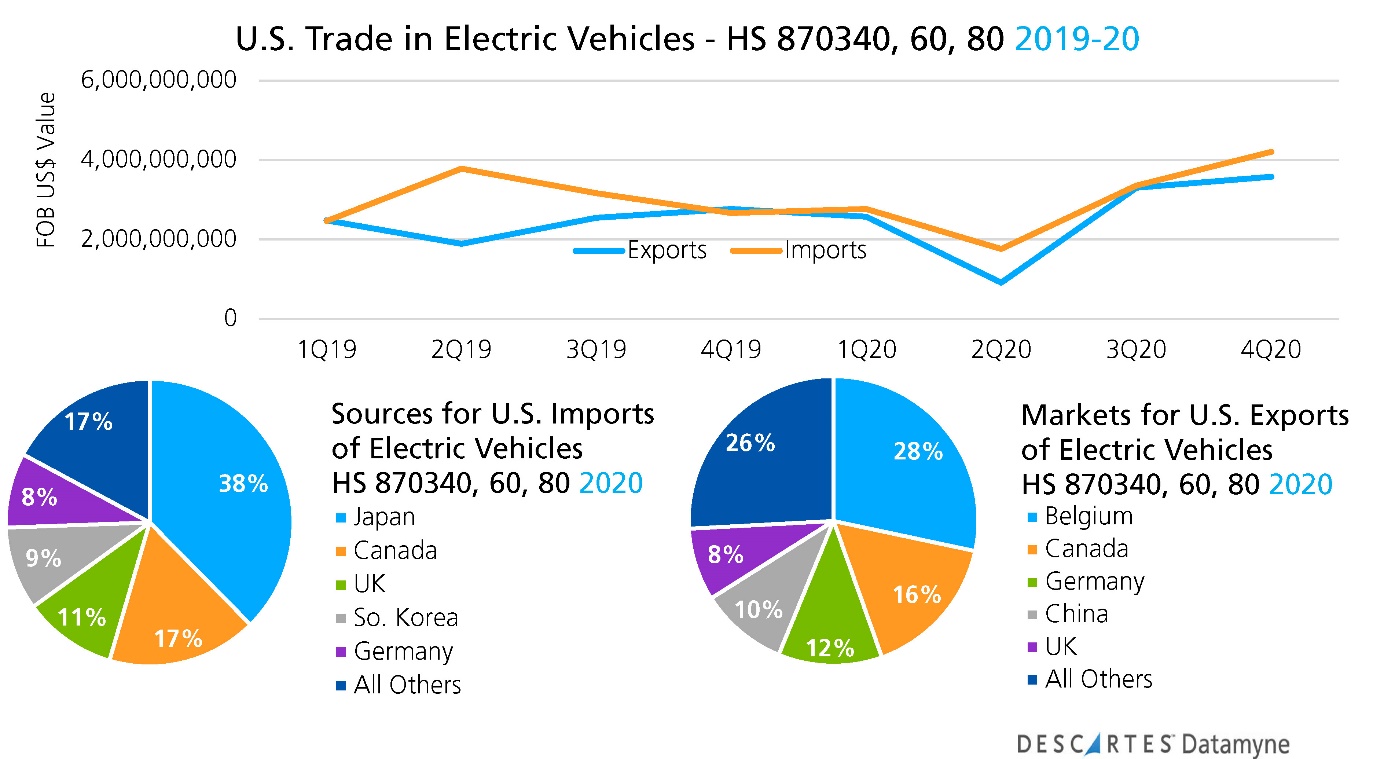

Descartes Datamyne global trade data provides a measure of the impact on trade: a year-over-year drop in second-quarter imports of 20.1%, while exports tumbled 29.8%. Compare the trendlines in the above graph with the following benchmark data on U.S. trade in critical EV metals over the last two years:

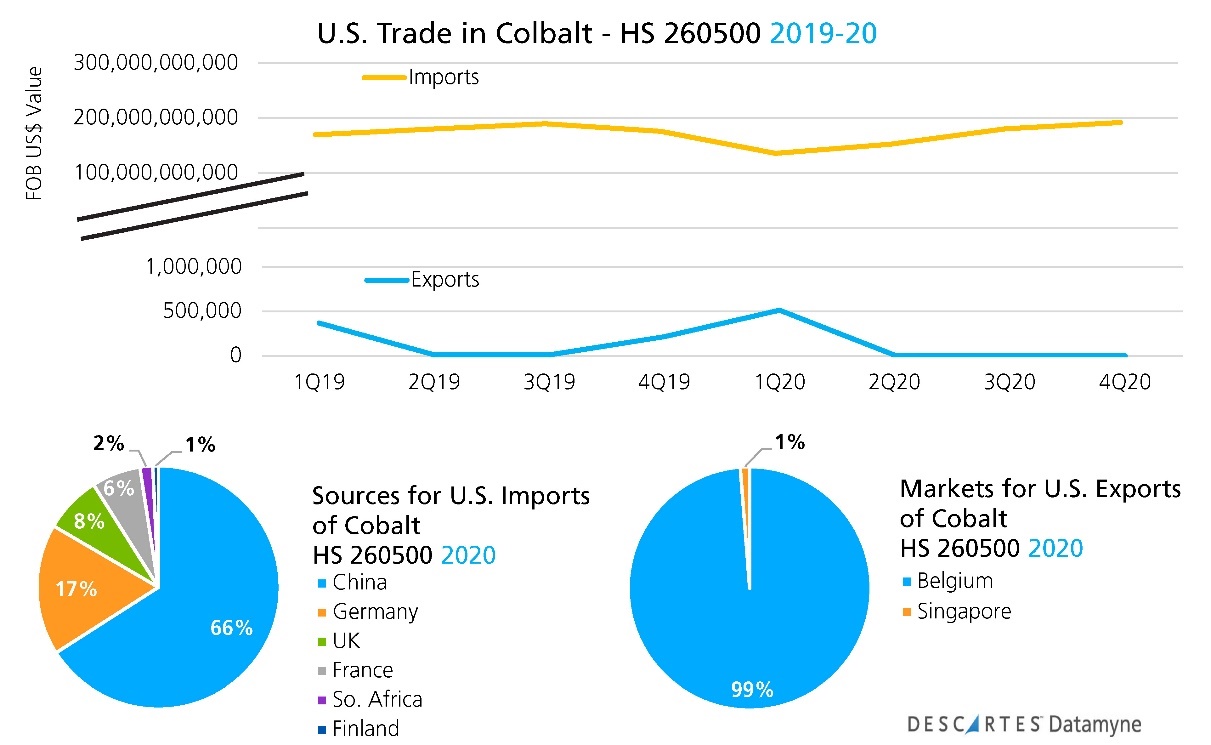

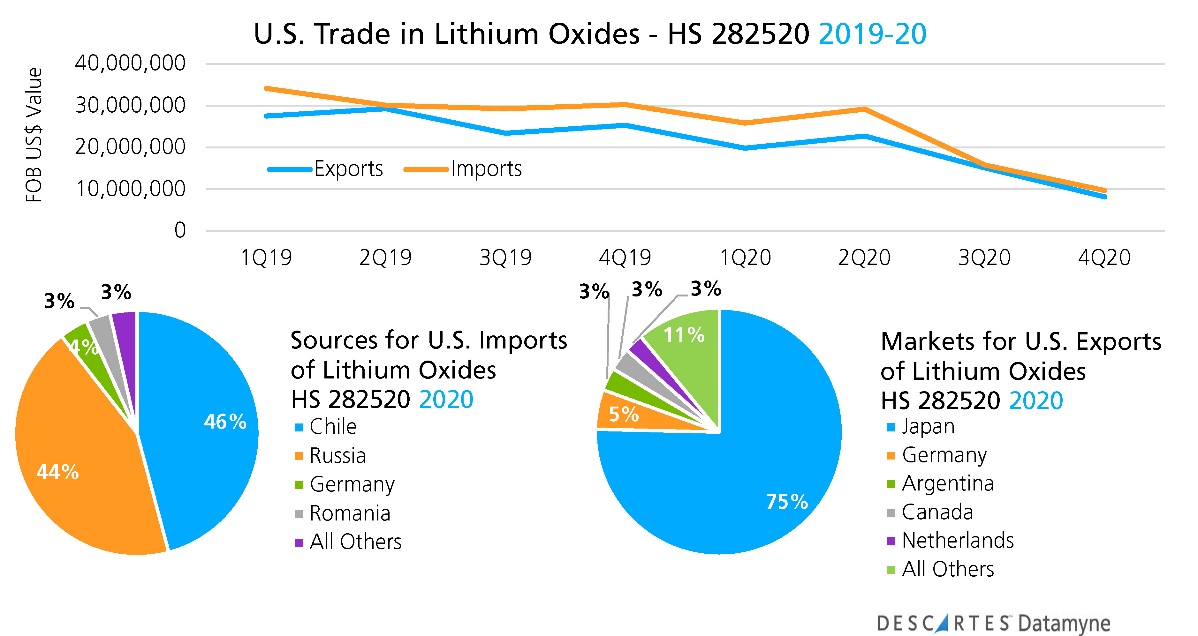

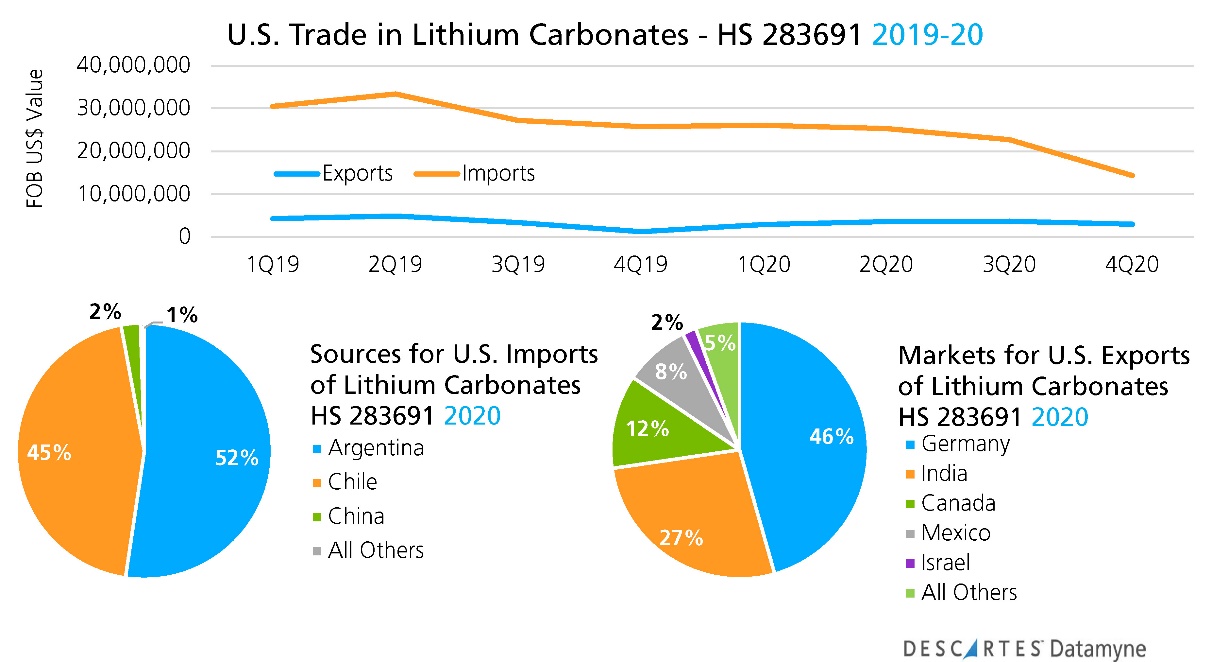

A few things are readily apparent from the data graphs: First, the U.S. is a net importer of EV metals, with the notable exception of nickel.

Second, as the graphs illustrate, import-export trendlines in these commodities do not conform to the pandemic era pattern of U.S. trade overall. There was no 2Q20 dip in nickel exports or manganese imports, the principal U.S. trade flows in these primary inputs to steel production.

According to the USGS, a single mine (Eagle Mine in Michigan) is the sole source for the approximately 16,000 tons of nickel in concentrate, all for export to smelters in Canada and overseas.

Stainless and alloy steel and nickel-containing alloys currently account for more than 85% of U.S. domestic nickel consumption. Similarly, U.S. consumption of manganese is mostly related to steel production and relies on imports, two-thirds of which is sourced from Gabon.

A growing share of U.S. graphite consumption is linked to Li-ion batteries. While a slow decline in graphite imports and exports has been the trend since the mid-teens, the USGS directly credits pandemic restrictions for a decrease by 18% in imports, which in turn caused a 21% decrease in consumption last year.

Most of the cobalt consumed in the U.S. last year was used in producing superalloys (43%). Chemical applications (31%) and various metallic applications accounted for the rest. The USGS notes that cobalt production and consumption had been forecast to decline in 2020 well ahead of the pandemic, for a range of reasons (see below).

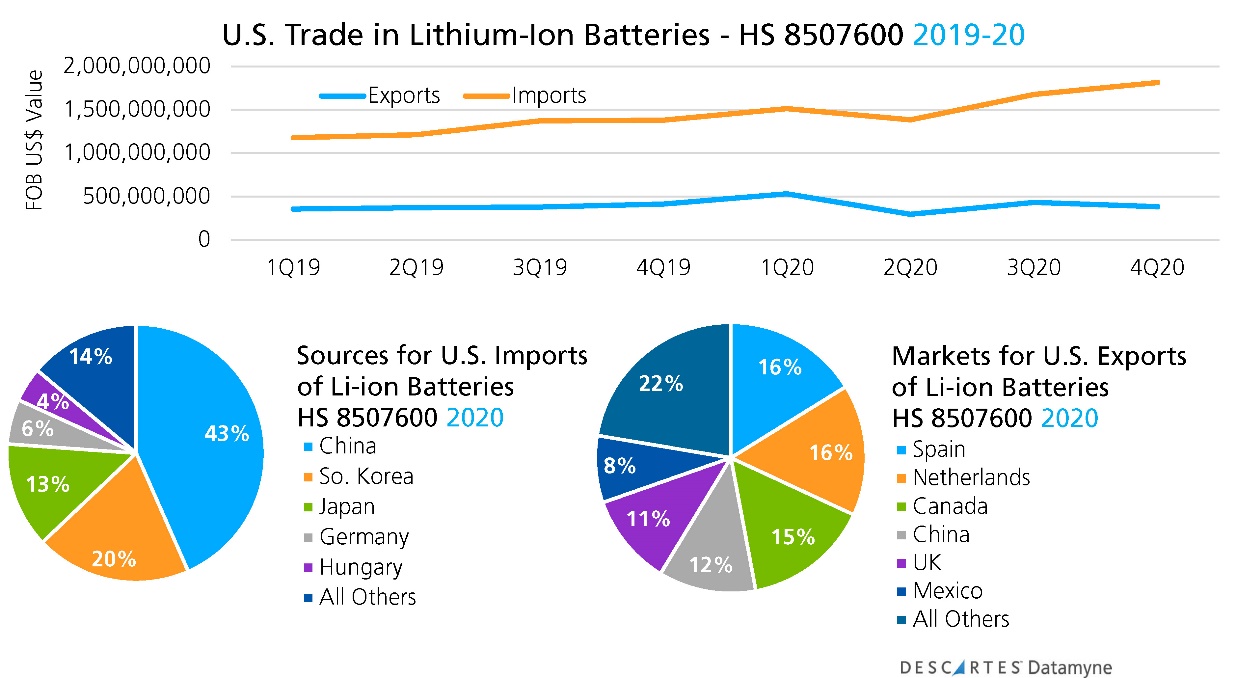

Of all these metals, lithium imports are most directly tied to U.S. battery production. In comparison to the mature steel industry, U.S. battery manufacturing is a fledgling, and its supply chains appear to be more vulnerable to stepped-up competition for resources.

According to the USGS, during the first half of 2020, the economic impact of the COVID-19 pandemic substantially reduced global customer demand for lithium. Strong growth in Li-ion market demand boosted global market demand for lithium in the second half. As the global trade data shows, this upward trend has yet to lift U.S. lithium imports.

In short, U.S. trade in EV metals has, as yet, little to do with the still-emergent U.S. Li-ion batteries industry. As the next graph makes clear, the U.S. gets most of its Li-ion batteries from abroad, with China the leading source:

Note that the higher-value trade in Li-ion batteries follows the pandemic era trade trendlines, with a distinct 2Q20 dip, for U.S. trade as a whole.

At the apex of the value chain, the data indicates a sharper dip in U.S. trade in electric vehicles in 2Q20, and a stronger rebound in the remaining three quarters:

The U.S. is, again, a net importer of EVs, but the gap between imports and exports was narrower, and closed two percentage points in 2020 compared with 2019.

Diversifying sources – and bringing EV value chains home

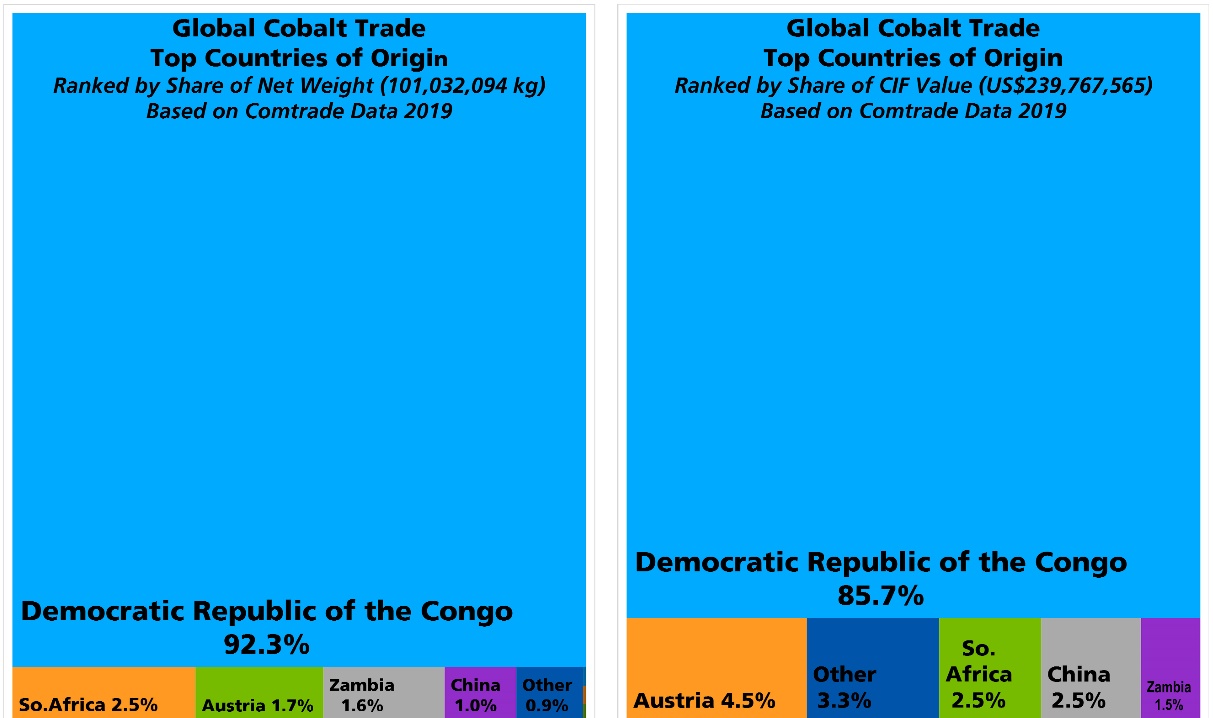

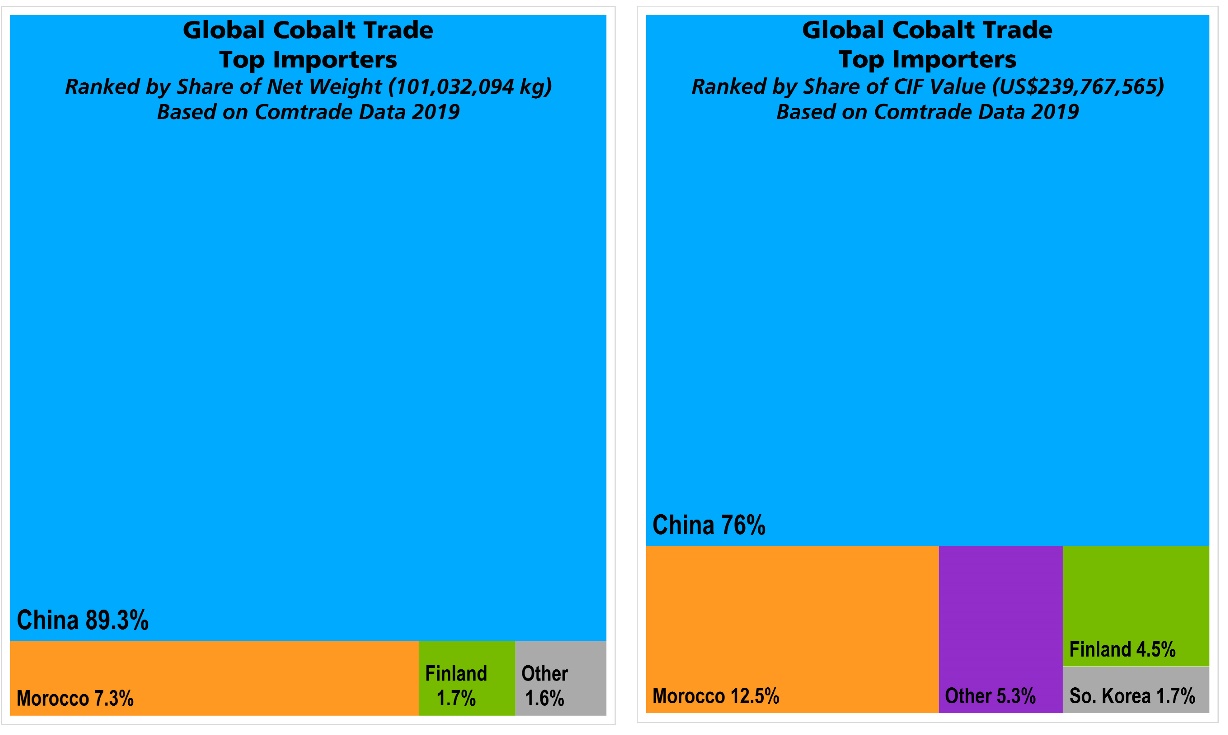

As already noted, U.S. imports represent a small share in global demand for raw materials for Li-ion battery production. For context, here’s a global view of the world’s trade in cobalt in 2019 (complete trade is not yet available for 2020):

Cobalt offers the starkest example of trade in a vital EV raw material dominated by a few countries, and why we expect to see significant changes in the global cobalt supply chain in the next few years.

As we noted earlier, the USGS projected cobalt production and demand would decline ahead of 2020. In response to the history of child labor in the Congo’s mining operations, China’s monopolization of supplies, the current and projected high costs of buying a mineral in limited supply, countries dependent on imported cobalt have stepped up the search for alternate sources of supply and less pricey substitute materials.

We have presented share based on both value and volume of trade in the above graph – in large part because the data on value indicates a more substantial share of trade for Austria as an exporter and Finland as importer. Finland is home to Europe’s largest cobalt refinery, recently acquired by a global metals company as part of its strategy to develop a fully integrated, battery materials supply chain in Europe. Austria, identified in the global trade data as a source for cobalt, is also home to a project aimed at producing lithium hydroxide by the end of 2023.

It will take a few years, but the EU has launched an IPCEI – Important Projects of Common European Interest – to provide government support to building a strategically autonomous Pan-European battery value chain with a target date of 2031.

Among the potential sources for cobalt identified by the European Battery Alliance, Australia and Canada are expected to gain in importance as cobalt producing countries, helping to reduce the concentration of supply and the risk of disruption by 29% in 2030.

In Australia, which currently produces nine of the 10 mineral elements used in most lithium-ion battery anodes and cathodes, and has commercial reserves of graphite, the feasibility of developing its own, complete EV battery chain is being explored.

In the U.S., the EV metals are among the 35 minerals listed by the U.S. in 2018 as critical to the country’s national security and economy.

More recently, as referenced earlier, President moved to review critical supply chains resiliency, including those that fuel electrification of transport, with the aim of reducing dependence on foreign materials.

For the U.S., mining its mineral resources will not be the only path to securing supply chains – not with mineral-rich allies and trade partners Canada and Australia on tap. Materials recovered in recycling are also expected to provide insurance against disruption.

Finally, EV battery technology will continue to advance and chemistries will change. The researchers working on batteries that can be recharged in as little as five minutes are testing prototypes that replace graphite with semiconductor nanoparticles, and plan on using much less expensive silicon in the product they bring to market.

How Descartes Can Help

Descartes Datamyne delivers business intelligence with comprehensive, accurate, up-to-date, import and export information that help companies save significant time in idetifying new suppliers, markets, customers, and sources of products.

Our multinational trade data assets can be used to trace global supply chains and our bill-of-lading trade data – with cross-references to company profiles and customs information – can help businesses identify and qualify new sources.