A global scramble is on to secure supplies of EV battery metals – the cobalt, graphite and lithium – that go into the batteries that make electric vehicles go.

The global market’s growing embrace of electric vehicles is driving demand, and sparking volatility in prices for EV battery metals.

In its Global EV Outlook 2018, the International Energy Agency calculates the global stock of electric cars passed the three-million mark in 2017 and could grow to 220 million by 2030 in a “best case” scenario that assumes stepped up public-policy support for EVs.

Meanwhile, a short but lengthening list of countries has set deadlines for outright bans on sales of petroleum-fueled internal combustion engine (ICE) vehicles.

EV Battery Chemistry:

Powering the EV revolution are rechargeable lithium ion – Li-ion – batteries. As the battery charges and discharges, energy is stored in and released from lithium ions, moving back and forth through an electrolyte conducting solution between a negative electrode, or cathode, to a positive electrode, or anode.

There is more than one version of Li-ion battery in current use – and more formulations being developed in the drive to lower cost per kilowatt.

In the Li-ion batteries used by today’s EVs, the cathode consists of lithium nickel manganese cobalt (NMC), the anode is graphite, and the electrolyte solution is lithium salts in an organic solvent. While certain EV storage products use NMC batteries, those vehicles run on batteries with lithium nickel cobalt aluminum (NCA) cathodes.

For now and (forecasters agree) through 2030, most EVs will rely on an NMC battery to get around. That means demand will continue to rise above historic levels for the battery ingredients, starting with cobalt, graphite, lithium, and nickel.

EV Battery Metals: Cobalt

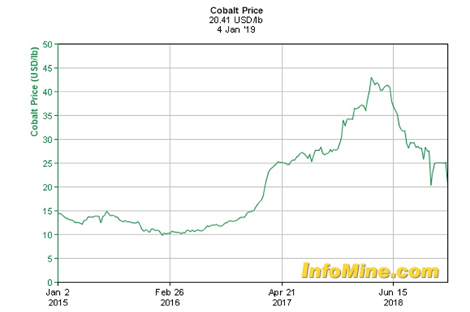

Demand for cobalt, used in superalloys as well as EV battery cathodes, helped triple the metal’s price in Spring of last year. While prices declined in the latter part of 2018, the safest bet is on continued volatility.

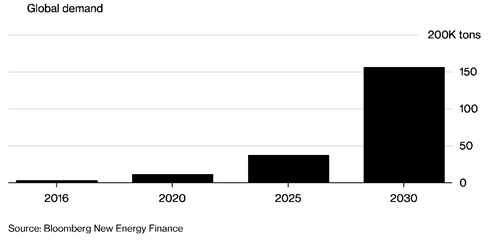

Despite a hot and heavy search for alternatives (see, for example, Nickel and Manganese below), none is expected to be mass-market ready in the near-term. Bloomberg, for one, expects EV-driven demand for cobalt will continue to grow apace through 2030:

All that new demand will be chasing a supply that’s concentrated in the hands of a few, heightening the risk of shortages and price spikes.

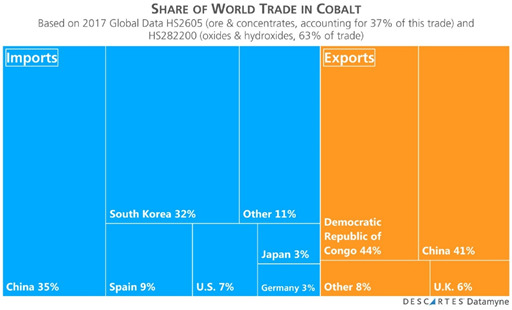

According to the USGS reports on critical mineral resources, the Democratic Republic of the Congo is the world’s principal source for mined cobalt. Poor infrastructure, nationalist policies, and regional tensions combine to give Congo a high-risk index for doing business. China is the leading refiner of cobalt, with most its production coming from cobalt ores, concentrates and partially refined material imported from Congo. An estimated 80% of the cobalt imported by China is used to make rechargeable batteries.

Descartes Datamyne global data illustrates the Congo-China dominance of this trade: Together, the top miner and top refiner accounted for 85% of global cobalt exports in 2017.

The U.S., which ranks third among consumers, after China and Japan, produces very little cobalt, most a byproduct of mining other metals. The U.S. net import reliance as a percentage of apparent consumption was 72% in 2017. Cobalt is on the U.S. government’s list of 35 minerals critical to national security and economy published last May as a first step to planning strategies to reduce the country’s dependence on imported minerals.

EV Battery Metals: Graphite

Traditionally used in steelmaking, graphite has seen a steady rise in demand as the anode material for EV batteries. Indeed, Tesla’s Elon Musk has said that Li-ion batteries might be better described as a nickel-graphite batteries as they can contain up to 15 times as much graphite as lithium.

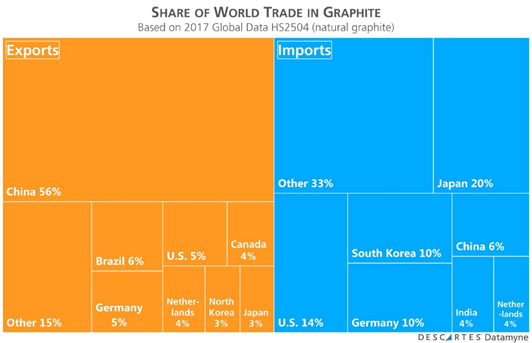

According to the USGS, China produces 67% of the world’s graphite. Descartes Datamyne global data indicates China is the source for more than half of the world’s graphite exports.

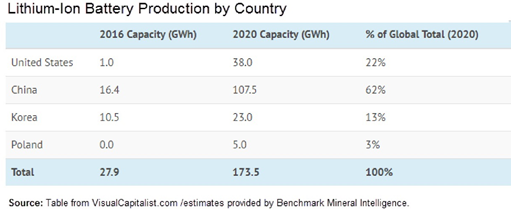

The U.S. produces no graphite. The USGS lists brake linings, lubricants, powered metals, refractories, and steel as the top U.S. manufacturing uses of graphite. Li-ion batteries are not on the list – but this may change as the U.S. brings more production online and moves past South Korea as a manufacturer of Li-ion batteries as soon as 2020, based on these projections from Benchmark Mineral Intelligence:

Graphite does make the U.S. list of 35 minerals critical to national security and economy.

EV Battery Metals: Lithium

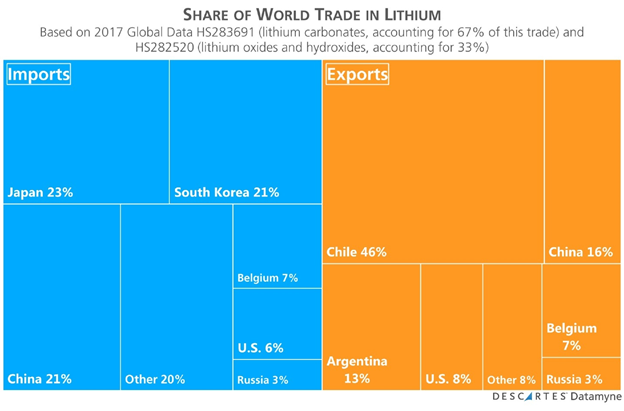

An estimated 46% of mined lithium is for EV battery use. Following on the growth in demand for EVs, lithium production has increased, rising an estimated 17% in 2017. Prices also trended upward through 2017 before supply started to outstrip demand as new mining operations came online as reported by Mining.com. This was not entirely unexpected – the forecasted impact on supply/price of new mining operations in 2018 was covered by this blog in 2016. As supply ramped up, a change in policy leading to a cutback in China’s EV production starting mid-2018 further depressed prices for lithium carbonate according to Benchmark Mineral Intelligence (cited by Mining.com).

Prices are expected to recover and concerns about shortages post-2025 are emerging. Upcoming developments in EV batteries – including solid-state lithium batteries with lithium anodes – suggest still greater demand for the metal.

As the USGS reports, the U.S. is not a major producer, with a single brine operation in Nevada, but has significant lithium resources. The company that leads the world in producing lithium is a U.S. company. In fact, two companies produce a range of downstream lithium compounds in the U.S. from domestic or imported lithium.

U.S. dependence on lithium imports exceeds 50% (production numbers are withheld to protect company proprietary information). Lithium is included in the U.S. list of 35 minerals critical to national security and the economy.

EV Battery Metals: Nickel

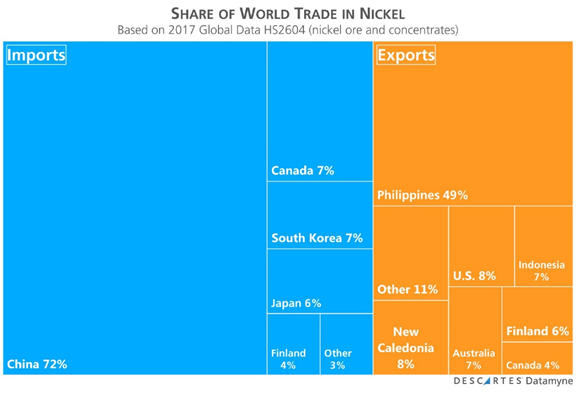

Nickel is one of the most widely used metals in the world. According to the London Metals Exchange, nearly two-thirds of all nickel produced is used in stainless steel. China accounts for more than half of annual global consumption of nickel; just 10 years ago, China’s share was less than 20%.

Descartes Datamyne global trade data shows China was the destination for 72% of nickel exports in 2017.

The large and well-established global market for nickel is not expected to be significantly impacted by increased demand for the metal used in EV batteries. China’s out-size role as a buyer makes it the pace-setter when it comes to nickel’s price.

Note, though, that battery makers are working to replace the pricier cobalt in the cathode with more nickel sulfate: the widely used NMC111 battery uses nickel, manganese and cobalt in equal measure. Wood Mackenzie reports some battery vendors are already using NMC532 (5 parts nickel to 3 parts manganese, 2 parts cobalt) in their EV battery packs.

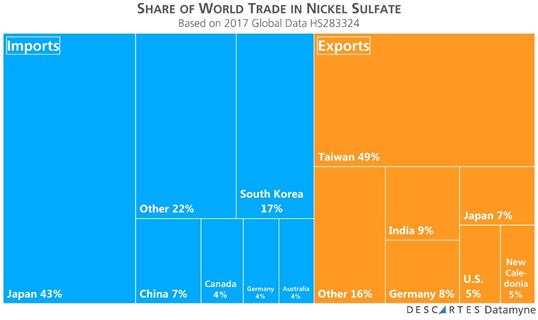

In addition, as Platt’s points out, the supply and price of the type of nickel used in Li-ion battery cathodes – nickel sulfate – may be more sensitive to EV growth. This could lead to a different pricing structure for the EV battery metal compared with the nickel used in stainless steel. Indeed, nickel sulfate has regularly fetched a premium on the London Metals Exchange. We’ve also benchmarked the global data on nickel sulfate in 2017:

The U.S. is a net exporter of nickel, with the biggest share, 58.4%, going to NAFTA-partner Canada in 2017. The U.S. is also a net exporter of nickel, sending 80% to Canada in 2017.

EV Battery Metals: Manganese

Manganese is an essential element for steelmaking. The six to nine kilograms used to make a ton of steel is a small amount but irreplaceable. The NMC Li-ion battery also uses a small, but irreplaceable amount of manganese, along with nickel and cobalt.

As noted above, battery makers are working to replace cobalt with less expensive nickel sulfate. They are also looking at adding more manganese to the mix. Not only can manganese be bought for less, it is expected to be in good supply, while shortages in nickel, cobalt and lithium are expected to develop post-2025, as the Financial Times reports.

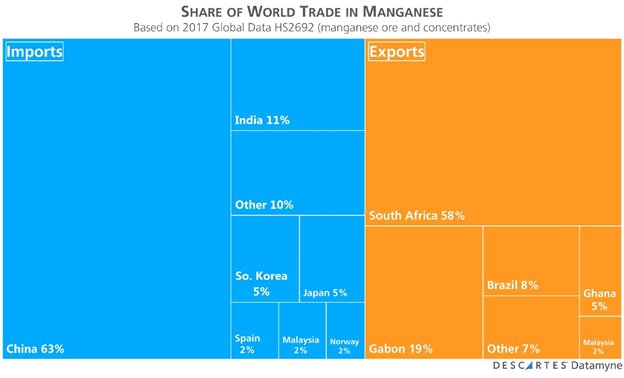

Four countries claim most of the world’s manganese resources: South Africa, Australia, China, and Gabon. Descartes Datamyne global data show South Africa is the top source for manganese ore exports, followed by Gabon – with China the leading destination.

According to the USGS, the U.S. is totally reliant on imported manganese. There are no domestic reserves, although some large low-grade resources are known. Magnesium has long been considered a strategic mineral by the U.S. and is on the government’s new list of 35 minerals critical to the nation’s security.

EV Battery Metals: Rare Earth Metals, Magnesium, Copper

The market for many other metals will be charged by the electrification of transport.

As Investing News reports, China controls approximately 80% of rare earth production – including neodymium, praseodymium and dysprosium, all expected to be in demand for next-generation EV batteries as well as other alternative energies.

Mainly used in alloys to strengthen aluminum (which is in demand to lighten the weight of cars), magnesium is another candidate to replace cobalt in EV Li-ion batteries.

Magnesium and the rare earth elements are on the list of 35 critical minerals.

EVs also need more copper. According to the Copper Development Association, while conventional cars have 18-49 pounds of copper, battery EVs contain 183 pounds, and a battery electric bus contains 814 pounds, most of which is used in the battery.