United States-Mexico-Canada Agreement

The USMCA agreement came into effect on July 1st 2020, replacing the North American Free Trade Agreement (NAFTA), which had been in place since 1994. The aim of the new accord was to modernize trade policy among the U.S., Mexico and Canada, and its implementation has begun to be felt in regional trade, according to Descartes Datamyne research.

As industries continue to recover and the global economy makes initial moves to try to push past the COVID-19 pandemic, it is critical for businesses to stay informed. This is where accurate, current, and fully reviewed global trade data comes in.

In this article, we will provide a high-level overview of the key industries impacted by changes in the USMCA, namely automotive, agriculture and chemical. For a more detailed review, access the full report.

AUTOMOTIVE INDUSTRY

While the majority of changes in the USMCA are largely updates addressing digital trade, labor, the environment, transparency, financial services, and currency policy, the most notable changes apply to the automotive industry. These changes include increased raw material and new labor standard requirements.

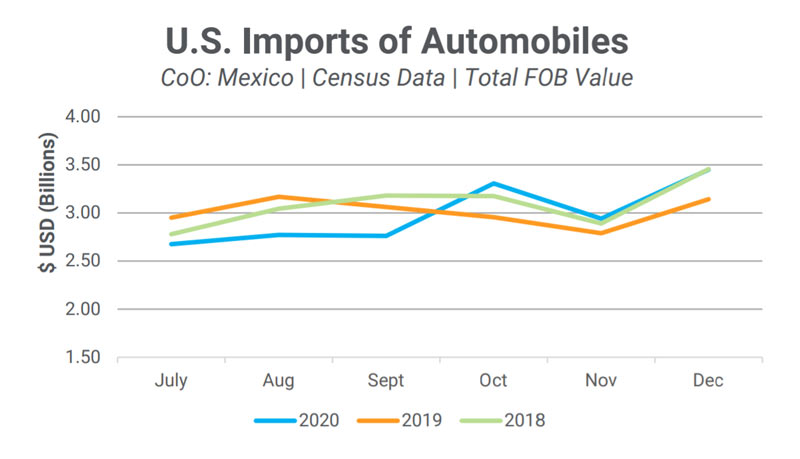

One of the stated goals of the USMCA was to increase domestic manufacturing. Despite this, the United States actually increased its imports of automobiles and auto parts during the second half of 2020, according to Descartes Datamyne research.

Additionally, the increased requirements for North American-made auto parts has, so far, not resulted in any substantial increase in the trade of auto parts between the three countries.

AGRICULTURAL INDUSTRY

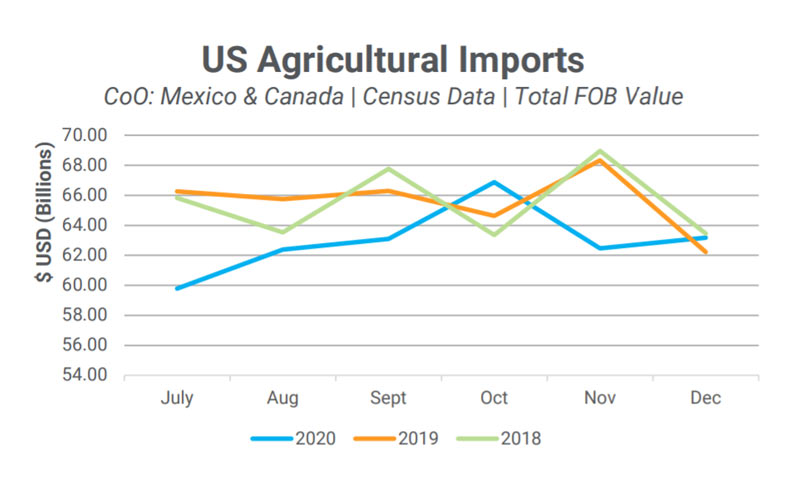

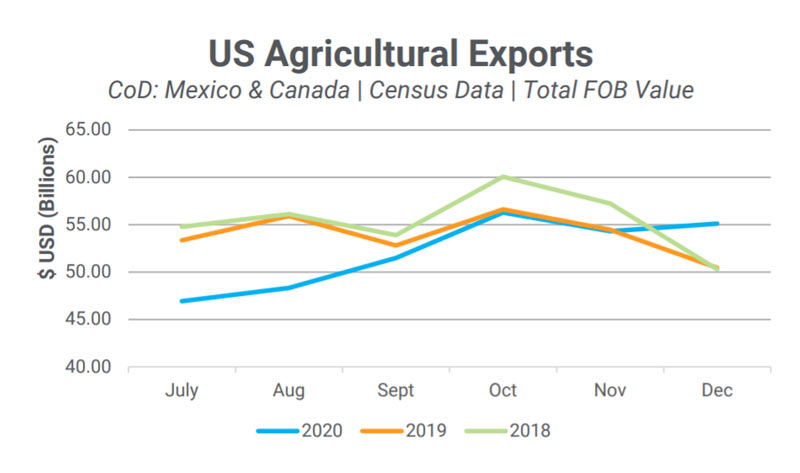

The agricultural industry also received several substantial changes with the updated USMCA. The most notable is a benefit to U.S. dairy farmers who gained increased access to the Canadian market.

The three countries additionally agreed to suspend the competitive grading of wheat, with Canada specifically giving the nod to rate U.S. wheat equally to its own. A similar agreement was made between the U.S. and Mexico.

Finally, the USMCA updated measures addressing scientific advancement in the agricultural industry, adding stipulations around sanitary and phytosanitary processes as well as agreeing to share information for biotechnology and agricultural gene editing.

Despite fears from Canadian dairy farmers, U.S. agricultural exports only saw a marginal increase with a negligible increase in U.S. exporter’s share of the Canadian market.

OTHER CHANGES

The majority of the USMCA is simply a modernized NAFTA and many companies and industries will remain unaffected by the updates.

Several of the other important changes that companies should keep an eye on include:

Protections Against Section 232 Tariffs: the USMCA specifies that the United States will not impose any Section 232 tariffs on Mexican or Canadian exports for at least 60 days after the global application of such a measure.

Increased De Minimis Shipment Value: the three countries have all agreed to raise their de minimis shipment value levels, making it easier and less expensive for small- and medium- sized businesses to take part in cross-border trade.

Digital Trade: the USMCA establishes rules for digital trade and digital technologies. Absent from NAFTA, these new rules include protections against force discloser of proprietary computer source codes and algorithms, consumer privacy protections, and promotion of open access to government-generated public data.

Environmental Standards: new requirements on the three countries include commitments to enforcing environmental law, increased protections of coastal and marine environments, and conservation efforts.

Rules of Origin Requirements: Rules of Origin requirements have been made clearer and more transparent. Many chemical manufacturers are no longer required to determine regional value content and provide the appropriate documentation. These new rules also allow additional qualification options to increase the number of originating products.

Intellectual Property Rights: increased IP protections under the USMCA also include more substantial protections of trade secrets.

How Descartes Can Help

Descartes Datamyne delivers business intelligence with comprehensive, accurate, up-to-date, import and export information that help companies save significant time in identifying new suppliers, markets, customers, and sources of products.

Our multinational trade data assets can be used to trace global supply chains and our bill-of-lading trade data – with cross-references to company profiles and customs information – can help businesses identify and qualify new sources.