USDA 10-year agricultural projections concede major role to ethanol and biodiesel

The US Department of Agriculture just released its long-term forecast for the farm sector. USDA Agricultural Projections for 2011-20 cover sector indicators, commodities, and trade. Key projections include some near-term retreat from current prices, but a long-term trend to historically high price levels. World economic growth overall and demand for biofuels specifically combine to drive consumption, trade, and prices.

Six markets accounted for 87% of biodiesel production and 98% of ethanol production: the US, Brazil, the EU, Argentina, Canada, and China. Tellingly, expansion across all markets is due to government policies, implemented through mandates and tax incentives, the USDA says.

Expansion in U.S. ethanol is projected to continue, but at a slower pace than the 2005-09 period. Corn is expected to remain the primary feedstock, as we noted last week. Corn-based ethanol is expected to account for more than 10% of annual gasoline consumption, while about 36% of corn crops going to ethanol over the next decade. U.S. biodiesel production is assumed to go to 1 billion gallons by 2010, half from first-use vegetable oils, the rest from recycled vegetable oil and animal fats.

The USDA projections make these assumptions about the EU mandate that renewables will provide 10% of transportation sector energy by 2020: Roughly 60% of the renewable fuel will come from agricultural crop feedstocks. In 2020, biodiesel will account for 60% of biofuel use (compared to 60% in 2010), and ethanol will account for 40% (compared to 31% in 2010).

To boost biodiesel production, the EU is projected to step up oilseed production and import more oilseeds and vegetable oil from former Soviet Union and non-EU European countries. While EU wheat will feed ethanol expansion early on, the use of corn will grow rapidly toward the end of the decade.

The EU is, and will remain, the largest importer of biodiesel (primarily from Argentina) and ethanol (from Brazil). Imports are expected to account for a quarter of EU biofuels.

For the two Latin American countries, biofuels are an export opportunity.

Argentina’s biodiesel production is projected to expand 16% over the next 10 years. Some goes to mandated domestic use, but most will go to keeping well ahead as the world’s largest biodiesel exporter.

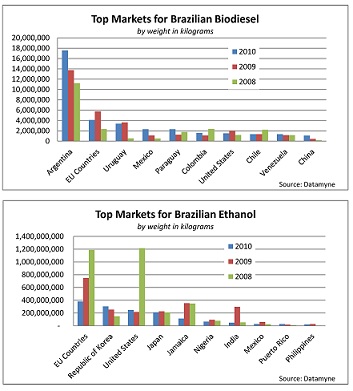

Meanwhile, Brazil’s sugarcane-based ethanol production is projected to rise 45% through 2020, with a growing share exported to the EU and the US. The rate of growth in soybean-oil-based biodiesel is expected to be even faster, but most of that will be consumed at home. Here’s a look at Brazil’s top markets for ethanol (HS 2207) and biodiesel (HS 382490).