Brazilian meat exports have taken a big hit.

On March 17, Brazil’s federal police raided meat packers accused of paying off inspectors to okay rotten and adulterated meat for market, capping a two-year investigation into official corruption dubbed “Operation Weak Flesh.”

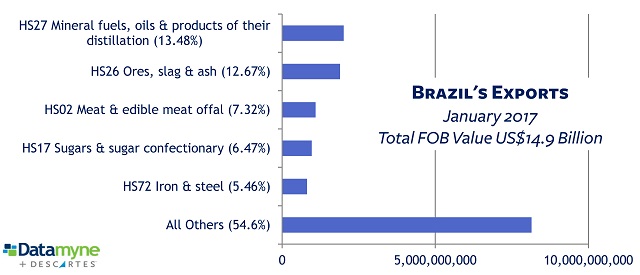

Some 20 countries quickly slapped bans on imported meat from Brazil. Within days, the world’s top meat processor reported its meat exports had dropped to $75,000 from a daily average of $63 million. That’s a ruinous drop in Brazil’s No. 3 export, accounting in January for 7% of sales abroad, as the graph below shows.

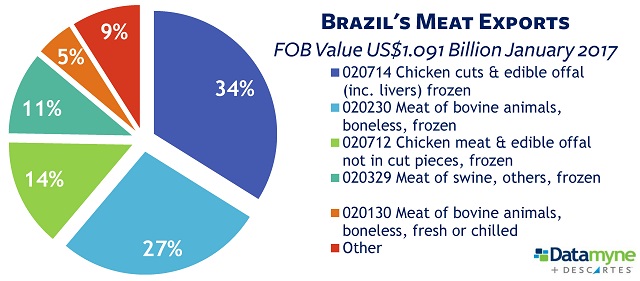

Chicken cuts led Brazilian meat product exports in January, followed by frozen beef.

Brazil has scrambled to restore its trade relationships. On March 27, three customers – China, Egypt and Chile – were reported to have agreed to confine their import bans to products from 21 processing plants subject to investigation. In January, these three customers accounted for about 20% of Brazilian meat exports.

Brazil has suspended operations at six of the 21 plants under investigation, according to this Reuters report in News Asia. The other 15 are not permitted to export their products, although they are being sold domestically.

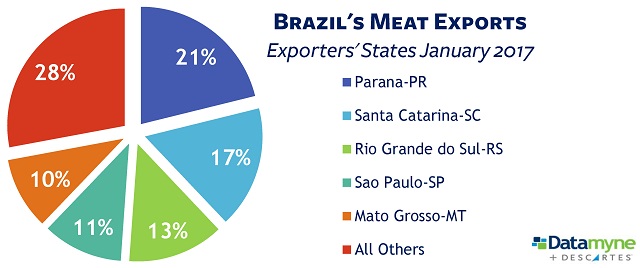

Unfortunately, the scandal has centered on processors in the state of Parana, the leading source for Brazilian meat exports, according to our Latin American data. Even the three countries that have eased their bans will be looking for alternatives: Parana was the source for 18.33% of China’s January imports of Brazilian meats and 16.31% of Chile’s.

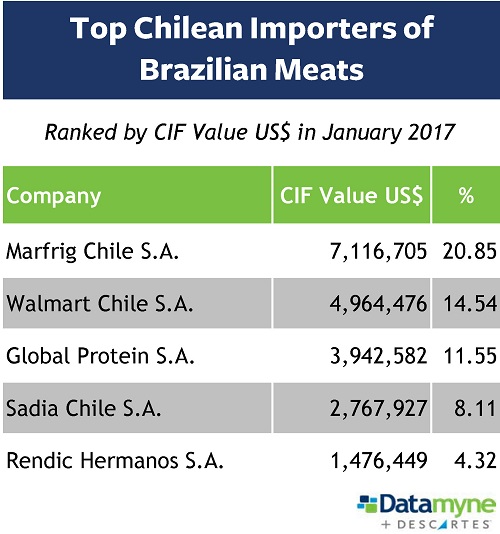

Our Latin American trade data can reveal more details about the trade upended by the corruption scandal including, in the case of Chile, the companies that import meat products from Brazil. The table ranks the top five by value of trade in January.

If you would like to see more data – on meats or any other product in trade – just ask us.

Related:

Brazil’s exports slipped 3.1% in 2016. For more data on Brazilian trade within the Mercosur trade bloc and beyond, see:

- From our blog, Actively Seeking Trade Ties | Mercosur

- From our free report library, Quick Look @ Mercosur Trade in 2016